We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

A Mortgage is a significant financial commitment that many people undertake to achieve their dreams of homeownership. Understanding the Mortgage Life Cycle is crucial for anyone considering taking out a Mortgage or those already in the process. This blog post will provide a comprehensive explanation of the Mortgage Life Cycle, from the initial application to the final payment. By gaining insight into each stage of the Mortgage Life Cycle, you can make informed decisions and navigate the process more confidently. From pre-application to repayment, let's explore the key stages of the Mortgage Life Cycle and gain a deeper understanding of this important financial journey.

Table of Contents

1) Pre-application stage

2) Application and approval stage

3) Closing stage

4) Repayment stage

5) Conclusion

Pre-application stage

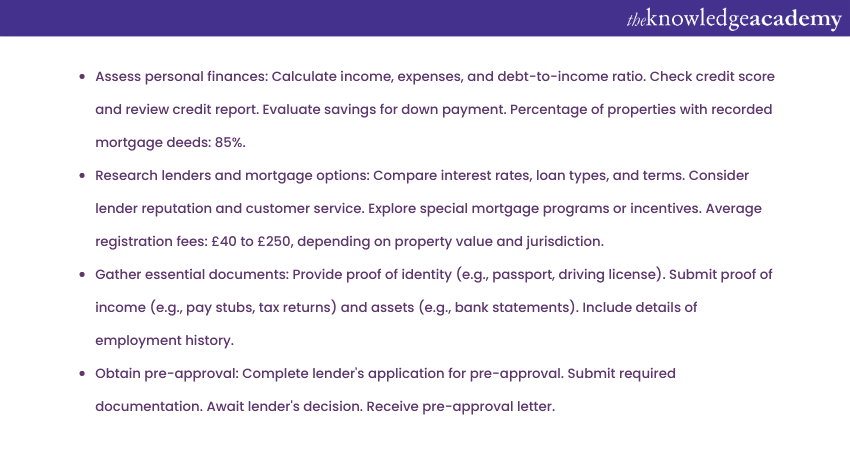

The pre-application stage marks the beginning of the Mortgage Life Cycle and is a crucial phase for prospective borrowers. During this stage, individuals or couples assess their financial situation, research lenders, and evaluate Mortgage options. It involves understanding personal finances, budgeting, and determining creditworthiness.

One of the first steps in the pre-application stage is obtaining a credit report and reviewing credit scores. This allows potential borrowers to assess their creditworthiness and identify any areas that need improvement. Addressing any issues, such as paying off outstanding debts or correcting errors on the credit report, can help improve the chances of obtaining a favourable Mortgage offer.

Budgeting is another important aspect of the pre-application stage. Prospective borrowers should carefully evaluate their income, expenses, and savings to determine how much they can comfortably afford to borrow. This involves considering not only the monthly Mortgage payment but also identify the difference between mortgage vs loan other homeownership costs, such as property taxes, insurance, and maintenance expenses.

Researching lenders and Mortgage options is a critical part of the pre-application stage. Different lenders offer varying Mortgage products with different interest rates, loan terms, and eligibility requirements. By comparing options and obtaining quotes from multiple lenders, borrowers can find the best Mortgage deal that suits their needs and financial situation.

Additionally, gathering essential documents is crucial during this stage. Lenders typically require income statements, bank statements, tax returns, and other financial documents to assess the borrower's financial stability and ability to repay the loan. Collecting these documents in advance can expedite the application process.

Lastly, it is advisable to get pre-approved for a Mortgage during the pre-application stage. Pre-approval provides an estimate of the loan amount for which borrowers may qualify, giving them a clearer understanding of their budget and enhancing their credibility as serious buyers. This pre-approval letter can also be advantageous when making an offer on a property, as it demonstrates financial readiness to sellers.

Unlock a rewarding career in Mortgage advice, acquire comprehensive industry knowledge, and become a certified Mortgage professional with our comprehensive CeMAP Training courses.

