We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Investment, in its essence, is a strategic approach to secure financial stability and build wealth. It involves a systematic process that, when followed diligently, can yield fruitful results over time. In this blog, we will break down the Investment Process by breaking it down into seven comprehensive steps to help you understand all about it. By understanding these steps in detail, readers can make informed decisions, mitigate risks, and work towards achieving their financial goals effectively.

Table of contents

1) What is an Investment Process?

2) Importance of understanding the Investment Process

3) Steps involved in the Investment Process

a) Step 1: Setting financial goals

b) Step 2: Assessing risk tolerance

c) Step 3: Creating a budget and emergency fund

d) Step 4: Diversifying Investment portfolio

e) Step 5: Conducting research and analysis

f) Step 6: Making informed Investment decisions

g) Step 7: Regularly reviewing and rebalancing the portfolio

4) Conclusion

What is an Investment Process?

An Investment Process is a systematic approach that individuals or organisations follow to make informed decisions about allocating their funds. The goal of an Investment Process is to maximise returns while managing risks effectively. It provides a structured framework, guiding Investors in selecting appropriate assets, diversifying portfolios, and adapting strategies to achieve specific financial objectives, ensuring long-term financial stability and growth. This process often involves understanding the various Types of Investment available, allowing investors to choose options that align with their risk tolerance and financial goals.

Want to know more about Investment? Join our Investment and Trading Training today!

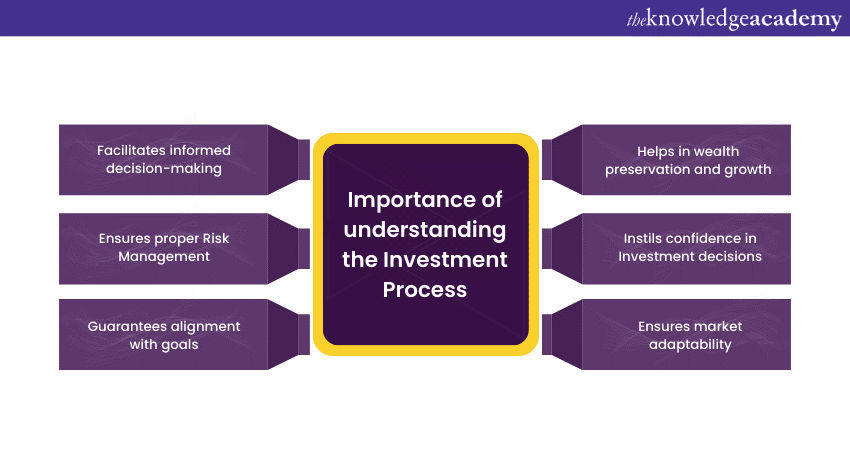

Importance of understanding the Investment Process

This section of the blog will explain why understanding the Investment Process is of paramount importance.

Facilitates informed decision-making

A comprehensive understanding of the Investment Process equips individuals with the ability to analyse various Investment options critically. It enables them to make decisions based on in-depth knowledge, market trends, and historical data. Informed decisions lead to Investments that are not only profitable but also aligned with personal financial goals.

Ensures proper Risk Management

Knowledge of the Investment Process empowers individuals to assess risks associated with different Investment avenues. It helps in distinguishing between high-risk, high-reward Investments and more stable, low-risk options. By understanding the risks involved, Investors can create a diversified portfolio that balances any potential returns with acceptable levels of risk, ensuring financial security even in fluctuating market conditions. By understanding the risks involved, investors can utilize various Investment Tools to create a diversified portfolio that balances potential returns with acceptable levels of risk, ensuring financial security even in fluctuating market conditions.

Guarantees alignment with goals

Each person's financial goals are unique, ranging from buying a house to funding a child's education or planning for retirement. Understanding the Investment Process enables individuals to match their goals with the right Investment products. Whether it's stocks for long-term growth or bonds for stable income, a sound understanding ensures that Investments align with specific objectives. This alignment enhances the likelihood of achieving these goals within the desired timeframe.

Ensures market adaptability

Financial markets are subject to constant change. Those who comprehend the Investment Process are better equipped to adapt to these changes. Whether it's a shift in economic conditions, regulatory alterations, or technological advancements affecting Investment options, a deep understanding allows Investors to adjust their strategies accordingly. This adaptability ensures that Investments remain relevant and optimised, maximising potential returns and minimising losses.

Instils confidence in Investment decisions

Understanding the Investment Process instils confidence. It eradicates the fear of the unknown, allowing Investors to approach their financial ventures with assurance. Confidence encourages proactive decision-making and prevents impulsive actions driven by market volatility. This knowledge also highlights the importance of Investment Banking Roles in providing expert guidance and support. As a result, Investors can maintain a steady course even when faced with market fluctuations, ensuring a disciplined and resilient Investment approach.

Helps in wealth preservation and growth

Investments are not just about earning money; they're also about preserving and growing wealth over time. A solid understanding of the Investment Process aids in wealth preservation by preventing common pitfalls and unnecessary risks. Moreover, it facilitates wealth growth by identifying opportunities that align with an individual's risk tolerance and financial objectives. This combination of preservation and growth is vital for creating a robust financial legacy that can benefit not only the Investor but also future generations.

Get Ahead in Crypto Markets – Register for our the Cryptocurrency Trading Course!

