We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

When it comes to purchasing a property, Mortgage is often an essential part of the process for many individuals. However, understanding the legal aspects of a Mortgage can be daunting. One critical document in the Mortgage process is the Mortgage Deed. A Mortgage Deed, also known as a deed of trust or security instrument, is a formal record that attests to the existence of an agreement. In this blog, we’ll discuss the details of What is a Mortgage Deed, as well as its components.

Table of Contents

1) Definition and purpose of a Mortgage Deed

2) Components of a Mortgage Deed

3) Recording and registration of a Mortgage Deed

4) Importance of understanding a Mortgage Deed

5) How to sign a Mortgage Deed?

6) Digital Mortgage Deeds

7) Conclusion

Definition and purpose of a Mortgage Deed

A Mortgage Deed, also referred to as a deed of trust or security instrument, is a legal document that is proof of a loan agreement between a borrower and a lender. It is used to secure a loan against a property, typically real estate.

A Mortgage Deed serves as a safeguard for the lender by allowing them to foreclose on the property and get back their investment in case the borrower fails to repay the loan. In other words, the Mortgage Deed gives the lender a legal claim, known as a lien or charge, on the property. The fee enables the lender to take possession of the property and sell it to settle the outstanding loan balance.

The Mortgage Deed establishes the terms and conditions of the Mortgage agreement between the borrower, often referred to as the Mortgagor, and the lender, known as the Mortgagee. The mortagage life cycle outlines the obligations of both parties, including the repayment schedule, interest rate, and any additional provisions specific to the loan. The terms and conditions can differ based on the lender, the borrower's creditworthiness, and the current market conditions.

By requiring the borrower to sign a Mortgage Deed, the lender mitigates the risk associated with lending a substantial amount of money. The Mortgage Deed provides legal protection and ensures that the lender has a legal recourse in case the borrower defaults on the loan. This security allows lenders to offer competitive interest rates and more favourable loan terms, making homeownership more accessible to individuals who may not have the entire purchase price upfront.

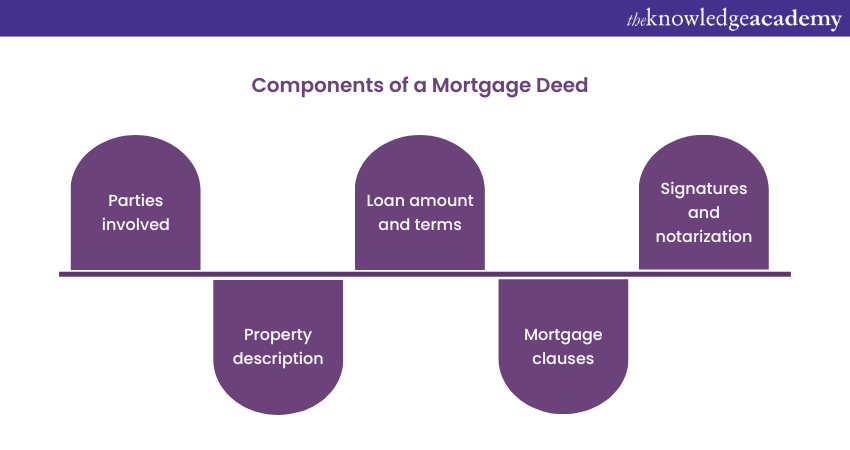

Components of a Mortgage Deed

A Mortgage Deed contains several essential components that outline the terms and conditions of the Mortgage agreement. Understanding these components is crucial for both borrowers and lenders. Let's explore each component in detail:

1) Parties involved: The Mortgage Deed identifies the parties involved in the transaction—the borrower (Mortgagor) and the lender (Mortgagee). It provides their names, addresses, and sometimes additional details such as their legal status or entity type.

2) Property description: The Mortgage Deed includes a detailed description of the property being used as collateral. This description typically includes the property's address, boundaries, and legal description to ensure accuracy. It ensures that the lender has a clear understanding of the property against which the Mortgage is being secured.

3) Loan amount and terms: The Mortgage Deed outlines the exact amount of money that the borrower will receive from the lender as a loan. It also outlines the repayment terms, including the interest rate, the duration of the loan, and the frequency of payments (monthly, quarterly, etc.). These terms and conditions may include provisions for late payment penalties, prepayment options, or adjustable interest rates, depending on the specific agreement.

4) Mortgage clauses: Various Mortgage clauses may be included in the deed to further define the rights and obligations of both parties. For example:

a) Acceleration clause: If the borrower fails to meet the terms of the agreement or breaches it, the lender can require the entire outstanding loan to be repaid with this provision.

b) Due-on-sale clause: This clause requires the loan to be repaid if the property is sold or transferred to a new owner. It protects the lender's interest and ensures that they have control over the repayment process.

c) Insurance and taxes: The Mortgage Deed may stipulate that the borrower is responsible for maintaining property insurance and paying property taxes to protect the lender's investment.

5) Signatures and notarisation: For the Mortgage Deed to be legally binding, both the borrower and the lender need to sign it. The signatures indicate the parties' agreement to the terms and conditions outlined in the deed. In many jurisdictions, notarisation or witnessing by a legal authority is required to validate the document.

