We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial Modelling involves developing a mathematical model to represent the financial status and performance of a company, project, or investment. Financial Modelling Software is a tool that helps you build, analyse, and present Financial Models conveniently and efficiently. This software can save you time, reduce errors, and enhance your decision-making process. This blog will review the top 10 best Financial Modelling Software and compare their features, benefits, and drawbacks.

Table of Content

1) What is Financial Modelling Software?

2) Best Financial Modelling Software

a) Finmark

b) Jirav

c) Quantrix

d) Cube

e) Oracle BI

f) Synario

g) IBM Cognos

h) Mosaic

i) Operis

j) Hyperion

3) Conclusion

What is Financial Modelling Software?

Financial Modelling Software is a software application that allows you to create and manipulate Financial Models using various functions, formulas, and data sources. This Software can help you perform tasks such as:

a) Forecasting revenues, expenses, cash flows, and profits

b) Valuing assets, liabilities, equity, and investments

c) Evaluating scenarios, sensitivities, and risks

d) Optimising strategies, plans, and budgets

e) Generating reports, charts, and dashboards

f) Sharing and collaborating with stakeholders

Financial Modelling Software can be classified into two types: spreadsheet-based and non-spreadsheet-based. Spreadsheet-based software uses a familiar interface and format, such as Excel, to create and edit Financial Models. Non-spreadsheet-based software uses a different interface and format, such as a graphical or web-based platform, to create and edit Financial Models. Each type has advantages and disadvantages, depending on your needs and preferences.

Best Financial Modelling Software

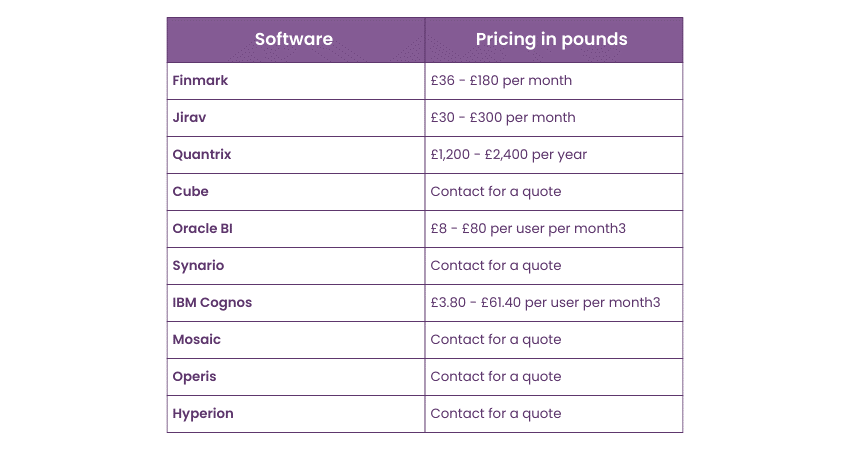

Many Financial Modelling Software packages are available on the market, each with its own strengths and weaknesses. Here, we list the top 10 best Financial Modelling Software based on their popularity, functionality, usability, and customer reviews. We will briefly overview each software, highlighting its main features, benefits, and drawbacks.

Finmark

Finmark is a cloud-based Financial Modelling Software that helps startups and small businesses plan, manage, and optimise their finances. Finmark allows you to create and update Financial Models in minutes without coding or spreadsheet skills. Finmark also provides insights, recommendations, and alerts to help you achieve your financial goals.

