We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Compliance Risk encompasses the potential that an organisation might deviate from the path of conformity to the myriad laws, regulations, standards, and ethical norms that underpin its operational framework. It covers the spectrum of risks arising from such deviations, stretching from financial repercussions to reputational harm.

Compliance Risk Management is a vital aspect of running a business that is responsible and sustainable. It helps an organisation avoid legal and financial troubles and fosters a culture of ethical integrity. Discover Compliance Risk Management through our comprehensive blog and safeguard your business against regulatory pitfalls. Read along to learn more.

Table of Contents

1) Understanding Compliance Risk

2) What is Compliance Risk Management?

3) Types of Compliance Risks

4) Identifying and assessing Compliance Risk

5) Factors contributing to Compliance Risk

6) Best practices for effective Compliance Risk Management

7) Conclusion

Understanding Compliance Risk

Compliance Risk embodies the vulnerability an organisation faces when it fails to align its actions with the legal and ethical codes relevant to its domain. Whether these deviations stem from internal shortcomings or external pressures, the consequences can resonate far beyond immediate setbacks, impacting an organisation's standing and viability.

Understanding Compliance Risk entails diving into its intricacies and recognising its profound influence on organisational dynamics. By embracing a comprehensive understanding of Compliance Risk, organisations can lay the groundwork for effective management strategies that mitigate vulnerabilities, foster ethical conduct, and ensure sustainable success.

What is Compliance Risk Management?

Compliance Risk Management is preventing and reducing the consequences of failing to comply with laws, regulations, standards, and policies that apply to an organisation. It involves identifying, assessing and managing the sources of Compliance Risks, which can affect the organisation’s reputation, performance, and legal liability. Managing Compliance Risks is an ongoing process that requires regularly monitoring regulatory changes and updating the organisation's policies, procedures, and training. Compliance Risk Management applies to all aspects of the organisation, including its Information Technology (IT) systems, which must support and enable compliance activities.

Compliance Risk Management is part of the broader Governance, Risk and Compliance (GRC) framework, which aims to ensure that an organisation operates in alignment with its values, mission and risk appetite. GRC policies are critical in the financial industry, but other sectors, such as healthcare, have legal obligations to implement Risk Management and compliance practices.

Types of Compliance Risks

Compliance Risks encompasses various facets of regulatory adherence that organisations must navigate. These risks can be categorised into three primary types: Regulatory Compliance, Legal Compliance, and Industry-specific Compliance. Let’s understand each of these risks in detail:

Regulatory Compliance

Regulatory Compliance Risk arises from the complex web of laws, rules, and regulations imposed by governmental bodies and regulatory authorities. Organisations are required to follow these regulations to ensure that their operations align with legal standards. These regulations can cover areas such as data privacy, financial reporting, environmental protection, and more.

Non-compliance with regulations can result in severe consequences, including fines, legal actions, and reputational damage. The challenge often lies in staying updated with the evolving regulatory landscape and adapting swiftly to changes.

Legal Compliance

Legal Compliance Risk extends beyond regulatory requirements to encompass broader legal obligations. This type of risk involves adhering to laws and statutes that govern various aspects of business operations, such as contract law, Intellectual Property Rights (IPR), labour laws, and anti-discrimination regulations.

Falling short of Legal Compliance can lead to lawsuits, legal penalties, and significant financial repercussions. Organisations must prioritise Legal Compliance to uphold the principles of fairness, transparency, and ethical conduct in their interactions.

Industry-specific Compliance

Industry-specific Compliance Risk is tailored to the unique characteristics and challenges of a particular industry. Different industries have their own set of standards and regulations that organisations must adhere to.

For instance, healthcare organisations need to comply with patient data protection regulations, while financial institutions must adhere to stringent anti-money laundering laws. Failing to meet these industry-specific regulations can lead to operational disruptions, loss of business licenses, and reputational harm. Industry compliance is essential for maintaining the credibility and reliability of an organisation within its sector.