It is essential for borrowers to carefully review all the components of the Mortgage Deed before signing it. By understanding and agreeing to the terms and conditions within the Mortgage Deed, borrowers can ensure that they are fully aware of their obligations and can make informed decisions regarding their loan agreement. Likewise, lenders rely on the Mortgage Deed to secure their investment and establish their rights and remedies in case of default or non-compliance by the borrower.

Embark on a rewarding journey in Mortgage achieve your Diploma for Financial Advisers (DipFA) through our specialised DipFA Training!

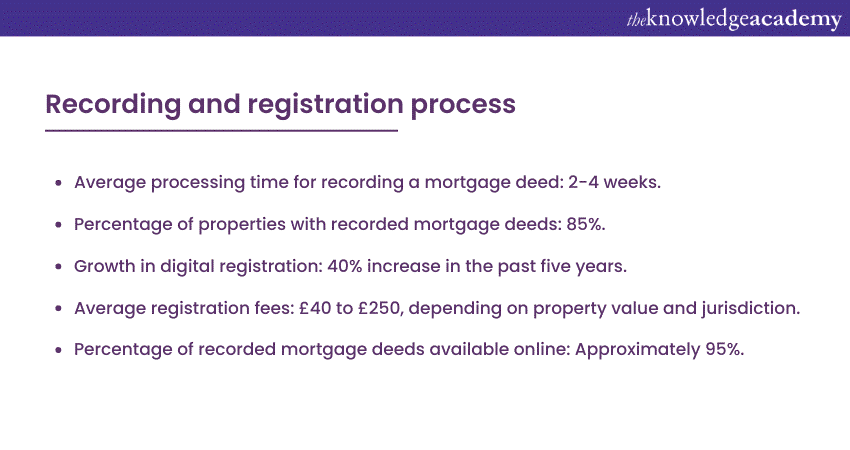

Recording and registration of a Mortgage Deed

To make the Mortgage Deed public and establish the lender's priority in case of multiple liens on the property, it is typically recorded with the relevant government office, such as the land registry. The recording process ensures that the Mortgage is officially documented and searchable by interested parties.

Recording the Mortgage Deed serves multiple purposes. To begin with, the Mortgage is publicly announced and documented as a legal transaction. This is important because it prevents subsequent buyers or lenders from claiming ignorance of the existing Mortgage. The recorded Mortgage Deed establishes the lender's priority in case of competing claims on the property.

Additionally, recording the Mortgage Deed helps in establishing the chain of title, which is a history of ownership transfers and encumbrances on the property. It creates a clear record of who holds the Mortgage and any changes in ownership or lien priority.

In order to finish registering, it is necessary to submit the Mortgage Deed along with any required supporting documents to the appropriate government office. These offices may vary depending on the jurisdiction but commonly include land registries or county recorders. The Mortgage Deed is assigned a unique identification number and becomes a permanent part of the public records.

It is important for lenders to ensure timely registration of the Mortgage Deed to protect their interest in the property. Failure to record the Mortgage can result in the loss of priority to subsequent liens or claims. Borrowers, on the other hand, benefit from the transparency and security provided by a recorded Mortgage Deed, as it ensures the legitimacy of the transaction and protects their rights as property owners.

Importance of understanding the Mortgage Deed

Understanding the Mortgage Deed is of utmost importance for borrowers as it is a legally binding document that outlines their rights, obligations, and responsibilities regarding the Mortgage agreement. Here are a few reasons why understanding the Mortgage Deed is crucial:

1) Clarity of obligations: By comprehending the terms and conditions outlined in the Mortgage Deed, borrowers can clearly understand their obligations towards the lender. This includes making timely payments, adhering to the repayment schedule, and fulfilling any additional requirements specified in the deed. Understanding these obligations helps borrowers avoid defaulting on the loan and facing potential legal consequences.

2) Awareness of rights: The Mortgage Deed also outlines the rights of the borrower. By understanding these rights, borrowers can ensure they are protected and treated fairly throughout the Mortgage term. This may include the right to prepay the loan, the right to dispute any errors or discrepancies in the loan servicing, or the right to receive proper documentation related to the loan.

3) Risk assessment: A thorough understanding of the Mortgage Deed allows borrowers to assess the risks associated with the Mortgage agreement. This includes evaluating the potential consequences of defaulting on the loan, understanding the impact of interest rate changes (if applicable), and identifying any potential penalties or fees that may be incurred. This knowledge empowers borrowers to make informed decisions and plan for any potential challenges they may face during the Mortgage term.

4) Protection against fraud: By understanding the contents of the Mortgage Deed, borrowers can protect themselves against potential fraud or misrepresentation. They can verify that the terms and conditions outlined in the deed align with their understanding and expectations. This helps in detecting any discrepancies or fraudulent activities that may compromise their rights or financial security.

Take your Mortgage advisory career to new heights, expand your knowledge across all levels, and achieve success with our comprehensive CeMAP Level 1, 2, and 3 Training.