Features:

a) Drag-and-drop interface to build and customise Financial Models

b) Pre-built templates and scenarios for various industries and use cases

c) Integration with accounting, banking, and payment platforms

d) Real-time data and analytics to track and improve financial performance

e) Collaboration and sharing tools to work with team members and Investors

Benefits:

a) Easy and intuitive to use, no coding or spreadsheet skills required

b) Fast and accurate, no manual errors or outdated data

c) Comprehensive and flexible, it covers all aspects of financial planning and management

d) Insightful and actionable, it provides guidance and feedback to optimise financial outcomes

e) Collaborative and transparent, facilitates communication and alignment with stakeholders

Drawbacks:

a) Relatively new and untested, it may have bugs or glitches

b) Limited customisation and integration options may not suit complex or specific needs

c) Subscription-based plans may be expensive for some users

Jirav

Jirav is a cloud-based Financial Modelling Software that helps businesses create and manage financial forecasts, budgets, and reports. Jirav enables you to connect your financial data sources, such as accounting, payroll, and CRM systems, and automatically generate Financial Models based on your assumptions and goals. Jirav allows you to visualise and analyse your financial data and share it with your team and stakeholders.

Features:

a) Data integration with various financial and operational platforms

b) Automated Financial Modelling and scenario analysis

c) Interactive dashboards and charts to display and explore financial data

d) Customisable reports and presentations to communicate financial results

e) Collaboration and sharing features to work with team members and stakeholders

Benefits:

a) Seamless and automated, with no manual data entry or calculations

b) Accurate and reliable, no human errors or data inconsistencies

c) Comprehensive and scalable, it covers all aspects of financial forecasting and reporting

d) Visual and interactive, it provides clear and engaging financial insights

e) Collaborative and secure, enables teamwork and accountability

Drawbacks:

a) Requires data integration and setup, which may take time and effort

b) Limited functionality and flexibility, may not support advanced or custom Financial Modelling

c) Subscription-based plans may be expensive for some users

Advance your career today with our expert-led Accounting & Finance Training – Join now!

Quantrix

Quantrix is a desktop-based Financial Modelling Software that helps businesses and professionals create and analyse complex Financial Models. Quantrix uses a multi-dimensional approach, which allows you to create and manipulate Financial Models using natural language and formulas without relying on cell references or macros. Quantrix also offers a web-based platform, Quantrix Qloud, which allows you to access, share, and collaborate on your Financial Models online.

Features:

a) Multi-dimensional Modelling engine to create and edit Financial Models

b) Natural language and formula interface to define and calculate financial data

c) Scenario manager to compare and evaluate different financial scenarios

d) DataLink and DataPush to import and export data from various sources

e) Qloud platform to access, share, and collaborate on Financial Models online

Benefits:

a) Powerful and flexible, it supports complex and custom Financial Modelling

b) Intuitive and user-friendly, no cell references or macros are required

c) Dynamic and responsive, it updates and recalculates financial data automatically

d) Data integration and exchange connect with various data sources and formats

e) Online access and collaboration, work with team members and stakeholders online

Drawbacks:

a) Desktop-based software requires installation and maintenance

b) The steep learning curve may take time and training to master

c) License-based pricing may be expensive for some users

Cube

Cube is a cloud-based Financial Modelling Software that helps finance teams and businesses create and manage financial plans, budgets, and reports. Cube lets you connect your existing spreadsheets, such as Excel or Google Sheets, and transform them into a centralised and collaborative financial platform. Cube also provides tools and features to enhance your Financial Modelling and analysis capabilities.

Features:

a) Spreadsheet integration and synchronisation to create and update Financial Models

b) Data integration with various financial and operational platforms

c) Workflow and approval management to streamline and automate financial processes

d) Reporting and dashboarding tools to visualise and communicate financial data

e) Collaboration and sharing features to work with team members and stakeholders

Benefits:

a) Spreadsheet-friendly and familiar, no need to change or abandon existing spreadsheets

b) Data integration and automation, no manual data entry or calculations

c) Workflow and process optimisation reduce errors and delays

d) Reporting and visualisation provide clear and concise financial insights

e) Collaboration and alignment facilitate teamwork and transparency

Drawbacks:

a) Dependent on spreadsheets, may not support non-spreadsheet-based Financial Modelling

b) Limited functionality and customisation may not suit complex or specific needs

c) Subscription-based plans may be expensive for some users

Elevate your financial acumen: Join our Financial Management Course today!

