We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial Planning is the compass that guides your journey to financial success and is a skill much in demand in the modern world. From proper budgeting and investing to managing debt and planning for retirement, this skill empowers you to make the right decisions and secure your financial future. In this blog, we will tell you all you need to know about What is Financial Planning, the elements of a Financial Plan and strategies for effective planning. Read ahead to learn more!

Table of Contents

1) Understanding What is Financial Planning

2) Different types of Financial Planning

3) Strategies for effective Financial Planning

4) Why is Financial Planning important?

5) Conclusion

Understanding What is Financial Planning

Before we dive into Financial Planning strategies, we will first provide you with a definition of Financial Planning. Financial Planning is the strategic process of organising and managing your finances to achieve your life goals. It involves assessing your current financial situation, setting specific objectives, and creating a roadmap to attain them. Key elements include budgeting, saving, investing, and managing debt.

By aligning your financial resources with your aspirations, Financial Planning empowers you to make informed decisions. Additionally, it helps navigate uncertainties, and work towards a secure and prosperous future. It's about taking control of your financial destiny and maximising the potential of your money to fulfil both short-term needs and long-term dreams.

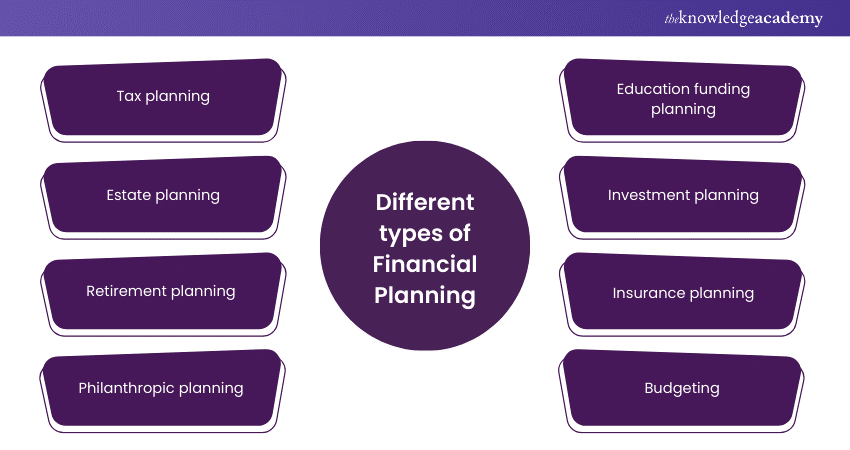

Different types of Financial Planning

Now that you know What is Financial Planning, let’s understand its various types. When engaging in Financial Planning, you're tapping into a wealth of expertise that encompasses various critical financial aspects. It helps construct a holistic plan, addressing both your present financial situation and your future aspirations. Here's a more in-depth look at the different types of Financial Planning:

a) Tax planning: Beyond addressing tax issues, Financial Planning helps craft strategies to maximise your tax refunds while minimising your tax liabilities. Some professionals even assist with the preparation and filing of your annual taxes.

b) Estate planning: This service aims to simplify matters for your loved ones after your passing. It includes essential tasks like drafting wills and devising strategies to manage potential estate taxes effectively.

c) Retirement planning: Aspirations of retirement underscore the importance of this service. Retirement planning ensures you're on track to accumulate the necessary capital to maintain your desired lifestyle during retirement.

d) Philanthropic planning: It's a noble endeavour to give back to the community or support causes close to your heart. Financial Planning ensures you do so efficiently, utilising available tax incentives to the fullest.

e) Education funding planning: If you have children or dependents aspiring to pursue higher education, then education funding planning can come in handy. This type of Financial Planning guides you in securing the necessary resources to support their academic journey.

f) Investment planning: While Financial Planning might not help you directly manage your assets, it does provide a roadmap for your investment portfolio. It outlines how much you should invest and in which types of investments align with your goals.

g) Insurance planning: This type of planning evaluates your insurance needs, providing recommendations to safeguard your financial future. This is typically done by Financial Analysts and licensed Insurance Agents. However, be cautious of potential conflicts of interest if the planner also sells insurance.

h) Budgeting: The cornerstone of Financial Planning, budgeting ensures your spending aligns with your income. It also serves as a preventative measure against unnecessary debt.