How to sign a Mortgage Deed?

Like with any legal document, signing a Mortgage Deed needs a witness who confirms that you are who you say you are, that they know you as this person, and that you have signed with your signature.

These requirements are standard and are meant to stop fraud.

Everyone named on the Mortgage must sign for themselves – you can't sign for someone else, like your partner or spouse.

Things to check before signing Mortgage Deed

Mortgage Deeds are a normal part of buying a property with a loan. However, any document that makes you agree to a long-term financial deal should be checked thoroughly before you sign it.

If there is something in the document that you do not know about, it could cause problems for you in the future.

Before you sign, we suggest you:

1) Ensure all the details are correct, including the property's price, it's worth, and your name.

2) Choose a suitable witness. We will explain this later, but your witness has to be someone who is not related to you and does not have anything to do with the property – they can't be someone who will live there, even if they are not signing the Mortgage.

3) Look at all of the terms and ensure they match what your lender offered.

4) Lenders and people who help with buying and selling properties are used to answering any questions, and it is better to ask for clarity at this stage than signing a document with content you are unsure about.

How to choose a Mortgage Deed witness?

There are certain things you must keep in mind while choosing your Mortgage Deed witness. You have to make sure that your witness can't be related to you, is over 18 and does not have any connection to the property – which means they can't be someone who will live there, regardless of whether they are signing the Mortgage or not.

Witnesses also have to have a different address and state it on the document; you might choose someone who helps with buying and selling properties, someone who works with law, someone who works with you or someone who lives near you, for example.

A signed deed without a witness is not valid and will not be accepted by the lender – the signature also must be 'wet', meaning it has to be signed in person and by hand, but there are times when you can sign online.

Mortgage deeds are usually sent to you by post by the lender or by professionals who help buy and sell properties.

What happens after signing a Mortgage Deed?

Once you have signed your Mortgage Deed, you have agreed to pay back your loan and follow the terms and conditions of your Mortgage contract.

The last step is to finish the deal, which means

1) Paying some money in advance through your contact who works with law

2) Swapping contracts with the person who is selling the property

3) Choosing a day that works for both of you to finish the deal

4) After completing the deal, you get your keys and are the owner of the property

Mortgage Deeds are valid for as long as the Mortgage agreement lasts. So, if you later change your Mortgage, you will be asked to sign a new deed, which replaces the old one. This is recorded by the people in charge of keeping records.

Embark on a rewarding journey in Mortgage advice, and become a certified Mortgage professional with our comprehensive CeMAP Course Training.

Digital Mortgage Deeds

Mortgage Deeds can be signed online, but only for changing your Mortgage.

The people who keep records of who owns properties allow online deeds only for changing Mortgages to try and reduce the time and paperwork involved in buying and selling properties.

A lender will still make the document, and you have to check everything carefully because the document still has legal power and can be used against you – the only difference is how you get the document and sign it.

Online deeds must be signed through the gov.uk link given to you, through a process that checks your identity. Once you confirm everything is correct, you will need to enter a phone number and get a unique code.

You will then be asked to enter your code, which acts like a signature and finishes the deed.

Steps to sign a Mortgage Deed online

If you are changing your Mortgage, you will be able to sign your Mortgage Deed online. This is a convenient and fast way to complete the legal document that shows that you agree to use your property as a security for the loan.

To sign a Mortgage Deed online, you need to confirm your full name, date of birth, internet availability and phone number. Here are the steps to follow:

1) The lender makes the Mortgage Deed and sends it to you through a digital link from your conveyancing solicitor

2) You use the gov.uk service to confirm your identity before you can access the Mortgage Deed

3) You review the Mortgage Deed and make sure that you understand and agree with the terms and conditions of the Mortgage

4) You ask for a code to be sent to your phone number

5. You enter the code, which acts as your 'signature' on the Mortgage Deed

Why sign a Mortgage Deed electronically?

Signing a Mortgage Deed electronically is a smart and convenient way to complete the legal document that shows that you agree to use your property as a security for the loan. Here are some of the benefits of signing electronically:

1) It saves you time, as you do not have to wait for the physical document to be sent and returned by post

2) It is more convenient, as you can access it anywhere and everywhere with an internet connection

3) It reduces the amount of paperwork involved in the transaction, which is good for the environment and your storage space

4) It is secure, as it requires you to verify identity before you can access and sign the Mortgage Deed

5) It is stored electronically at the Land Registry, which means that it cannot be lost or changed

Conclusion

To sum it up, a Mortgage Deed is a critical legal document that serves to secure a loan against a property. It outlines the terms and conditions of the Mortgage agreement, identifies the parties involved, and provides a detailed description of the property being used as collateral. By understanding the Mortgage Deed and its components, borrowers can make informed decisions and ensure compliance with their obligations. Taking the time to thoroughly understand the Mortgage Deed empowers individuals to navigate the Mortgage process confidently and responsibly, ensuring a smoother and more secure homeownership experience.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 20th May 2024

Mon 22nd Jul 2024

Mon 18th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please