Oracle BI

Oracle BI is a cloud-based Business Intelligence and analytics software that helps businesses and organisations create and manage Financial Models, reports, and dashboards. Oracle BI enables you to connect and analyse data from various sources, such as databases, files, applications and web services, and generate insights and recommendations to improve your financial performance and decision-making. Oracle BI allows you to share and collaborate on your Financial Models and insights with your team and stakeholders.

Features:

a) Data integration and preparation to connect and transform data from various sources

b) Data analysis and discovery to explore and understand data using various methods and techniques

c) Data visualisation and storytelling to create and customise charts, graphs, and narratives

d) Data governance and security to manage and protect data access and quality

e) Data collaboration and sharing to work with team members and stakeholders

Benefits:

a) Data integration and analysis support various data sources and formats

b) Data visualisation and storytelling provide engaging and interactive financial insights

c) Data governance and security ensure data quality and integrity

d) Data collaboration and sharing enable teamwork and communication

e) Cloud-based and scalable, accessible and adaptable to changing needs

Drawbacks:

a) Complex and comprehensive, it may require technical skills and training.

b) Limited functionality and flexibility may not support advanced or custom Financial Modelling.

c) Subscription-based plans may be expensive for some users.

Synario

Synario is an advanced Modelling platform designed for financial analysis and strategic planning. It targets businesses and organisations looking to enhance their decision-making processes through robust Financial Modelling.

Features:

a) Dynamic Modelling capabilities that adapt to complex financial scenarios.

b) Interactive dashboards for visualising financial forecasts and outcomes.

c) Customisable modules to address specific industry or organisational needs.

d) Advanced what-if scenarios to explore different financial strategies.

e) Integration with existing financial systems for seamless data flow.

Benefits:

a) Provides deep insights into the financial impacts of strategic decisions.

b) Enhances accuracy in financial forecasting with dynamic scenarios.

c) A User-friendly interface allows for easy adoption across teams.

d) Supports strategic planning with data-driven insights.

e) Facilitates collaboration in financial planning and analysis.

Drawbacks:

a) It can be complex for users without a financial background.

b) Potentially high cost of implementation for smaller organisations.

c) It requires a time investment to leverage its advanced features fully.

IBM Cognos

IBM Cognos is a comprehensive Business Intelligence suite with data analytics and reporting capabilities. It's designed for businesses of all sizes to help them understand data and make informed decisions.

Features:

a) Extensive data integration from various sources.

b) Advanced analytics, including Artificial Intelligence (AI) and Machine Learning capabilities.

c) Customisable dashboards and reporting tools.

d) Real-time data processing for up-to-date information.

e) Mobile capabilities for on-the-go data access.

Benefits:

a) Enhances decision-making with data-driven insights.

b) Offers a holistic view of business performance.

c) Scalable to accommodate growing data needs.

d) Facilitates regulatory compliance through accurate reporting.

e) Empower users with self-service analytics.

Drawbacks:

a) It can be overwhelming and complex for amateurs.

b) It may require significant resources for setup and maintenance.

c) Integration with certain legacy systems can be challenging.

Mosaic

Mosaic is a strategic finance platform that provides real-time insights into business financials. It's tailored for modern companies looking to streamline their financial planning and analysis.

Features:

a) Real-time financial reporting and analysis.

b) Automated consolidation of financial data from multiple sources.

c) Scenario planning tools for forecasting and budgeting.

d) Collaborative workspace for team-based financial planning.

e) Customisable dashboards and KPI tracking.

Benefits:

a) Offers a real-time view of a company’s financial health.

b) Simplifies financial planning and reduces manual workload.

c) Enhances collaboration in financial decision-making.

d) Customisable to meet the needs of different businesses.

e) User-friendly interface for ease of use.

