We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Purchasing a home is a significant milestone, and for most people, it requires securing a Mortgage. Mortgages are financial tools that allow individuals to borrow funds to buy a property while spreading the repayments over an extended period However, the world of Mortgages can be complex, with various Types of Mortgages available, each offering different terms, interest rates, and repayment options.

Understanding mortgage vs loan the different Types of Mortgages and how they work is crucial for anyone considering homeownership or looking to refinance an existing loan.You will have several choices to make while purchasing or maintaining real estate, including the kind of Mortgage you require. There are several types of mortgages, each with its Pros & Cons. Here are some common types of mortgages: 1. Fixed-rate mortgage 2. ARM

Table of Contents

1) Different Types of Mortgages

a) Fixed-rate Mortgage

b) Variable-rate Mortgage

2) Understanding your repayment options

3) What are the other Types of Mortgages?

4) Conclusion

Different Types of Mortgages

This section of the blog will walk you through the two broad categories of Mortgages:

Fixed-rate Mortgage

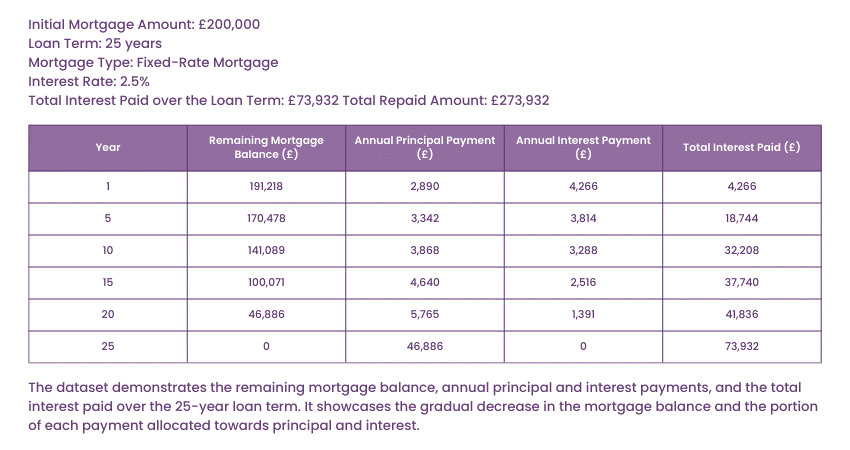

A Fixed-rate Mortgage is a type of home loan where the interest rate remains constant throughout the entire loan term. This means that your monthly Mortgage payments, consisting of both principal and interest, stay the same from start to finish.

A Fixed-rate Mortgage works by setting a consistent interest rate for the entire duration of the loan. This means that your monthly Mortgage payments remain unchanged, providing stability and predictability throughout the loan term. Regardless of fluctuations in the market, your interest rate and payments will stay the same.

Example: Let's say you secure a 25-year Fixed-rate Mortgage with an interest rate of 3.5%. This means that for the entire 25-year period, your interest rate will remain at 3.5%, and your monthly payments will be consistent. This allows you to plan your budget accurately and know exactly what to expect each month.

Here’s a hypothetical case study for this type of Mortgage:

Looking to gain expertise in Mortgage advice? Discover the comprehensive CMAP Level 1, 2, and 3 training. Take the next step towards a productive career in Mortgage advice!

Variable-rate Mortgage

In the UK, a Variable-rate Mortgage encompasses various Mortgage types where the interest rate is not fixed and can fluctuate over time. This category includes Tracker Mortgages and Standard Variable-rate Mortgages. Variable-rate Mortgages offer borrowers the advantage of flexibility, but they also come with the risk of higher payments if interest rates rise significantly.

Example: If you have a Variable-rate Mortgage, your interest rate can shift based on changes in the chosen benchmark (e.g., base rate) or lender decisions. For instance, with a Tracker Mortgage, if the base rate rises, your rate increases; if it falls, your rate decreases.

