We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Entering the financial industry can be a rewarding and challenging experience. If you are looking to enter the field, you might have come across and wondered, "What is CeMAP?".

According to a report from the London Institute of Banking and Finance, young people from the ages of 11-18 would like to learn the most about financial products like mortgages. CeMAP provides opportunities to aspirants who are interested in the financial industry to excel in it.

In this beginner's guide, we will explore What is CeMAP, its importance, the training required, the exams involved, and career opportunities after holding one.

Table of Contents

1) What is CeMAP?

2) Benefits of obtaining CeMAP Certification

3) CeMAP training

4) CeMAP exams

5) Career opportunities with CeMAP

6) Conclusion

What is CeMAP?

CeMAP is a professional qualification designed for those interested in working as mortgage advisors or in related financial roles. Controlled by the Financial Conduct Authority (FCA), it demonstrates a person's understanding of the mortgage market, regulations, and ethical practices. By obtaining CeMAP, individuals showcase their competence and commitment to providing quality mortgage advice to clients. Is CeMAP Worth It? This certification not only validates your expertise but also opens doors to opportunities in the dynamic field of mortgage advising.

CeMAP aims to ensure mortgage advisors have the knowledge and skills to provide accurate advice to their clients. It covers various topics, including mortgage products, the mortgage application process, interest rates, and ethical conduct. The purpose of CeMAP is to maintain high standards within the mortgage advice industry and protect consumers.

Benefits of obtaining CeMAP Certification

Obtaining CeMAP certifications offer several benefits for individuals aspiring to build a successful career in the financial industry. Let's explore some of these advantages.

a) Industry recognition: CeMAP is a recognised qualification in the UK financial sector. By obtaining CeMAP, you showcase your commitment to professional standards and gain credibility among employers and clients. It demonstrates your knowledge of mortgage advice and your dedication to providing quality services.

b) Enhanced career prospects: Having CeMAP on your resume significantly enhances your career prospects. Employers value candidates with industry-specific qualifications, and CeMAP provides a solid foundation for entering the mortgage advice sector. The qualification increases your chances of securing rewarding positions and advancing within the industry.

c) Professional development: CeMAP is not just a one-time qualification but a commitment to continuous professional development. The financial industry constantly evolves, and staying updated with industry regulations and market trends is essential. CeMAP holders are encouraged to engage in ongoing training and development to maintain their expertise and improve their career prospects.

d) Official authorisation: In the UK, the mortgage market is highly regulated, and it is mandatory for mortgage advisors to hold a recognised qualification like CeMAP. Without this qualification, individuals are not permitted to provide mortgage advice.

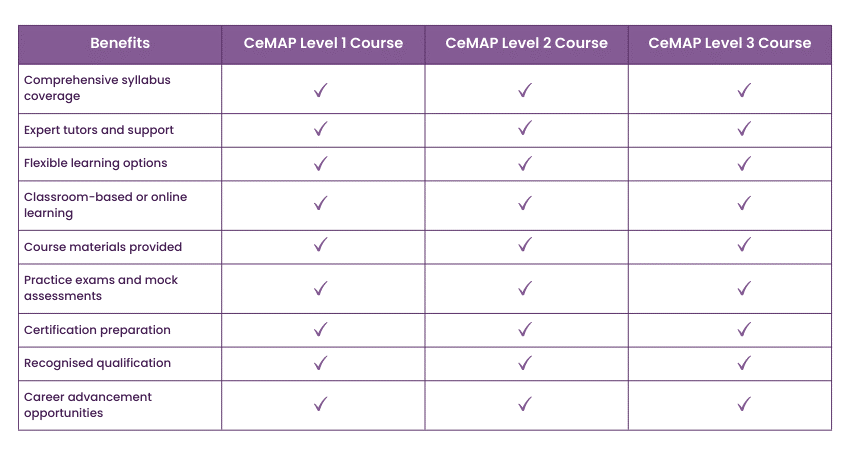

CeMAP training

There are no specific educational requirements to sign up for a CeMAP training course. However, having a basic understanding identify the differences between mortgage vs loan and a good command of English is beneficial. CeMAP training courses are open to anyone interested in pursuing a career in mortgage advice.

Several training providers offer CeMAP courses, both in-person and online. These courses cover the syllabus comprehensively, providing candidates with the knowledge required to pass the exams. Choosing a reputable training provider with experienced tutors who can guide you throughout the learning process is essential.

By completing CeMAP training, individuals equip themselves with the knowledge and competence required to excel in the mortgage advice industry. The cemap exam tips prepares them for the exams and lays the foundation for a successful career as a mortgage advisor or in related financial roles. It is a valuable investment that can open doors to exciting opportunities and contribute to professional growth.

Unlock your potential in the mortgage industry with CeMAP Training – Register now for expert guidance and comprehensive courses!

