We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Getting started on the journey of Investment requires more than mere financial resources; it demands a comprehensive understanding of the key characteristics that underpin successful decision-making. These characteristics serve as guiding lights, illuminating the path towards sound Investment strategies. In this blog, we will expand on 10 key Characteristics of Investment and how they shape every Investment decision. Keep reading to know more!

Table of Contents

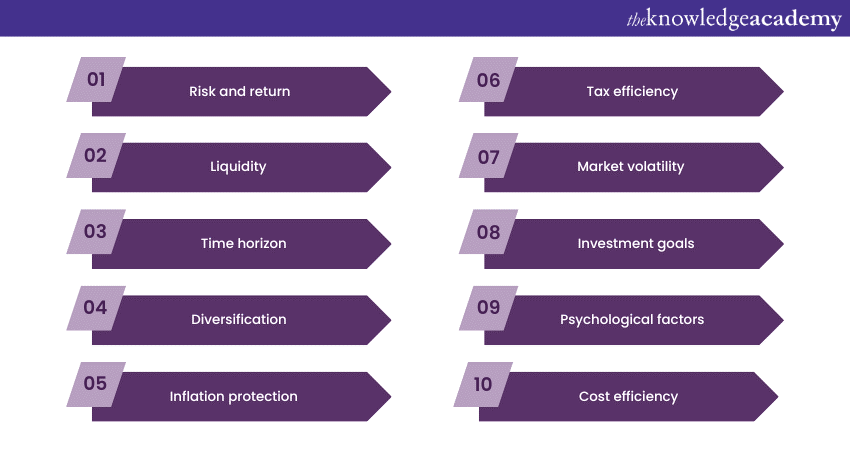

1) Key Characteristics of Investment

a) Risk and return

b) Liquidity

c) Time horizon

d) Diversification

e) Inflation protection

f) Tax efficiency

g) Market volatility

h) Investment goals

i) Psychological factors

j) Cost efficiency

2) Tips for Effective Investment

3) Conclusion

Key Characteristics of Investment

This section of the blog will expand on 10 Characteristics of Investment.

Risk and return

Risk and return are the twin determinants that shape every Investment decision. In the context of Investment, risk encapsulates the possibility of not achieving expected returns or experiencing losses. It's vital to recognise that higher levels of risk often accompany the potential for higher returns. This relationship underscores the importance of aligning one's risk tolerance with one's choices.

Individual risk tolerance varies based on age, financial goals, and emotional disposition towards uncertainty. Striking the right balance between risk and potential rewards is a cornerstone of successful investing. A prudent approach entails diversifying one's portfolio to manage risk and adapting the risk profile in line with evolving circumstances.

Liquidity

Liquidity is the ease and speed at which an Investment can be converted into cash without significantly affecting its value. Cash itself is the most liquid asset, as it can be used immediately for transactions. Conversely, real estate or certain Investments might have lower liquidity due to the time required for selling and the potential impact on the sale price.

Emergency funds, upcoming expenses, and goals influence an individual's liquidity needs. Striking a balance between liquid and illiquid assets ensures the availability of funds when required while simultaneously pursuing growth opportunities.

Time horizon

The time horizon in investing refers to the amount of time an investor intends to hold an Investment before needing access to the funds. It's a critical determinant that shapes decisions.

Short-term Investments, such as day trading or short-maturity bonds, focus on preserving capital and generating immediate gains. Medium-term Investments span several years and aim to achieve growth or specific financial milestones. Long-term Investments, often held for decades, leverage the power of compounding to deliver substantial returns potentially. Aligning Investments with the appropriate time horizon ensures that the chosen assets can effectively fulfil one's financial objectives.

Acquire a solid understanding of how to trade Cryptocurrency by signing up for the Cryptocurrency Trading Training now!

Diversification

Diversification is akin to distributing risk across various baskets to protect against unforeseen events. It involves investing in a mix of asset classes, sectors, and geographic regions to help decrease the impact of poor performance in any single area. By diversifying, an investor can potentially achieve more stable returns over time, as different assets often react differently to economic events.

For instance, when stocks underperform, bonds or real estate might thrive. Diversification requires thoughtful asset allocation and periodic rebalancing to maintain the desired risk-return profile. While it doesn't eliminate risk, diversification is a powerful strategy to mitigate its effects and create a well-rounded portfolio.

Inflation protection

Inflation is the eventual erosion of purchasing power over time due to rising prices. Certain Investments have historically acted as a hedge against inflation, aiming to retain or even increase their value in the face of rising costs. These assets include commodities like gold and oil, Real Estate, and specific equities.

By incorporating inflation-protected assets into a portfolio, investors seek to maintain the value of their wealth and purchasing power over the long term. Considering inflation protection becomes pivotal in constructing a resilient strategy that withstands the erosive impact of inflation on financial goals.

Elevate your Investment prowess with our Investment Management Masterclass – Empower your financial decisions today!

Tax efficiency

Tax efficiency in investing focuses on optimising after-tax returns by managing the tax impact of Investment decisions. This involves understanding the tax implications of different choices and structuring Investments to minimise tax liabilities.

Utilising tax-advantaged accounts like Individual Savings Accounts (ISAs) or pensions can significantly enhance long-term returns. Strategies such as tax-loss harvesting, which involves selling losing Investments to offset capital gains taxes, contribute to tax efficiency. By integrating tax considerations into the process, investors can amplify the compounding effect and maximise their overall returns.

Market volatility

Market volatility underscores the dynamic nature of financial markets, where prices can rapidly fluctuate due to economic data releases, geopolitical events, or investor sentiment. Understanding market volatility is essential for maintaining a disciplined Investment approach.

