We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

A Mortgage is a crucial financial tool in the real estate industry, enabling individuals to achieve their dream of owning a home. So, what is a Mortgage? It is a loan specifically designed for purchasing property, where the property itself serves as collateral for the loan. Understanding mortagage life cycle is essential to make informed decisions about this significant financial commitment.

In this blog, we'll explore what is a Mortgage, explain key terms, cover different types, and guide you through the process. We'll discuss Mortgage applications, pre-approval, finding the right lender, payments, interest rates, expenses, repayment, equity, and refinancing. By the end of this blog, you'll have a solid understanding to make informed decisions on your homeownership journey.

Table of Contents

1) What is a Mortgage?

2) The Mortgage process

3) Types of Mortgages

4) Mortgage terminology

5) Why do people need Mortgages?

6) Mortgage payments and interest

7) The repayment process and considerations

8) Conclusion

What is a Mortgage?

A Mortgage is a financial agreement between a borrower (homebuyer) and a lender (usually a bank or financial institution). It allows the borrower to secure funds to purchase a property while using the property as collateral for the loan. A Mortgage is a loan particularly designed for purchasing real estate.

People obtain a Mortgage as a means of buying a home without having to pay the complete amount upfront. Instead, the borrower makes regular payments, typically on a monthly basis, over a specified period of time.

Unlock a rewarding career in Mortgage advice, acquire essential industry knowledge, and become a certified Mortgage professional with our comprehensive CeMAP Training courses.

The Mortgage process

Navigating the Mortgage process involves clearing essential steps like application filing, pre-approval, and finding the right lender. This section will guide you through each stage, ensuring a smooth path to securing your dream home.

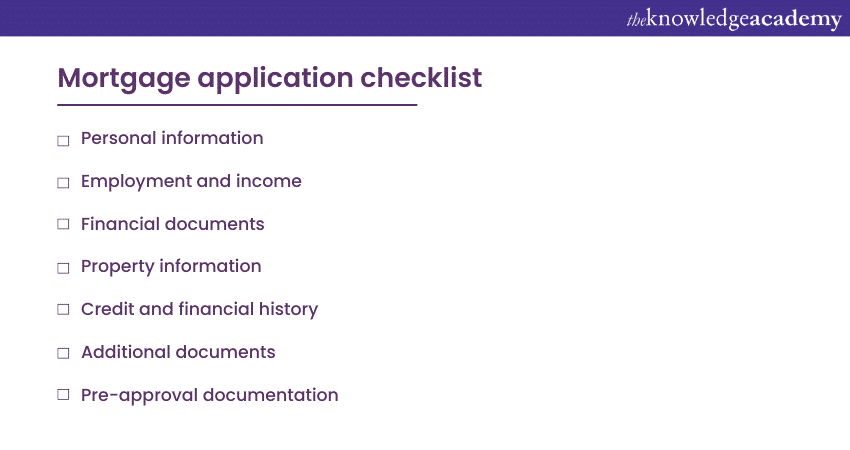

Mortgage application

When applying for a Mortgage, you must complete an application form and give your financial information to the lender. Prior to beginning the application process, ensure you have all the necessary documents, including bank statements, tax returns, and proof of income. These documents will enable the lender to evaluate your financial situation and determine the amount you can borrow.

Mortgage pre-approval

Obtaining a Mortgage pre-approval is highly recommended before house hunting. Pre-approval involves submitting your financial information to the lender, who then assesses your creditworthiness and provides a conditional commitment for a loan amount. Pre-approval strengthens your position as a serious buyer and gives you a clear idea of your budget, making the home search more focused.

Finding the right Mortgage lender

Researching and finding the right Mortgage lender is crucial for a smooth Mortgage process. Consider factors such as interest rates, fees, customer service, and reputation when evaluating lenders. Comparing loan options and obtaining multiple quotes allows you to make an informed decision. It's beneficial to work with a lender who understands your financial goals and offers suitable Mortgage products.

The Mortgage underwriting process

The underwriting process is where the lender thoroughly reviews your financial information and assesses the risk associated with lending money to you. This process involves verifying your income, assets, employment history, credit history, and property appraisal. The underwriter ensures that all requirements are met, and the loan meets the lender's guidelines. It's important to promptly provide any additional documentation or information requested during this stage.

During underwriting, the lender evaluates your creditworthiness, debt-to-income ratio, and overall financial stability. They also consider the property's appraisal value to ensure it meets the loan amount. The process could last for a few weeks, and the lender might require additional information or clarification.

Upon successful completion of the underwriting process, you will receive a Mortgage commitment letter, which confirms that the lender approves your loan application. This commitment letter is an important milestone in the Mortgage process and paves the way for the final steps.

