We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Finance Management is a crucial function in both personal and professional life, whether you are running a business or trying to manage your personal finances. Understanding What is Financial Management will help you achieve personal Financial independence and ensure a healthy financial cycle for your business.

One of the main functions of Finance Management is achieving financial stability, growth and sustainable growth for the short and long term. It involves informed decision-making, resource analysis and other various aspects to successfully manage Finance. However, that’s just a surface definition of the approach, there’s much more to learn. In this blog, you will learn everything about What is Financial Management, its scope, objectives, and importance in your personal and professional life.

Table of Contents

1) What is Financial Management?

2) Financial Management objectives

3) Scope of Financial Management

4) Importance of Financial Management

5) Conclusion

What is Financial Management?

Financial Management is the process of planning and managing the Finances of an individual or organisation to achieve its goals and objectives. It involves optimising shareholder value, generating profit, reducing risk, and ensuring financial health from both short-term and long-term perspectives. For individuals, Financial Management may include retirement planning, college savings, and other personal investments.

Financial Management Objectives

The aim of Financial Management is to assist businesses or individuals in making informed financial decisions. These decisions aim to enhance their financial stability and well-being, both in the present and the future. To do this, Financial Management experts examine financial and investment data and advise clients on the best course of action that aligns with their goals.

Financial Management can also improve the financial performance and profitability of clients by creating a strategic plan for how, why, and where Finances are used and allocated. The specific strategies and methods of Financial Management vary depending on whether the client is a company or an individual. The following are some key objectives of Financial Management:

Wealth maximisation

Wealth maximisation is a fundamental objective of Financial Management. It involves making relevant strategies for the current investment and their future returns by making optimum decisions. With good Financial Management, businesses and individuals can make informed capital investments and expand into new markets.

Resource utilisation

Financial Management enables businesses to allocate and utilise resources based on their requirements and needs. It ensures that the resources are not only utilised in the most efficient way but also generate optimum returns for the business. Financial Management also helps in allocating financial resources like capital, funds, and assets to projects which offer the highest returns.

Risk management

One important objective of Financial Management is identifying, assessing and managing different types of financial risks. If these risks are not taken care of, they can harm the overall functioning of the business. Risk management objective enables businesses to maintain financial stability and protect stakeholders' interests.

Compliance consideration

Financial Management ensures that business decisions and activities align with the jurisdictions and established laws for the respective industry. In an organisation, professionals like Finance Analysts are responsible for accounting standards, tax regulations and industry-specific regulations.

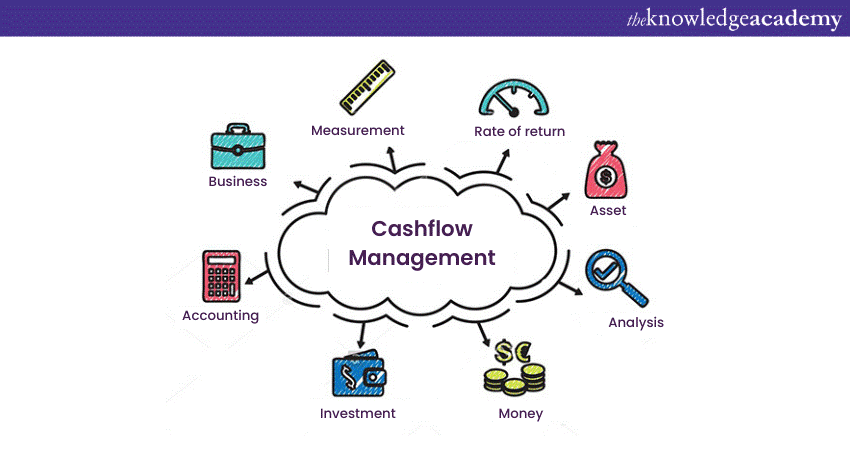

Cash flow management

Cash flow management refers to the inflow and outflow of cash within a business. Financial Management addresses this process to maintain an adequate level of liquidation to meet the short-term obligations and opportunities. By effectively managing the cash flow, businesses can prepare for any financial challenge that may arise in the future.

Learn how to manage cash flows and achieve financial stability – register for our Cash Flow Training today!

Scope of Financial Management

Financial Management is the process of planning, managing, and controlling the Finances of an individual or an organisation to achieve their goals and objectives. The scope of Financial Management covers the following areas:

Capital budgeting

It is the process of estimating the fixed and working capital needs of the business and allocating the available funds to different projects based on their expected returns and risks.

Capital structure

It is the process of determining the optimal mix of debt and equity that minimises the cost of capital and maximises the value of the firm or the shares in the market.

Financial decision

Financial decisions involve selecting optimal sources of funds, including investors, shareholders, banks, public deposits, and other financial lenders. It also entails determining the best methods for investing these funds. This involves capital budgeting, opportunity cost analysis, and considering safety, liquidity, and profitability criteria.

Working capital management

It is the process of managing the short-term assets and liabilities of the business to ensure smooth operations and sufficient cash flow. It involves analysing various ratios, such as the working capital ratio, the collection ratio, and the inventory ratio, to optimise the use of resources and reduce wasteful expenditure.

Dividend decision

It is the process of deciding whether to pay dividends to shareholders or retain the profits for reinvestment. It depends on the earnings per share, the market value of the shares, the investment opportunities, and the shareholder’s preferences.