Investors should focus on their long-term objectives instead of making impulsive decisions in response to short-term fluctuations. Strategies like dollar-cost averaging, which involves investing a fixed amount at regular intervals, can mitigate the impact of volatility on outcomes. Diversification and staying informed about market trends contribute to effective volatility management.

Investment goals

Investment goals act as guiding stars that steer one's financial journey. These goals include retirement planning, buying a home, funding education, or achieving financial independence.

Defining clear and realistic Investment objectives provides a roadmap for asset allocation and risk tolerance. Short-term goals might lean towards lower-risk, more liquid Investments, while long-term objectives allow for exposure to higher-risk, higher-return assets. Regularly reviewing and adjusting strategies based on evolving goals ensures that your portfolio aligns with your aspirations.

Psychological factors

Psychological biases often influence investor behaviour, leading to suboptimal decisions. Fear of missing out (FOMO), fear of loss, and herd mentality are common cognitive biases that can drive irrational actions. Recognising these biases and actively countering them is crucial for successful investing.

Educating oneself about these psychological factors, setting predefined strategies, and seeking advice from financial professionals can help temper emotional responses and enable rational Decision-making. By acknowledging the impact of psychological factors, investors can better navigate market fluctuations and maintain a steady course towards their financial goals.

Cost efficiency

Cost efficiency is a crucial yet often overlooked characteristic of Investment. It pertains to the expenses associated with acquiring, managing, and eventually selling Investments. These costs can impact the overall returns an investor receives.

Investment costs come in various forms, including management fees, transaction fees, and ongoing expenses associated with maintaining certain assets. For instance, mutual funds and exchange-traded funds (ETFs) charge management fees, which are deducted from the fund's assets and can eat into your returns over time. Similarly, trading fees can accumulate, especially for frequent traders.

Investors should consider low-cost options, such as passively managed index funds or ETFs, to enhance cost efficiency. These often have lower management fees compared to actively managed funds. Additionally, long-term investors can benefit from lower trading costs by adopting a buy-and-hold strategy rather than engaging in frequent trading.

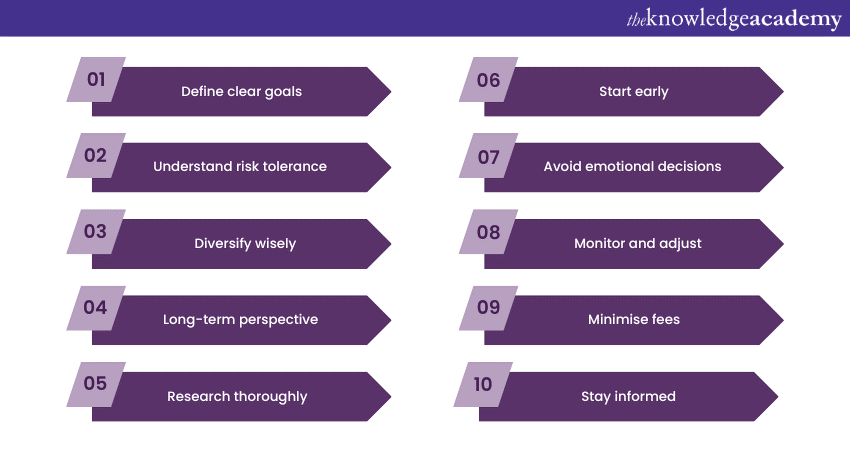

Tips for effective Investment

Investing is a journey that demands careful consideration and strategic planning. Here are some key tips to help you navigate the complex world of Investment and increase your chances of success:

1) Define clear goals: Before you start investing, identify your financial objectives. Whether it's saving for retirement, buying a house, or funding education, having clear goals will guide your decisions.

2) Understand risk tolerance: Assess your risk tolerance honestly. Make sure to choose Investments that align with your comfort level for handling market fluctuations. Remember, risk and return are interconnected.

3) Diversify wisely: Spread your Investments across different asset classes, industries, and regions. Diversification helps mitigate risk and enhances the potential for stable returns.

4) Long-term perspective: Investing is not a get-rich-quick scheme. Maintain a long-term outlook to benefit from compounding growth and ride out short-term market volatility.

5) Research thoroughly: Conduct in-depth research before investing in any asset. Understand the market, trends, and historical performance to make informed decisions.

6) Start early: Time is a powerful ally in investing. The earlier you start, the more you can leverage compounding to grow your Investments over time.

7) Avoid emotional decisions: Emotional reactions to market ups and downs can lead to impulsive decisions. It is advisable to stick to your plan and refrain from making significant changes based on short-term fluctuations.

8) Monitor and adjust: Regularly review your Investment portfolio. Make adjustments as your financial goals evolve and market conditions change.

9) Minimise fees: High fees can eat into your returns. Choose low-cost options, like index funds or ETFs, to maximise your net gains.

10) Stay informed: Keep up with financial news, economic trends, and strategies. Knowledge empowers you to make well-informed decisions.

Ready to master the art of Investment? Explore our Investment and Trading Training Courses!

Conclusion

In the intricate world of investing, understanding and embracing the key Characteristics of Investment empowers individuals to make informed decisions. From risk and return to psychological factors, each facet plays a pivotal role in shaping a successful journey. By navigating these aspects wisely, investors can construct resilient portfolios that align with their goals, manage risks, and lay the groundwork for financial prosperity.

Ready to master foreign exchange trading? Explore our comprehensive Foreign Exchange Training today!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 13th Dec 2024

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please