Drawbacks:

a) It may not cater to very specific or unique financial analysis needs.

b) As a newer platform, it might have fewer integrations than established products.

c) Subscription costs could be a consideration for smaller businesses.

Operis

Operis is a desktop-based Financial Modelling Software that helps businesses and professionals create and analyse complex Financial Models. Operis uses a spreadsheet-based approach, which allows you to create and manipulate Financial Models using Excel, with enhanced features and functions. Operis also offers a web-based platform, Operis Analysis Kit, which allows you to audit, review, and validate your Financial Models online.

Features:

a) Spreadsheet-based Modelling engine to create and edit Financial Models using Excel

b) Enhanced functions and formulas to define and calculate financial data

c) Model audit and review tools to check and improve the quality and accuracy of Financial Models

d) Model validation and certification services to verify and certify the reliability and robustness of Financial Models

e) Analysis Kit platform to access, audit, and validate Financial Models online

Benefits:

a) Spreadsheet-friendly and familiar, no need to change or abandon existing spreadsheets

b) Enhanced functions and formulas support complex and custom Financial Modelling

c) Model validation and certification provide assurance and confidence

d) Online access and validation, work with team members and stakeholders online

Drawbacks:

a) Desktop-based software requires installation and maintenance

b) Dependent on spreadsheets, may not support non-spreadsheet-based Financial Modelling

c) License-based pricing may be expensive for some users

Hyperion

Hyperion is a cloud-based Modelling Software that helps businesses and organisations create and manage Financial Models, plans, budgets, and reports. Hyperion enables you to connect and analyse data from different sources, such as databases, applications, files, and web services, and generate insights and recommendations to improve your financial performance and decision-making. Hyperion allows you to share and collaborate on your Financial Models and insights with your team and stakeholders.

Features:

a) Data integration and preparation to connect and transform data from various sources

b) Data analysis and discovery to explore and understand data using various methods and techniques

c) Data visualisation and storytelling to create and customise charts, graphs, and narratives

d) Data governance and security to manage and protect data access and quality

e) Data collaboration and sharing to work with team members and stakeholders

Benefits:

a) Data integration and analysis support various data sources and formats

b) Data visualisation and storytelling provide engaging and interactive financial insights

c) Data governance and security ensure data quality and integrity

d) Data collaboration and sharing enable teamwork and communication

e) Cloud-based and scalable, accessible and adaptable to changing needs

Drawbacks:

a) Complex and comprehensive, it may require technical skills and training

b) Limited functionality and flexibility, may not support advanced or custom Financial Modelling

c) Subscription-based plans may be expensive for some users.

Master the art of Financial Forecasting: Join our advanced Financial Modelling Course now!

Conclusion

Financial Modelling software is a dynamic and multifaceted solution that assists in building and maintaining Financial Models for various purposes and domains. This Software can save you time, reduce errors, and enhance your decision-making process. This blog has reviewed the top 10 best Financial Modelling Software and compared their features, benefits, and drawbacks. We hope that this blog has helped you understand and appreciate the value and potential of Financial Modelling Software and that you will find the best Software for your needs and objectives.

Elevate your Accounting skills: Join our comprehensive Accounting Training today!

Frequently Asked Questions

When selecting Financial Modelling Software, consider its ease of use, integration capabilities with other tools, range of modelling features, scalability, and cost-effectiveness. Ensure it aligns with your business size, complexity, and specific financial analysis needs.

Yes, many Financial Modelling Software tools are designed with user-friendly interfaces and provide tutorials for beginners. However, a basic understanding of financial concepts is beneficial for effectively utilising these tools for complex modelling and analysis.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Financial Modelling, Payroll and Financial Management. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our Business Skills blogs cover a range of topics related to Financial Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Financial Modelling Course

Financial Modelling Course

Fri 7th Jun 2024

Fri 2nd Aug 2024

Fri 4th Oct 2024

Fri 6th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please