CeMAP exams

There are three kind of Cemap exam:CeMAP 1, CeMAP 2, and CeMAP 3. Each exam can be broken down into the following modules

CeMAP 1

CeMAP 1 is the first level of the qualification and focuses on providing a comprehensive understanding of mortgage advice principles, regulations, and ethics. Let's break down the modules covered in CeMAP 1:

Module 1: Introduction to Financial Services Environment and Products

Module 2: UK Financial Services and Regulation

Module 3: Mortgage Law, Policy, Practice, and Markets

Module 4: Mortgage Applications

Module 5: Mortgage Payment Methods and Products

Module 6: Mortgage Arrears and Post-Completion Issues

Module 7: Assessment

CeMAP 2

CeMAP 2 is the second level of the qualification and focuses on expanding candidates' knowledge of mortgage products and their applications. This level delves deeper into the technical aspects of mortgages, repayment methods, and calculations. Let's break down the modules covered in CeMAP 2:

Module 1: Mortgage Law, Policy, Practice, and Markets

Module 2: Mortgage Applications

Module 3: Mortgage Payment Methods and Products

Module 4: Mortgage Arrears and Post-Completion Issues

Module 5: Further Advances and Product Transfers

Module 6: Regulation and Practice

Module 7: Assessment

CeMAP 3

CeMAP 3 is the final level of the CeMAP qualification and focuses on applying mortgage advice principles and ethical considerations practically. This level challenges candidates to apply their knowledge to real-life client scenarios and develop the skills to provide appropriate mortgage advice. Let's break down the modules covered in CeMAP 3:

Module 1: Mortgage Law, Policy, Practice, and Markets

Module 2: Mortgage Applications

Module 3: Mortgage Payment Methods and Products

Module 4: Mortgage Arrears and Post-Completion Issues

Module 5: Providing Mortgage Advice

Module 6: Regulation and Practice

Module 7: Assessment

Some module names overlap across exam levels because it is an expansion or continuation of the module of the same name.

The next step in your mortgage career - Sign up now for a comprehensive CeMAP Level 1, 2, And 3 training!

Career opportunities with CeMAP

Achieving the CeMAP qualification opens various career opportunities within the financial industry. Let's explore some of the job roles you can pursue with CeMAP.

a) Mortgage Advisor: As a CeMAP-qualified individual, you can work as a mortgage advisor, helping clients navigate the complex mortgage life cycle Mortgage advisors provide guidance on suitable mortgage options, assist with applications, and ensure compliance with regulations.

b) Financial Consultant: CeMAP can also lead to a career as a financial consultant. With this qualification, you can offer comprehensive financial advice, including mortgages, investments, and insurance products. Financial consultants provide personalised recommendations based on client's financial goals and circumstances.

c) Mortgage Underwriter: Mortgage underwriters play a vital role in the application process. They review and assess mortgage applications, considering factors such as clients' financial stability, credit history, and property valuation. CeMAP qualification equips individuals with the necessary knowledge to analyse mortgage applications, evaluate risks, and make informed decisions regarding mortgage approvals.

d) Mortgage Broker: As a mortgage broker, individuals with CeMAP certification act as intermediaries between borrowers and lenders. They help clients navigate the mortgage market, research available options, and negotiate favourable terms. Mortgage brokers provide personalised advice, handle paperwork, and guide clients through the mortgage application process. They work independently or within brokerage firms.

e) Mortgage Consultant: Mortgage consultants provide expert advice on mortgage-related matters to individuals and businesses. With CeMAP qualification, individuals can offer consultancy services, guiding clients on mortgage strategies, refinancing options, and investment decisions. Mortgage consultants stay updated with market trends, interest rates, and regulatory changes to provide up-to-date and valuable advice to their clients.

f) Mortgage Manager: Mortgage managers oversee the operations of mortgage departments within financial institutions, including banks and building societies. They ensure compliance with regulatory guidelines, manage mortgage portfolios, and develop strategies to attract new customers. CeMAP qualification equips individuals with the necessary knowledge and understanding of mortgage products and regulations to excel in this managerial role.

g) Mortgage Administrator: Mortgage administrators provide administrative support to mortgage teams or departments. They handle paperwork, process mortgage applications, liaise with clients, and coordinate with lenders and solicitors. Individuals with CeMAP certification can efficiently manage administrative tasks specific to the mortgage industry and contribute to the smooth functioning of mortgage processes.

h) Mortgage Compliance Officer: Mortgage administrators provide administrative support to mortgage teams or departments. They handle paperwork, process mortgage applications, liaise with clients, and coordinate with lenders and solicitors. Individuals with CeMAP certification can efficiently manage administrative tasks specific to the mortgage industry and contribute to the smooth functioning of mortgage processes.

Conclusion

In this blog, we discussed What is CeMAP, its benefits, and the exams. We have also discussed the career opportunities available after holding a CeMAP certification.

CeMAP is a valuable qualification for anyone interested in pursuing a career as a mortgage advisor or entering related roles within the financial industry. By obtaining CeMAP, individuals demonstrate their competence, commitment to professionalism and dedication to providing quality mortgage advice. With a solid understanding of the mortgage market, regulations, and ethical practices, CeMAP holders can unlock numerous career opportunities and enjoy a rewarding professional journey.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 20th May 2024

Mon 22nd Jul 2024

Mon 18th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please