Borrowers considering Variable-rate Mortgages should assess their risk tolerance and stay informed about market trends to make well-informed decisions regarding their Mortgage payments.

Tracker Mortgage

A Tracker Mortgage is a popular choice among UK homeowners. It offers a transparent way to align your Mortgage interest rate with movements in the Bank of England's base interest rate. Typically, the interest rate on a Tracker Mortgage is set at a fixed percentage above or below the base rate.

The appeal of a Tracker Mortgage lies in its responsiveness to economic conditions. When the base rate decreases, your Mortgage payments shrink, providing financial relief. Conversely, when rates rise, your Mortgage costs increase. This adaptability can be advantageous, especially when interest rates remain low. However, it carries the risk of higher payments if rates surge, so borrowers should be prepared for potential fluctuations.

Example: Let's say you take out a Tracker Mortgage with a rate set at 1.5% above the Bank of England's base rate, which currently stands at 0.5%. Your initial Mortgage rate would be 2%. If the base rate subsequently rises to 1%, your Mortgage rate would increase to 2.5%. If it falls to 0.25%, your rate drops to 1.75%. Tracker Mortgages are attractive when base rates are low but can become costly if rates rise significantly.

Standard Variable-rate Mortgage

A Standard Variable-rate Mortgage is a straightforward yet flexible option. The interest rate for Standard Variable-rate Mortgages is set by the lender themselves and can change at their discretion. It's usually higher than the base rate, so borrowers may pay more in interest compared to other Mortgage types.

The strength of a Standard Variable-rate Mortgage is its adaptability. Borrowers can typically make overpayments, pay off the Mortgage early, or switch to other Mortgage products without incurring significant penalties. This flexibility is ideal for those who anticipate changes in their financial circumstances or plan to re-mortgage in the future.

Example: Suppose your lender's standard variable-rate is initially 4%. Your Mortgage interest rate would also be 4%. If the lender decides to raise the standard variable-rate to 4.5%, your Mortgage rate follows suit, increasing your monthly payments. Conversely, if they lower the standard variable-rate to 3.5%, your rate decreases, reducing your monthly Mortgage costs.

Interested in becoming a Financial Adviser? Explore the Diploma for Financial Advisers (DipFA) training. Take a leap towards a successful career in accounting and finance today!

Discount Mortgage

A Discount Mortgage is an appealing option for those seeking lower initial Mortgage payments. The interest rate on a Discount Mortgage is set at a specified percentage below the lender's Standard Variable-rate Mortgage. This means that borrowers enjoy a reduced rate for an initial period, typically between two to five years. However, the rate is variable and will rise when the lender increases its Standard Variable-rate Mortgage.

Discount Mortgages can be advantageous for borrowers who expect their income to rise in the near future or who want to free up funds for other investments during the discount period. It's crucial to budget for potential rate increases after the discount period ends.

Example: Let's say your lender's standard variable-rate is 5%, and you choose a Discount Mortgage with a 1% discount for the first three years. Your initial Mortgage rate would be 4%. If the standard variable-rate increases to 6% during those three years, your rate would remain 1% below, at 5%. After the discount period, your rate may revert to the lender's standard variable-rate or switch to another product.

Capped-rate Mortgage

A Capped-rate Mortgage combines elements of both fixed and variable-rate Mortgages. It offers borrowers a variable interest rate that cannot exceed a predetermined "cap" for a specified period. This means that even if interest rates rise significantly, your Mortgage rate won't surpass the cap during the capped period.

Capped-rate Mortgages provide a degree of predictability and protection against sharp rate increases, making them attractive to risk-averse borrowers who desire flexibility without exposing themselves to excessive interest rate fluctuations.

Example: Suppose you have a Capped-rate Mortgage with an initial rate of 3% and a cap of 5% for five years. If the lender's standard variable-rate rises to 6%, your rate remains capped at 5%, providing protection against significant rate increases. This allows you to budget with confidence, knowing your payments won't become unmanageable even if market rates rise substantially.