Throughout the Mortgage process, it's crucial to maintain open communication with your lender. Promptly respond to their requests for information and address any concerns or questions they may have. Clear communication and timely cooperation will help ensure a smoother and faster Mortgage approval.

Please keep in mind that every Mortgage application is distinct, and the duration of the processing can vary depending on various factors, such as the intricacy of your finances and the lender's current workload. Collaborating closely with your lender and staying patient can speed up the process and increase your likelihood of being approved for a Mortgage.

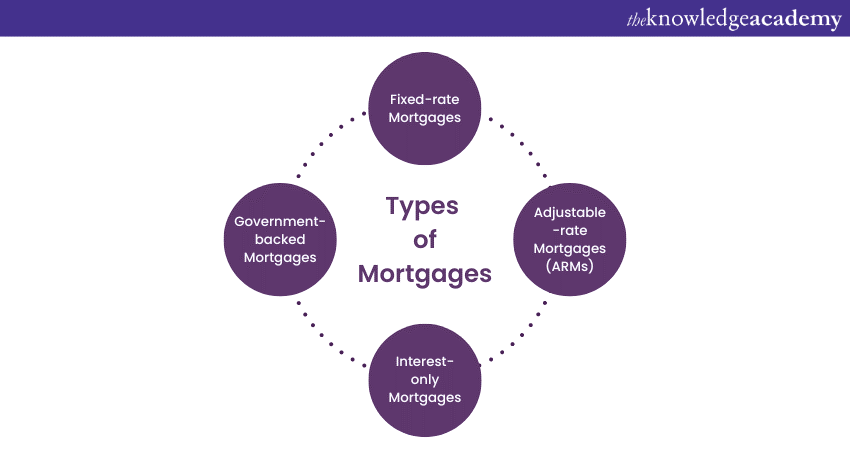

Types of Mortgages

There are different types of Mortgages available to suit different financial situations and preferences. Here are some common types:

a) Fixed-rate Mortgages: A fixed-rate Mortgage maintains the same interest rate throughout the entire loan period, ensuring stable and predictable monthly payments.

b) Adjustable-rate Mortgages (ARMs): Unlike fixed-rate Mortgages, ARMs have an interest rate that may change periodically, typically after an initial Fixed-rate period. The interest rate fluctuates based on prevailing market rates.

c) Interest-only Mortgages: In an Interest-only Mortgage, the borrower initially pays only the interest for a certain period, typically five to ten years. After the initial period, regular principal and interest payments begin.

d) Government-backed Mortgages: These Mortgages are insured or guaranteed by government entities, such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). They often have more flexible qualification requirements and lower down payment options.

Mortgage terminology

To better understand Mortgages better, it's important to familiarise yourself with key Mortgage terms:

a) Principal: The initial amount borrowed, which represents the purchase price of the property.

b) Interest: The cost charged by the lender for borrowing the money. It is usually expressed as an APR (Annual Percentage Rate) and affects the total amount paid over the loan term.

c) Amortisation: The process of gradually paying off the Mortgage over time through regular payments that include both principal and interest.

d) Loan term: The length of time given to repay the Mortgage. Typical loan terms range from 15 to 30 years, although other options may be available.

e) Down payment: The initial payment made by the borrower towards the purchase price of the property. It is usually a percentage of the total price and affects the loan amount and interest rate.

Understanding these terms is essential for comprehending how Mortgage payments are structured and how they impact your financial commitment.

Why do people need Mortgages?

People often need Mortgages for several reasons, some of them can be listed as follows:

1) Home ownership: One of the primary reasons people take out Mortgages is to buy a home. Houses can be quite expensive, and most individuals or families don't have the full purchase price readily available. A Mortgage allows them to spread the cost over many years, making homeownership more affordable.

2) Investment: Some people buy property as an investment. They may purchase a property only to rent it out to generate rental income, or hold onto it with the hope that its value will appreciate over time. Mortgages can help them finance these investments.

3) Lack of savings: Many individuals and families do not have enough savings to buy a property upfront. Mortgages enable them to enter the property market without the need for a large upfront payment.

4) Financial planning: Mortgages can be seen as a form of long-term financial planning. By taking out a Mortgage with a fixed interest rate, homeowners can lock in their housing costs for an extended period, providing stability in budgeting.

5) Tax benefits: There are tax benefits often associated with Mortgage interest payments. Homeowners can subtract the Mortgage interest from their taxable income, reducing their overall tax liability.

6) Property upgrades: Homeowners often take out Mortgages to finance major renovations or extensions to their homes. This allows them to improve their living conditions or increase the property's value.

7) Retirement planning: Some individuals use reverse Mortgages, which allow them to convert a portion of their home equity into cash. This can be a way to supplement retirement income or cover unexpected expenses later in life.

8) Building credit: Successfully managing a Mortgage can help individuals develop a positive credit history, which can be beneficial for future borrowing, such as loans for education or other major expenses.