Identifying and assessing Compliance Risks

Effective identification and assessment of Compliance Risks are fundamental to proactive Risk Management strategies. By understanding potential risks and their impact, organisations can implement targeted mitigation measures. Here’s how the identification and assessment process works:

Risk Assessment process

The Risk Assessment process involves a systematic evaluation of an organisation's operations, practices, and external factors to identify potential compliance vulnerabilities. This process typically comprises the following steps:

a) Identifying risks: In the process of identifying Compliance Risks, organisations meticulously review regulatory requirements and industry standards that pertain to their operations. This thorough analysis involves scrutinising laws, regulations, and guidelines that are relevant to the industry's unique landscape. By understanding the specific compliance obligations that apply to them, organisations lay the foundation for a comprehensive Risk Assessment strategy.

b) Evaluating impact: Once potential risks are identified, organisations assess their potential impact on the various facets of the organisation. This evaluation extends beyond the financial realm to encompass reputational standing and operational continuity. By considering the broader implications of each risk, organisations gain insights into the potential consequences that non-compliance might bring.

c) Likelihood assessment: To gauge the likelihood of a risk materialising, organisations dive into a multifaceted evaluation process. This involves studying historical data, observing industry trends, and analysing the effectiveness of internal controls. By considering these elements, organisations can better estimate the probability of a compliance breach occurring.

d) Risk scoring: Risks are often assigned scores using predefined scales that consider both their potential impact and likelihood of occurrence. This systematic scoring system enables organisations to rank risks in order of priority. Such prioritisation ensures that efforts are focused on addressing risks that carry the greatest potential impact and likelihood.

e) Mitigation strategies: Once risks are evaluated and prioritised, organisations embark on the development of targeted mitigation strategies. These strategies are designed to address the identified risks effectively. They may involve making process adjustments, introducing additional controls, or embracing innovative technologies.

Compliance Risk indicators

Compliance Risk indicators are essential tools in the Risk Assessment process. These indicators are specific measurable criteria that highlight potential compliance issues. Here are some key aspects to consider:

a) Monitoring regulatory changes: Staying attuned to evolving regulations is paramount. Failing to monitor and adapt to new compliance requirements can render existing practices obsolete, leading to inadvertent violations. Regular monitoring allows organisations to align their operations with the latest regulatory landscape.

b) Employee training and awareness: The importance of well-informed employees cannot be overstated. A lack of awareness regarding regulations can lead to unintentional breaches. Regular training initiatives that provide employees with up-to-date information can significantly reduce the risk of non-compliance.

c) Audit findings: Internal and external audits serve as valuable tools for detecting potential compliance gaps. The insights gained from audit findings shed light on areas that necessitate corrective action, enabling organisations to rectify shortcomings promptly.

d) Customer complaints: Customer complaints often serve as a reality check for compliance processes. They highlight areas where processes may be falling short and expose vulnerabilities that require immediate attention.

e) Data analysis: Analysing data related to compliance activities provides a comprehensive view of an organisation's compliance status. Patterns and trends within compliance-related data can reveal potential risks and areas of concern.

f) Third-party relationships: Organisations often engage third-party partners, such as suppliers or vendors, in their operations. Ensuring the compliance of these partners is essential, as any non-compliance on their part can pose significant risks to the organisation's reputation and operations.

Factors contributing to Compliance Risk

Compliance Risk arises from a confluence of factors that can significantly impact an organisation's ability to adhere to regulations and standards. These factors not only highlight the complexity of the compliance landscape but also emphasise the need for proactive Risk Management. Here’s a comprehensive list:

Evolving regulations

Evolving regulations represent a substantial challenge for organisations. In an era of rapid regulatory change, staying up-to-date with shifting laws and requirements demands constant vigilance. Failure to adapt quickly can lead to non-compliance, potentially exposing organisations to penalties and legal liabilities. Organisations must establish mechanisms to monitor regulatory changes across relevant jurisdictions, ensuring that compliance strategies remain relevant and effective.

Lack of clarity

Lack of clarity in regulations poses a formidable obstacle to Compliance Risk Management. When regulations are ambiguous or open to interpretation, organisations may inadvertently misinterpret their requirements. This can lead to inconsistent compliance practices and create room for inadvertent breaches.

Establishing clear channels of communication and interpretation within the organisation is crucial to addressing this challenge. Detailed guidance and training can help employees understand complex regulations and navigate uncertainties more effectively.

Inadequate training

Inadequate training is a root cause of Compliance Risk. Employees who lack awareness of regulations and their implications can unknowingly engage in non-compliant activities. A robust compliance training program is vital to ensure that all employees recognise their responsibilities and the potential consequences of non-compliance.

Effective training programs go beyond basic awareness, delving into specific regulations applicable to each role and equipping employees with the knowledge to make informed decisions that align with compliance requirements.

Identifying and assessing Compliance Risk

Effective identification and assessment of Compliance Risk are fundamental to proactive risk management strategies. By understanding potential risks and their impact, organisations can implement targeted mitigation measures.