Understanding your repayment options

Mortgages offer you different options to repay the funds that you received. This section of the blog will tell you all you need to know about understanding your repayment options.

Capital Repayment Mortgage

A Capital Repayment Mortgage, often referred to as a Repayment Mortgage, is a common way to finance the purchase of a property in the UK. With this type of Mortgage, your monthly payments are designed to cover both the interest on the loan and gradually reduce the outstanding balance or "capital" you owe to the lender.

Here's how it works:

a) Monthly payments: Each month, you make a fixed Mortgage payment to your lender. This payment includes a portion that goes toward paying off the interest charges accrued on your remaining loan balance and another portion that reduces the principal or the amount you initially borrowed.

b) Gradual debt reduction: Over time, as you continue making these regular payments, the proportion allocated to paying off the capital gradually increases, while the interest portion decreases. This means that as the years go by, you owe less and less on your Mortgage.

c) Complete ownership: By the end of the Mortgage term (usually a term of 25 to 30 years), you will have paid off both the interest and the original loan amount in full. At this point, you own your property outright, and you no longer have any Mortgage payments to make.

Interest-only Mortgage

An Interest-only Mortgage is a less common repayment option in the UK. With this category of Mortgage, your monthly payments only cover the interest charges on the loan. Unlike a Capital Repayment Mortgage, you don't make payments toward reducing the principal balance during the Mortgage term.

Here's how it works:

a) Monthly payments: Your monthly payments solely focus on paying the interest on the outstanding loan amount. This means that you don't make any progress in reducing the original loan balance during the Mortgage term.

b) Lower monthly payments: Because you're not paying down the principal, your monthly payments for an Interest-only Mortgage are typically lower than those for a Capital Repayment Mortgage. This can make it an attractive option for some borrowers.

c) Principal repayment plan: To ensure you eventually pay off the loan, borrowers with Interest-only Mortgages often need to have a separate savings or investment plan in place. This plan is designed to accumulate enough funds to repay the full loan amount when the Mortgage term ends.

d) Risks: Interest-only Mortgages come with risks, as you're not building equity in your property during the Mortgage term. Additionally, if your investment plan doesn't perform as expected, you may face difficulties repaying the original loan amount at the end of the term.

Ready to explore your Mortgage options? Check out our CeMAP training for a deeper understanding. Start your journey today!

What are the other Types of Mortgages?

Apart from the Types of Mortgages that we have discussed already, there are a few other types that you should know about as well. These Types of Mortgages are namely:

Offset Mortgages

Offset Mortgages are a unique type of Mortgage that allows you to link your savings and current account balances to your Mortgage debt. The interest you owe on your Mortgage is calculated on the difference between your outstanding Mortgage balance and your combined savings and current account balances. This can help you reduce the overall interest you pay on your Mortgage and potentially pay it off faster. It's a flexible option that can benefit those with substantial savings.

With an Offset Mortgage, you link your savings and current accounts to your Mortgage. The Mortgage lender calculates the interest you owe based on the difference between your outstanding Mortgage balance and the combined balance of your savings and current accounts. The idea is that by offsetting your savings against your Mortgage debt, you reduce the overall interest you pay.

Example: Suppose you have a Mortgage of £200,000 and savings of £30,000 in your linked accounts. Instead of paying interest on the full £200,000, you only pay interest on £170,000 (£200,000 - £30,000). Over time, this can significantly reduce the interest paid and the time it takes to repay the Mortgage.

95% Mortgages

A 95% Mortgage, often referred to as a 95% LTV (Loan-to-Value) Mortgage, is a home loan where you borrow 95% of the property's purchase price, with a deposit of only 5%. These Mortgages are generally aimed at first-time customers who may not have a large deposit saved up. However, they can have higher interest rates and may require additional insurance, such as Mortgage Indemnity Guarantees (MIGs), to protect the lender in case of default.