9) Family homes: Many people take out Mortgages to provide a stable and secure environment for their families. Owning a home can offer stability and a sense of belonging for children and provide a family with a sense of ownership and responsibility.

10) Housing demand: In areas with high demand for housing, renting can be more expensive than the monthly Mortgage payments. This makes owning a home a financially sensible choice in the long run.

Mortgage payments and interest

Understanding how Mortgage payments are structured and the impact of interest rates is crucial for effective Mortgage management.

Understanding Mortgage payments

Mortgage payments are the regular installments you make towards repaying your loan. They typically consist of two components: principal and interest.

a) Principal: The principal is the initial amount borrowed to purchase the property. Each payment reduces the outstanding principal balance, gradually building equity in your home.

b) Interest: Interest is the cost charged by the lender for borrowing the money. It is calculated based on the interest rate and the remaining principal balance. In the early years of the Mortgage, a larger portion of the payment goes towards interest, gradually shifting towards principal as the loan term progresses.

Calculating Mortgage payments

To calculate your Mortgage payments accurately, you can either use a Mortgage calculator or a formula that takes into account the loan amount, interest rate, and loan term into account. It's worth noting that your monthly payment may also cover other expenses such as property taxes and insurance, which will be placed in an Escrow account.

Impact of interest rates

The interest rates have a major impact on the total cost of your Mortgage. When the interest rates are lower, you will have lower monthly payments and may save thousands in cash throughout the loan's lifespan. Conversely, if the interest rates increase, your monthly payments will increase, and you will pay more for the loan in total.

Fixed-rate vs Adjustable-rate Mortgages

With a Fixed-rate Mortgage, the interest rate remains constant throughout the loan term. This provides stability, as your monthly payment amount remains unchanged, making it easier to budget for homeownership.

On the other hand, Adjustable-rate Mortgages (ARMs) have interest rates that can fluctuate over time. Initially, they typically offer lower interest rates compared to Fixed-rate Mortgages. However, after an initial Fixed-rate period, the interest rate may adjust periodically based on market conditions. ARMs carry the risk of potentially higher payments if interest rates rise.

Additional costs: Insurance and taxes

Your Mortgage payment may include additional costs, such as property insurance and property taxes, in addition to the principal and interest. Lenders often require borrowers to have homeowners, insurance to protect against property damage or loss. Property taxes are assessed by local government entities and contribute to funding public services.

Amortisation and building equity

Amortisation refers to the process of gradually paying off your Mortgage through regular payments. With each payment, a portion goes towards the principal, reducing the outstanding balance. Over time, this helps build equity in your home, which is the difference between the property's value and the remaining Mortgage balance.

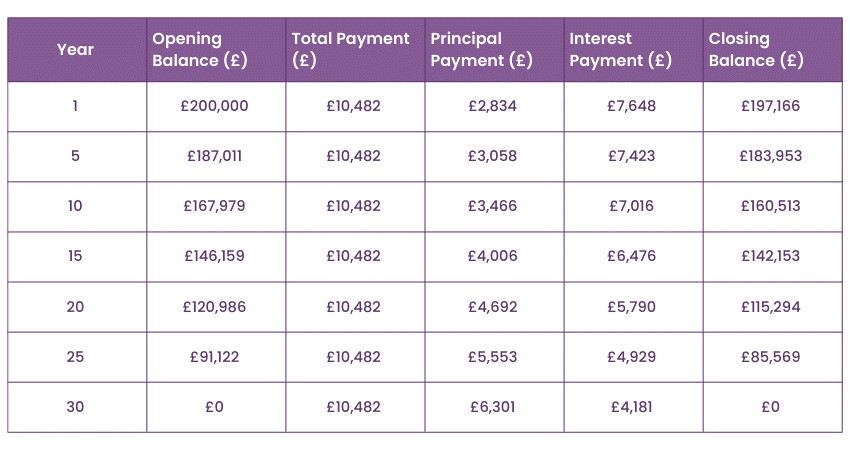

An amortisation schedule illustrates how Mortgage payments are allocated towards the principal and interest over the course of the loan term. Here is an example of a £200,000 Mortgage with a 30-year term and a fixed interest rate of 3%:

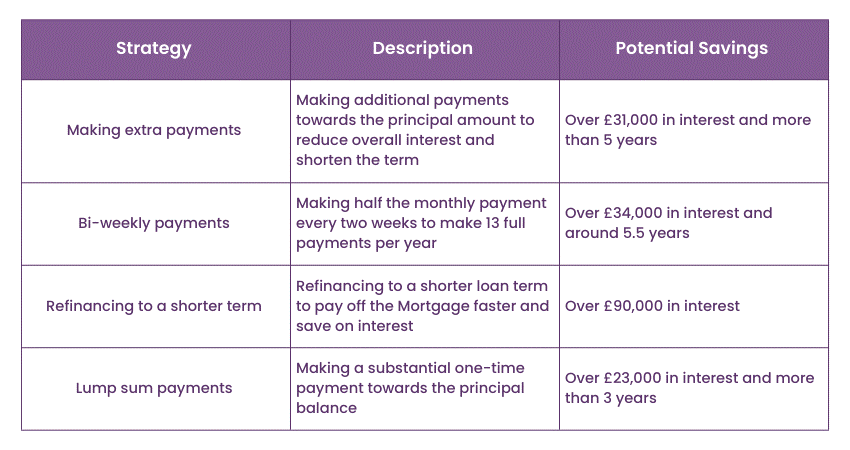

Paying off the Mortgage early

If you have the right financial means, paying off your Mortgage early can provide long-term benefits. By making extra principal payments or opting for shorter loan terms, you can save on interest payments and potentially own your home outright sooner.

Mortgage refinancing

Refinancing is the process of replacing your current Mortgage with a new one, usually to get a better interest rate or more favourable loan terms. Refinancing can help reduce monthly payments, save on interest costs, or tap into home equity for other financial goals. However, it's essential to consider the associated fees and evaluate the long-term benefits before deciding to refinance.

Understanding Mortgage payments, interest rates, and associated costs is crucial for managing your Mortgage effectively. In the following section, we'll explore the concept of equity and discuss considerations for paying off your Mortgage early.

Embark on a transformative journey in Mortgage advice, gain expertise across all levels, and become a fully qualified Mortgage professional with our comprehensive CeMAP Level 1, 2, and 3 Training.

The repayment process and considerations

Understanding how to repay your Mortgage and exploring factors like early payoff options and equity building are essential for successful Mortgage management. In this section, we'll delve into the intricacies of the repayment process and provide valuable considerations for optimising your Mortgage strategy.

Repayment options

When it comes to repaying your Mortgage, you have different options available. The most common repayment methods include:

a) Monthly payments: This is the standard repayment method where you make fixed monthly payments over the loan term, consisting of both principal and interest.

b) Bi-weekly or accelerated payments: Selecting this option allows you to make payments every two weeks instead of once a month. This results in 26 half-payments per year, which is equivalent to 13 full monthly payments. With this, you can pay off your Mortgage at a quicker pace and potentially reduce the interest you have to pay.

c) Lump-sum payments: You may have the flexibility to make lump-sum payments towards your Mortgage principal, which can help reduce the outstanding balance and the overall interest paid.

Considerations for early Mortgage payoff

Paying off your Mortgage early can provide several benefits, including interest savings and the freedom from monthly Mortgage payments. However, before pursuing early Mortgage payoff, consider the following factors:

a) Financial stability: Ensure you have sufficient emergency savings and are free from high-interest debt before allocating extra funds towards Mortgage repayment.

b) Prepayment penalties: Some Mortgages may have prepayment penalties, which are charges imposed by the lender for paying off the loan early. Review your Mortgage agreement to determine if any penalties apply and assess their impact on your decision.

c) Opportunity cost: Consider whether the funds used for early Mortgage repayment could be better utilised in other investments or financial goals that offer higher returns.

Building equity and home appreciation

When you pay your Mortgage, you are also increasing your equity in the home. To determine the equity of a property, subtract the current remaining Mortgage balance from its current value. Home appreciation, where the value of your property increases over time, can also contribute to building equity. Building equity can provide financial security and potentially unlock opportunities for accessing additional funds through refinancing or home equity loans.

The importance of regular Mortgage reviews

Regularly reviewing your Mortgage is essential to ensure it aligns with your financial goals and current market conditions. Consider the following aspects during a Mortgage review:

a) Interest rates: Monitor interest rate trends and explore opportunities to refinance if rates have significantly dropped since you obtained your Mortgage.

b) Loan terms: Assess whether your current loan term still suits your financial situation or if refinancing to a shorter or longer term may be beneficial.

c) Changing circumstances: Evaluate any changes in your financial circumstances, such as increased income or decreased expenses, that could allow for higher Mortgage payments or accelerated repayment.

By regularly reviewing your Mortgage and making informed decisions, you can optimise your Mortgage strategy and potentially save on interest payments.

Unlock a rewarding career in financial advice, gain comprehensive knowledge and skills, and earn your Diploma for Financial Advisers (DipFA) with our specialised DipFA training.

Conclusion

To sum it up understanding Mortgages is essential for successful homeownership. Remember, each Mortgage is unique, so seek professional advice whenever needed. With this knowledge, you're nowequipped to navigate the Mortgage process and achieve your homeownership goals. Best of luck on your journey!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 20th May 2024

Mon 22nd Jul 2024

Mon 18th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please