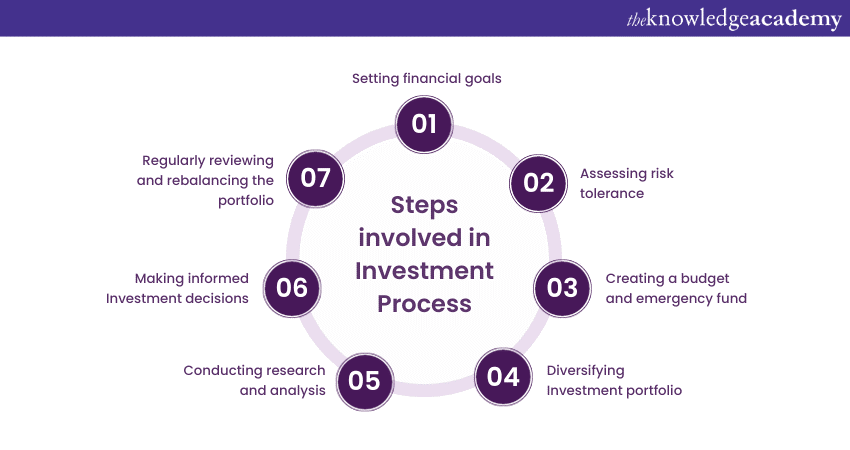

Steps involved in Investment Process

This section of the blog will expand on the different steps involved in the Investment Process.

Step 1: Setting financial goals

Setting clear financial goals is the cornerstone of any successful Investment journey. Short-term goals like purchasing a car and long-term objectives such as retirement planning must be defined and prioritised. These goals act as guiding stars, shaping your Investment strategies and providing direction.

Through meticulous goal-setting, individuals create a roadmap, ensuring that their Investments align with their aspirations, whether it's funding a dream holiday or securing a comfortable retirement. Clear goals provide the purpose and motivation needed to navigate the intricate world of Investments, turning dreams into tangible financial achievements.

Step 2: Assessing risk tolerance

Understanding your risk tolerance is pivotal in making Investment decisions. It refers to your ability to endure fluctuations in the value of your Investments. Assessing your risk tolerance involves evaluating your comfort level with market uncertainties.

Are you conservative, moderate, or aggressive in your risk appetite? By gauging your psychological and financial resilience, you can tailor your Investment portfolio accordingly. Conservative Investors prefer stability, while aggressive ones seek high returns despite higher risks. Understanding these preferences also highlights the value of Investment Banking Skills in managing diverse investment strategies. This step ensures that your Investments align with your temperament, making your financial journey not just profitable but also emotionally secure.

Step 3: Creating a budget and emergency fund

A strong financial foundation starts with disciplined budgeting and building an emergency fund. Budgeting helps in tracking income and expenses, ensuring surplus funds for Investments. Simultaneously, having an emergency fund safeguards Investments from unexpected events such as medical emergencies or sudden job loss.

The emergency fund acts as a safety net, preventing the need to liquidate Investments during crises, thus preserving long-term goals. Creating a budget cultivates financial discipline, enabling systematic Investments, while an emergency fund provides:

1) Financial security

2) Reinforcement in your ability to stay invested during market fluctuations

3) Surety that your Investments stay on course to meet your goals

Step 4: Diversifying Investment portfolio

Diversification is the golden rule of Investments. It refers to spreading Investments across different asset classes, such as stocks, bonds, mutual funds, and real estate. This strategy mitigates risks by reducing the impact of poor performance in any single Investment. Effective Investment Management involves diversifying your portfolio to ensure that a downturn in one sector doesn’t devastate your entire portfolio, balancing potential losses.

For instance, when stocks underperform, bonds might flourish, maintaining overall stability. Diversification aligns Investments with risk tolerance and financial goals, ensuring a resilient portfolio. By not putting all your financial resources into one category, you safeguard your Investments, enhancing your chances of steady, long-term growth.

Step 5: Conducting research and analysis

Informed decisions are the bedrock of successful investing. Conducting thorough research and analysis is imperative before making Investment choices. Fundamental analysis delves into a company's financial health, while technical analysis studies market trends. Staying updated on economic indicators and market dynamics enables anticipation of trends.

Informed Investors can identify promising opportunities, avoiding impulsive decisions. Research ensures an understanding of potential risks and rewards, leading to prudent choices. Continuous analysis aids in tracking Investments, ensuring they align with goals. With comprehensive knowledge, Investors can navigate the ever-changing market landscape, making well-informed decisions that pave the way for sustainable financial growth.

Step 6: Making informed Investment decisions

Professional guidance and continuous monitoring are pivotal in making informed Investment decisions. Seeking advice from financial experts provides nuanced insights tailored to your specific needs. Regularly monitoring Investment performance is essential, ensuring they align with your goals. Adapting strategies to market changes and evolving life goals is critical.

Whether it’s seeking expert advice or using online tools, informed decisions are the result of meticulous evaluation and adaptation. By staying vigilant and flexible, Investors can respond to market dynamics, ensuring that their Investments remain aligned with their objectives, even amidst economic fluctuations, securing their financial future.

Step 7: Regularly reviewing and rebalancing the portfolio

Investment strategies need periodic review and adjustment. Regular portfolio reviews help gauge performance against goals. Rebalancing involves adjusting asset allocation to maintain the desired risk and return levels. Life events like marriage or nearing retirement may necessitate changes in the Investment approach.

Adapting the portfolio ensures it remains effective in fulfilling objectives. By responding to changing circumstances, Investors maximise opportunities and minimise risks. Regular reviews and rebalancing not only safeguard Investments against market volatility but also optimise their potential. This step ensures that Investments remain relevant, aligning with evolving goals, ultimately securing a stable and prosperous financial future.

Conclusion

In conclusion, mastering the Investment Process is not just about making money; it's about creating a secure financial future. By following the seven steps outlined in this blog, readers can navigate the complex world of Investments with confidence. Empowered with knowledge and a systematic approach, individuals can work towards achieving their financial dreams and aspirations. Remember, Investment is not just about numbers; it is about building a foundation for a prosperous and financially secure life.

Want to know more about Investment Management? Join our Investment Management Masterclass today!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 13th Dec 2024

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please