Application and approval stage

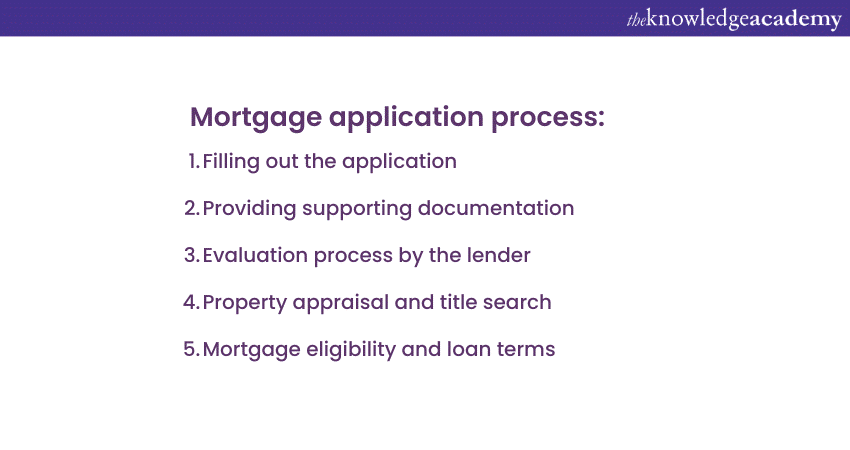

Once the pre-application stage is complete, the next crucial phase of the Mortgage Life Cycle is the application and approval stage. During this stage, prospective borrowers formalise their Mortgage application and go through the evaluation process by the lender.

To initiate the application process, you must fill out the necessary paperwork provided by the lender. This includes personal information, financial details, employment history, and other relevant information. Being meticulous and precise when completing the application is crucial to prevent any delays or complications.

Along with the application, borrowers are required to provide supporting documentation. This typically includes recent pay stubs, bank statements, tax returns, and other financial statements that verify income, assets, and liabilities. The lender uses these documents to assess the borrower's financial stability and determine their ability to repay the loan.

Once the application and accompanying documents are submitted, the lender commences a thorough evaluation process. This involves a thorough review of the borrower's credit history, employment status, debt-to-income ratio, and other relevant factors. The lender may contact employers, financial institutions, and credit agencies to verify the information provided.

As part of the evaluation, the lender will also conduct an appraisal of the property. A professional appraiser will assess the value of the property to ensure it aligns with the loan amount requested. This step helps protect both the borrower and the lender from overvaluing the property.

Additionally, the lender may require a title search to ensure the property's legal ownership and identify any outstanding liens or claims against it. This step is crucial to confirm that the property can serve as collateral for the Mortgage.

Based on the evaluation, the lender will determine the borrower's eligibility for the Mortgage. This includes assessing the risk associated with the loan and determining the terms and conditions, such as the interest rate, loan duration, and type of Mortgage (e.g., fixed-rate or adjustable-rate). The lender will also specify the maximum loan amount for which the borrower qualifies.

Once the evaluation is complete, the lender will provide the borrower with a formal Mortgage offer or a loan commitment letter. This document outlines the terms and conditions of the loan, including the loan amount, interest rate, monthly payment, and any other relevant details. The borrower should review this offer carefully and seek clarification if needed.

Unlock your full potential in Mortgage advice, advance through all levels of expertise, and achieve your CeMAP Level 1, 2, and 3 certifications with our comprehensive training.

Closing stage

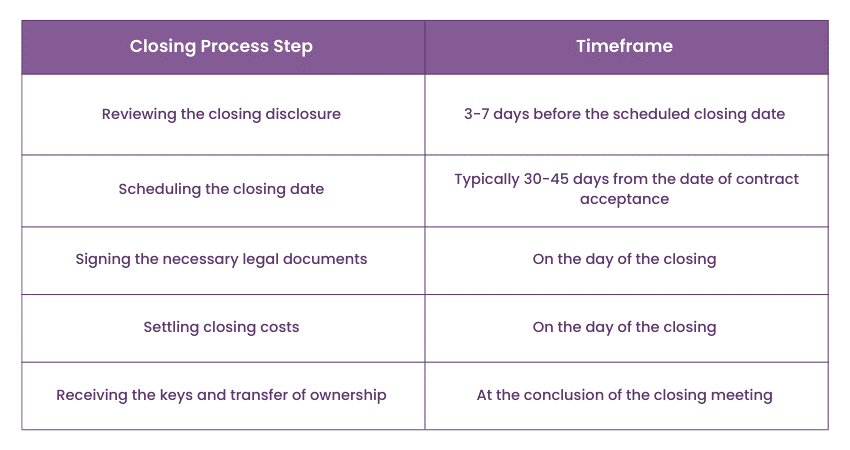

The closing stage is a significant milestone in the Mortgage Life Cycle, marking the final steps before homeownership becomes a reality. During this stage, all the necessary paperwork is completed, and the transfer of ownership takes place.