A 95% Mortgage allows you to borrow 95% of the property's purchase price, typically with a 5% deposit. For example, if you're buying a house worth £200,000, you would put down a deposit of £10,000 and borrow £190,000. These Mortgages are aimed at first-time buyers who might not have substantial savings for a larger deposit.

Example: You find a property valued at £200,000. You have saved up £10,000 as your deposit, which is 5% of the property price. To secure the property, you take out a 95% Mortgage for the remaining £190,000.

Buy-to-let Mortgages

Buy-to-let Mortgages are designed for individuals who want to acquire property with the intention of renting it out to tenants. These Mortgages differ from standard residential Mortgages, often requiring larger deposits and having higher interest rates. Lenders assess the potential rental income of the property to determine the loan amount, and the rental income should cover the Mortgage payments.

Buy-to-let mortgages are designed for property investors. Lenders assess the potential rental income of the property, and this income typically needs to cover a certain percentage of the Mortgage payment. The deposit required is usually higher than for residential Mortgages.

Example: You want to purchase a Buy-to-let property for £250,000. The lender requires a 25% deposit, which amounts to £62,500. The expected rental income from the property must cover at least 125% of the monthly Mortgage payment. You secure a Buy-to-let Mortgage for the remaining £187,500.

Flexible Mortgages

A Flexible Mortgage allows borrowers to overpay, underpay, take payment holidays, or make lump-sum repayments without incurring hefty penalties. This flexibility can help homeowners pay off their Mortgage quicker or navigate financial challenges. Borrowers can adapt their repayments to suit their changing financial circumstances.

Flexible Mortgages allow you to make extra repayments, underpay when necessary, take payment holidays, or make lump-sum payments without penalties. These features enable borrowers to adapt their Mortgage to their changing financial circumstances.

Example: Let's say you receive a year-end bonus of £5,000. With a Flexible Mortgage, you can use this bonus to make a lump-sum payment towards your Mortgage principal, reducing the overall interest paid and potentially shortening the Mortgage term.

Joint Mortgages

A Joint Mortgage is taken out by two or more individuals, such as couples or family members, to buy a property together. All parties are equally responsible for the Mortgage debt, and their income and creditworthiness are typically combined to determine the Mortgage amount and terms. This type of Mortgage is common for those sharing ownership of a home.

A Joint Mortgage involves two or more individuals purchasing a property together. All parties are jointly responsible for the Mortgage debt, and their income and creditworthiness are combined to determine the Mortgage terms.

Example: A couple, Sarah and John, decide to buy a home together. Sarah earns £30,000 per year, and John earns £40,000. Combining their incomes, they qualify for a Joint Mortgage of £250,000, allowing them to purchase a property jointly.

Guarantor Mortgages

A Guarantor Mortgage is often used by first-time buyers or those with limited credit history. In this arrangement, a family member or close friend acts as a Guarantor, providing a guarantee that they will cover the Mortgage payments if the borrower defaults. This can help individuals secure a Mortgage they might not otherwise be eligible for based on their own financial standing.

In a Guarantor Mortgage, a family member or friend acts as a Guarantor for the borrower. The Guarantor provides a guarantee that they will cover the Mortgage payments if the borrower defaults. This can help individuals with limited credit history or income qualify for a Mortgage.

Example: Lisa, a first-time buyer, wants to purchase a property, but her income isn't sufficient to qualify for a Mortgage. Her parents agree to be her Guarantors. They pledge their assets and income as collateral, enabling Lisa to secure a Mortgage and purchase her first home

Conclusion

In conclusion, selecting the right Mortgage Type is crucial for successful homeownership. By exploring the mortagage life cycle options, comparing their features, and considering individual circumstances, borrowers can make informed decisions that align with their financial goals and needs. Seeking professional advice is recommended to ensure the best choice for a secure and rewarding homeownership experience.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 20th May 2024

Mon 22nd Jul 2024

Mon 18th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please