The above is some of the most common approaches of Financial Planning. Selecting the right Financial Planning service can hold the key to your success. So, ensure that the services you choose align with your unique needs and goals. This helps in creating a personalised and effective financial strategy tailored to your specific circumstances.

Elevate your financial expertise with our Accounting Masterclass - Sign up now to enhance your knowledge and excel in the realm of accounting and finance.

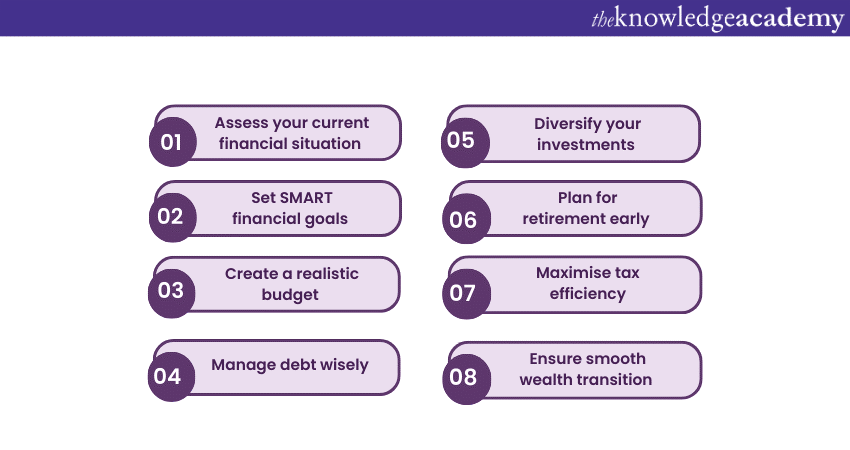

Strategies for effective Financial Planning

Now, let’s understand some strategies to ensure effective Financial Planning:

Assess your current financial situation

Begin your Financial Planning journey by evaluating your present financial status. Take stock of your assets, including savings, investments, and property, and calculate your liabilities such as loans and credit card debt. Accurately understanding your income and expenses provides a comprehensive view of your financial health. This assessment forms the basis for setting realistic goals and tailoring your Financial Plan to your unique circumstances.

Set SMART financial goals

Shift from vague aspirations to well-defined objectives using SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, transform "I want to save more" into "I will save £500 monthly for a home down payment within two years." SMART goals provide clarity, enabling you to monitor progress and stay motivated. This approach helps you set clear milestones for various aspects of your financial journey.

Create a realistic budget

Forge a budget that accurately reflects your financial reality. Account for income sources, fixed expenses, discretionary spending, savings, investments, and debt repayments. A well-structured budget aligns your spending with your financial goals. As life changes, adjust your budget to accommodate new priorities and ensure it remains a relevant guide for your financial decisions.

Manage debt wisely

Effective debt management is essential for financial stability. Prioritise high-interest debts to reduce overall interest payments. Develop a repayment plan, allocate extra funds to pay down debts faster, and avoid accumulating new debt. Responsible debt management frees up funds for savings, investments, and achieving your goals, ultimately putting you on a path towards financial independence.

Diversify your investments

Spread the risk by diversifying your investment portfolio across various asset classes such as the likes of stocks, bonds, and real estate. Diversification safeguards your financial future by minimising the impact of poor performance in a singular investment. This strategy ensures that potential losses in one area can be balanced by gains in another, enhancing the stability and growth potential of your overall investment portfolio.

Plan for retirement early

Commence retirement planning as early as possible. Capitalise on compound interest by starting contributions to retirement accounts like pensions or ISAs during your early earning years. Employer-matched contributions, if available, amplify your retirement savings. Initiating retirement planning early allows your investments more time to grow, providing you with a better chance to achieve the comfortable retirement you envision.