Risk Assessment process

The Risk Assessment process involves a systematic evaluation of an organisation's operations, practices, and external factors to identify potential compliance vulnerabilities. This process typically comprises the following steps:

a) Identifying Risks: In the process of identifying Compliance Risks, organisations meticulously review regulatory requirements and industry standards that pertain to their operations. This thorough analysis involves scrutinising laws, regulations, and guidelines that are relevant to the industry's unique landscape. By understanding the specific compliance obligations that apply to them, organisations lay the foundation for a comprehensive risk assessment strategy.

b) Evaluating impact: Once potential risks are identified, organisations assess their potential impact on the various facets of the organisation. This evaluation extends beyond the financial realm to encompass reputational standing and operational continuity. By considering the broader implications of each risk, organisations gain insights into the potential consequences that non-compliance might bring.

c) Likelihood assessment: To gauge the likelihood of a risk materialising, organisations dive into a multifaceted evaluation process. This involves studying historical data, observing industry trends, and analysing the effectiveness of internal controls. By considering these elements, organisations can better estimate the probability of a compliance breach occurring.

d) Risk scoring: Risks are often assigned scores using predefined scales that consider both their potential impact and likelihood of occurrence. This systematic scoring system enables organisations to rank risks in order of priority. Such prioritisation ensures that efforts are focused on addressing risks that carry the greatest potential impact and likelihood.

e) Mitigation strategies: Once risks are evaluated and prioritised, organisations embark on the development of targeted mitigation strategies. These strategies are designed to address the identified risks effectively. They may involve making process adjustments, introducing additional controls, or embracing innovative technologies.

Compliance Risk indicators

Compliance Risk indicators are essential tools in the Risk Assessment process. These indicators are specific measurable criteria that highlight potential compliance issues. Here are some key aspects to consider:

a) Monitoring regulatory changes: Staying attuned to evolving regulations is paramount. Failing to monitor and adapt to new compliance requirements can render existing practices obsolete, leading to inadvertent violations. Regular monitoring allows organisations to align their operations with the latest regulatory landscape.

b) Employee training and awareness: The importance of well-informed employees cannot be overstated. A lack of awareness regarding regulations can lead to unintentional breaches. Regular training initiatives that provide employees with up-to-date information can significantly reduce the risk of non-compliance.

c) Audit findings: Internal and external audits serve as valuable tools for detecting potential compliance gaps. The insights gained from audit findings shed light on areas that necessitate corrective action, enabling organisations to rectify shortcomings promptly.

d) Customer complaints: Customer complaints often serve as a reality check for compliance processes. They highlight areas where processes may be falling short and expose vulnerabilities that require immediate attention.

e) Data analysis: Analysing data related to compliance activities provides a comprehensive view of an organisation's compliance status. Patterns and trends within compliance-related data can reveal potential risks and areas of concern.

f) Third-party relationships: Organisations often engage third-party partners, such as suppliers or vendors, in their operations. Ensuring the compliance of these partners is essential, as any non-compliance on their part can pose significant risks to the organisation's reputation and operations.

Register for our Effective Compliance Training and navigate regulations with confidence!

Best practices for effective Compliance Risk Management

Compliance Risk Management is a critical endeavour that demands a proactive approach to identify, assess, and mitigate potential risks associated with non-compliance. Implementing best practices ensures that organisations navigate complex regulatory landscapes with confidence and integrity.

Developing compliance programs

A well-structured compliance program serves as the foundation for effective Risk Management. Here are key elements to consider while developing a compliance program:

a) Clear policies and procedures: Developing comprehensive policies and procedures tailored to your industry and organisation is pivotal. These documents serve as roadmaps, outlining specific compliance requirements and guidelines. Ensuring easy accessibility for all employees fosters a consistent understanding of what is expected:

b) Leadership buy-in: Leadership commitment is the cornerstone of a strong compliance culture. When senior leaders actively endorse and advocate for the compliance program, it sends a powerful message throughout the organisation. Their support emphasises the seriousness of compliance and influences employees to embrace it as a shared responsibility

c) Regular training: Continuous education is paramount for maintaining a well-informed workforce. Regular training sessions equip employees with a deeper understanding of regulations and their roles in compliance. This awareness ensures that employees recognise the significance of compliance and its impact on the organisation's success.

d) Whistleblower mechanism: Creating a secure and confidential mechanism for employees to report potential compliance violations is a crucial aspect of any effective compliance program. A whistleblower mechanism empowers employees to come forward without fearing retaliation. Early reporting enables timely intervention and resolution, minimising the potential consequences of violations.

Empower your organisation’s success: by registering for our Corporate Governance Training!