Profit management

It is the process of distributing the business' revenues and profits among various stakeholders, such as owners, creditors, employees, government, and society. Further, it involves evaluating the strengths and weaknesses of different sources of using the profits and earnings, such as reserves, withdrawals, and reinvestments.

Become a master of Financial Management – register for our Financial Management Course and start today!

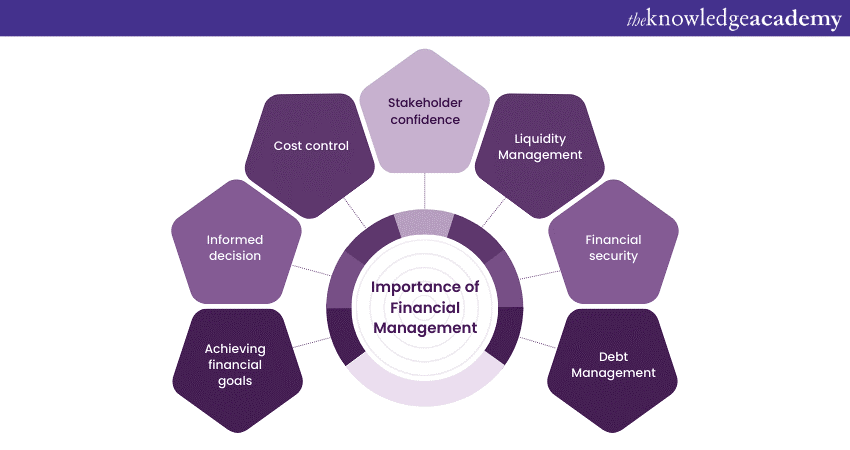

Importance of Financial Management

Financial Management is the process of planning, managing, and controlling the Finances of a company to achieve its goals and objectives. It helps the company to avoid bankruptcy and cope with various challenges, such as loss of revenue, natural disasters, strikes, wars, etc. Thus, Financial Management becomes paramount. Here are some other reasons why:

.

.

Achieving financial goals

It provides a framework and necessary techniques to plan, allocate resources and make informed decisions to achieve these goals. Financial Management also helps set clear and well-defined goals and assess the potential risks that might arise while following these goals. With a proper management plan, businesses and individuals can attain the desired financial outcome and secure a stable financial future.

Informed decision

Financial Management ensures that individuals and businesses make informed decisions considering the financial condition of the business and individual. The process of making an informed decision includes collecting the right information and analysing the possible outcomes using Financial Management techniques.

Cost control

Financial Management helps businesses and individuals identify unnecessary cost expenditures and suggest the best possible way to achieve cost-effectiveness. It involves a systematic approach to managing and reducing expenses and focusing on providing stability and profitability. Financial Management also enables businesses and individuals to identify the areas of inefficiency and implement measures to optimise costs by effectively using the available resources.

Stakeholder confidence

Good Financial Management boosts the confidence of stakeholders in the company and attracts more opportunities to grow and scale the business. It also helps make the financial system of a business more transparent and honest. One of the most significant importance of good stakeholder confidence is the trust of the investors.

This helps in attracting more investments and business opportunities. With the right Financial Management, businesses can make sure that the employees are aligned with the financial goals of the business.

Liquidity management

Having an adequate amount of liquidity is of crucial importance for a business. Financial Management enables businesses to maintain the optimum cash flows and resources to meet short-term financial obligations. This also enables businesses to cover immediate expenditures and focus on opportunities and stability.

By managing cash flows and liquidity, businesses can remain agile and equip themselves to navigate through the uncertainties that might arise in the future.

Financial security

One of the paramount benefits of Financial Management is ensuring financial security for businesses and individuals. With the help of rigorous planning, resource allocations, and effective decision-making, organisations can secure their financial cycles.

This also offers a strategy against financial instabilities and other financial uncertainties and ensures that businesses achieve long-term success.

Debt Management

Financial Management allows businesses to manage debt in the most effective ways. It also helps in making informed decisions for borrowing, structuring debt, and avoiding unnecessary fundraising. By effectively managing debt, businesses can achieve financial stability and improve their capacity to achieve their financial goals.

Unlock the potential of Accounts and Finance – register for our Accounting & Finance Training today!

Conclusion

Financial Management is an essential tool to secure a healthy financial future. With the use of its strategies and techniques businesses and individuals can achieve their financial goals and overall financial success. We hope that this blog helped you understand What is Financial Management, its objectives, scopes and importance.

Learn everything about finance – register for our Finance for Non Financial Managers Course and start your journey to achieve financial freedom.

Frequently Asked Questions

Financial Management helps achieve long-term financial goals by planning, managing, and controlling the Finances of an individual or an organisation. It helps in selecting the best projects, sources, and uses of funds and optimising the returns, risks, and costs of the financial decisions.

Yes, there are specific certifications related to Financial Management that can enhance one’s career prospects. Some of the popular ones are Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), and Financial Risk Manager (FRM).

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Payroll Course, Finance for Non-Financial Managers, Financial Management Course and more. These courses cater to different skill levels, providing comprehensive insights into What is Credit Risk.

Our Business Skills Blogs cover a range of topics related to Fintech, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 17th May 2024

Fri 21st Jun 2024

Fri 19th Jul 2024

Fri 16th Aug 2024

Fri 20th Sep 2024

Fri 18th Oct 2024

Fri 15th Nov 2024

Fri 20th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please