The closing process begins with scheduling a closing date, typically coordinated by the lender or a closing agent. Prior to the closing, the borrower should carefully review the closing disclosure, which outlines the final loan terms, including the interest rate, loan amount, closing costs, and any other fees associated with the Mortgage.

On the closing day, the borrower and the seller, if applicable, meet at a designated location, usually the office of a title company or an attorney. The borrower will be required to bring a government-issued identification and any funds required for the closing, such as the down payment and closing costs.

During the closing, both parties sign the necessary legal documents. These documents consist of the Mortgage Note, which represents the borrower's commitment to repay the loan, and the Mortgage or Deed of Trust, which grants the lender a security interest in the property. Additionally, the seller will transfer the property's title to the buyer, signifying the official change of ownership.

The closing costs are settled during this stage. These costs typically include attorney fees, appraisal fees, title insurance, and other expenses associated with the Mortgage process. The borrower should carefully review the closing statement, also known as the HUD-1 Settlement Statement or Closing Disclosure, which provides a detailed breakdown of all the costs involved. Any questions or discrepancies should be addressed with the closing agent or attorney.

At the end of the closing, the borrower provides the necessary funds, typically in the form of a certified or cashier's check, to cover the down payment and closing costs. The lender will also fund the loan by transferring the Mortgage proceeds to the closing agent or attorney.

Once the closing is completed, the borrower receives the keys to the property, officially becoming the homeowner. The borrower should arrange for homeowner's insurance coverage prior to closing to protect the investment.

Embark on a rewarding career in financial advice, gain comprehensive knowledge and skills, and earn your Diploma for Financial Advisers (DipFA) through our specialised DipFA training.

Repayment stage

After the closing stage, borrowers enter the repayment stage of the Mortgage Life Cycle. This stage spans the entire duration of the Mortgage loan and involves making regular monthly payments to the lender.

Each Mortgage payment consists of two components: principal and interest. The principal is the amount borrowed and is gradually paid down over time. The interest is the cost of borrowing the money and is calculated based on the outstanding principal balance and the interest rate.

The repayment stage requires borrowers to make timely payments to the lender. It’s essential to establish a system to ensure payments are made on time, such as setting up automatic payments or creating reminders. Late payments can result in penalties and may negatively impact credit scores.

The proportion of principal and interest in each payment changes over time. In the early years of the Mortgage, a larger portion of the payment goes towards interest, while in the later years, a larger portion goes towards reducing the principal. This is known as an amortisation schedule.

During the repayment stage, borrowers should be aware of their options. Some borrowers choose to make additional principal payments to pay off the Mortgage early and save on interest costs. This can be done by making extra payments or increasing the monthly payment amount.

Another option is refinancing the Mortgage. Refinancing involves replacing the current Mortgage with a new one, typically with more favourable terms such as a lower interest rate. This can help borrowers reduce their monthly payments or shorten the loan term. However, it is important to carefully consider the costs and benefits of refinancing before making a decision.

Throughout the repayment stage, borrowers should stay informed about their Mortgage account. This includes regularly reviewing statements, verifying the accuracy of payments applied, and contacting the lender if any discrepancies or concerns arise.

Additionally, borrowers should be proactive in managing their finances to ensure the ability to make Mortgage payments. This involves budgeting, maintaining an emergency fund, and being mindful of other financial obligations to avoid any financial strain that may impact Mortgage repayment.

Conclusion

The Mortgage Life Cycle encompasses several stages, from pre-application to repayment. By understanding each stage in detail, prospective homeowners can navigate the Mortgage process more confidently. It begins with assessing personal finances, researching lenders, and obtaining pre-approval. The application and approval stage involve completing paperwork, providing supporting documents, and undergoing evaluation. The closing stage finalises the Mortgage agreement and transfer of ownership. Finally, the repayment stage requires making regular payments and exploring options such as early payment or refinancing. By staying informed and managing finances responsibly, borrowers can successfully navigate the Mortgage Life Cycle and achieve their homeownership goals.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 20th May 2024

Mon 22nd Jul 2024

Mon 18th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please