Understanding the role of technology in Compliance Risk Management

Leveraging technology can enhance the efficiency and effectiveness of Compliance Risk Management. Let’s understand some of the key factors in which technology can help you in Compliance Risk Management:

a) Automated monitoring: Utilise automated tools to monitor and track compliance with regulations. These tools can provide real-time alerts and reduce the risk of oversight.

b) Data analytics: Data analytics enable organisations to analyse large datasets to identify patterns that could indicate potential Compliance Risks.

c) Document management systems: Centralised document management systems ensure that policies, procedures, and regulatory updates are readily available to employees.

d) Risk Assessment Software: Use Risk Assessment Software to evaluate and prioritise Compliance Risks based on their potential impact and likelihood.

Continuous monitoring and improvement

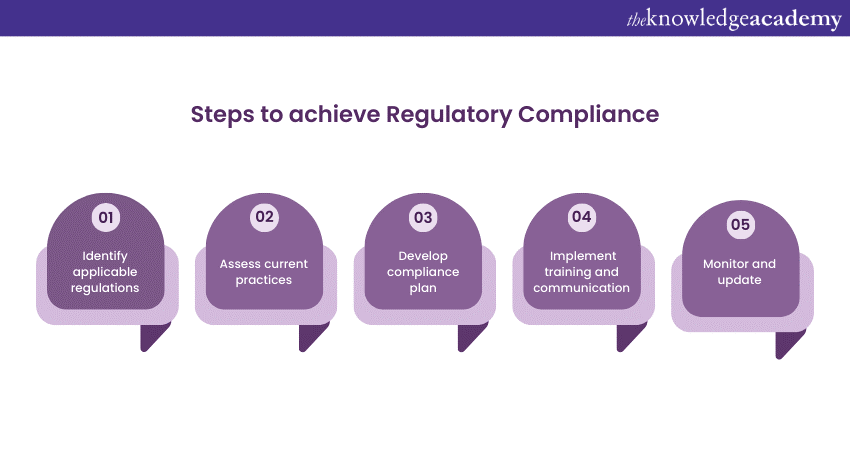

Compliance Risk Management is a continuous process that requires constant vigilance and improvement. The following are the most significant steps to consider in managing Compliance Risk:

a) Regular audits and assessments: Conduct regular internal audits to evaluate the effectiveness of your compliance program. Assessments helps in identifying the gaps and areas for improvement.

b) Adapting to regulatory changes: Stay informed about changes in regulations that affect your industry. Update your compliance program promptly to ensure alignment with evolving requirements.

c) Learning from incidents: Treat compliance incidents as learning opportunities. Investigate the root causes of non-compliance and implement corrective actions to prevent recurrence.

d) Feedback and communication: Foster a culture of open communication where employees can provide feedback on the effectiveness of compliance measures. Use this feedback to refine your strategies.

Conclusion

Effective Compliance Risk Management is a shield that safeguards organisations from legal troubles and promotes stakeholder trust. By identifying, assessing, and proactively addressing Compliance Risks, businesses can navigate the complexities of regulations and ensure sustained success while upholding their integrity and legitimacy.

Unlock the power of Compliance by registering for our Compliance Training today!

Frequently Asked Questions

One way to minimise Compliance Risks without compromising growth is to adopt a proactive and integrated approach to Compliance Risk Management. It means anticipating and addressing potential compliance issues before they become problems and aligning compliance objectives with business goals and strategies. A proactive and integrated approach can help organisations avoid costly fines, penalties, lawsuits, and reputational damage and enhance their competitive advantage, customer loyalty, and innovation potential.

The frequency of updating Compliance Risk Management strategies depends on the nature and complexity of the regulations that apply to the business, as well as the level of risk exposure and tolerance of the organisation. However, as a general rule, companies should review and update their Compliance Risk Management strategies at least once a year or whenever significant changes in the regulatory environment, such as new laws, rules, standards, or guidance. Additionally, businesses should monitor and evaluate the effectiveness of their compliance risk management strategies regularly and make adjustments as needed.

Few important metrics can measure the effectiveness of a Compliance Risk Management strategy.:

a) The number and severity of compliance incidents, breaches, violations, or complaints, and the associated costs and consequences.

b) The level of awareness, understanding, and adherence to compliance policies, procedures, and training among employees, managers, and other stakeholders.

c) The quality and timeliness of compliance reporting, auditing, and remediation activities.

d) The degree of alignment and integration of Compliance Risk Management with business strategy, operations, and culture.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy offers various Compliance Training, including Corporate Governance Course and Security Governance and Compliance Training. These courses cater to different skill levels, providing comprehensive insights into various Compliance Frameworks.

Our Compliance Training blogs covers a range of topics related to ISO and Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please