Maximise tax efficiency

Understanding tax implications is vital for effective Financial Planning. Research tax-efficient investment accounts and strategies to reduce your tax liability. Utilise tax advantages offered by ISAs, pensions, and other tax-advantaged accounts. Be aware of tax deadlines and opportunities for deductions and credits, optimising your tax savings. A proactive approach to tax planning can significantly impact your overall financial picture.

Ensure a smooth wealth transition

Estate planning makes sure that your assets are distributed according to your wishes and minimises potential conflicts among heirs. Draft a legally sound will, designating beneficiaries for financial accounts and investments. If needed, consider setting up trusts to manage assets and ensure beneficiaries' interests are protected. Regularly review and update your estate plan to reflect changes in your financial situation and family circumstances, providing peace of mind for yourself and your loved ones.

Why is Financial Planning important?

Financial Planning serves as the cornerstone of sound Financial Management, offering a multitude of benefits that extend far beyond mere number crunching. Let’s explore its importance:

a) Goal achievement: At its core, Financial Planning is a roadmap to realising your financial dreams. Whether you aspire to purchase a home, fund your child's education, or retire comfortably, a well-structured plan provides the steps needed to reach these milestones.

b) Risk management: Financial Planning encompasses risk mitigation strategies, including insurance coverage and emergency funds. These measures shield your assets and cushion you from the financial shockwaves of unexpected events.

c) Tax efficiency: Expert Financial Planning optimises your tax position. By leveraging available tax deductions, credits, and exemptions, you minimise your tax liability and retain more of your hard-earned income.

d) Retirement security: A carefully crafted financial plan ensures that you accumulate sufficient savings to maintain your desired lifestyle during retirement. It maps out how much you need to save, invest, and allocate for retirement to achieve financial security.

e) Debt management: Financial Planning helps prevent the accumulation of excessive debt by aligning your spending with your income. It establishes a sustainable budget, curbing unnecessary expenses and fostering long-term financial stability.

f) Wealth accumulation: Through strategic investment and wealth-building strategies, Financial Management promotes the growth of your assets over time. It considers various investment avenues and risk profiles to grow your wealth sensibly.

g) Legacy planning: Beyond your lifetime, Financial Planning ensures the orderly transfer of assets to your rightful heirs. This minimises potential conflicts, legal complications, and tax implications, preserving your financial legacy.

h) Emergency preparedness: Financial Planning equips you to handle unexpected financial emergencies like medical bills or sudden unemployment without derailing your long-term financial goals. It builds financial resilience and reduces anxiety.

i) Financial peace of mind: Ultimately, comprehensive Financial Planning grants you peace of mind. Knowing that your financial future is secure and well-structured relieves stress and allows you to focus on your life's other pursuits.

Overall, Financial Planning is not a static document but a dynamic tool that empowers you to take control of your financial destiny. It provides guidance, adaptability, and a structured approach, ensuring you traverse the financial journey with confidence and foresight.

Conclusion

To sum it up, incorporating the above-mentioned financial strategies into your life can bring clarity and direction to your financial journey. With diligent planning, you can shape your financial future, achieve your aspirations, and navigate challenges with confidence. Hope we could answer all your queries about “What is Financial Planning”!

Unlock your financial potential with expert Accounting and Finance Training - join now to gain essential skills for a prosperous future!

Frequently Asked Questions

The frequency of financial plan reviews depends on individual circumstances. Typically, annual reviews are advisable to ensure your plan remains aligned with evolving goals, income changes, and market fluctuations. Life events like marriage, parenthood, or career shifts should trigger immediate updates.

Disciplined saving is the cornerstone of financial success. It empowers you to accumulate funds systematically, ensuring you have the resources to achieve your goals and navigate unexpected expenses. Consistency in saving fosters financial stability and fuels your journey towards financial aspirations.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. By tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Training, including Financial Management Course, Financial Modelling Course and many more. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our Business Skills Blogs cover a range of topics related to Java, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Planning skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 17th May 2024

Fri 21st Jun 2024

Fri 19th Jul 2024

Fri 16th Aug 2024

Fri 20th Sep 2024

Fri 18th Oct 2024

Fri 15th Nov 2024

Fri 20th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please