We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In global maritime trade, various uncertainties, like late payments, slow deliveries, and financial concerns, can arise between buyers and sellers. The vast distances, diverse laws, and changing politics make it challenging. Sellers, therefore, need assurance of payment when delivering goods internationally. This is why understanding What is Letter of Credit is important.

Letters of Credit were introduced to solve this by involving a financial institution as a third party, reducing risks for exporters. In this blog, we discuss What is Letter of Credit, its significance, types and steps to apply for a Letter of Credit. Read more!

Table of Contents

1) What is Letter of Credit?

2) Significance of Letter of Credit

3) Types of Letters of Credit

4) Steps to apply for a Letter of Credit

5) Conclusion

What is Letter of Credit?

A Letter of Credit represents a commitment made by a bank. It says that the bank will pay someone or a company upon certain pre-established conditions. People often use this document when they buy things from other countries to make sure the buyer can pay for what they get from the seller. It is also known as a documentary credit.

Significance of Letter of Credit

The significance of a Letter of Credit lies in its crucial role in facilitating secure and trustworthy international trade transactions. This financial instrument provides a set of benefits that are vital for both the buyer and the seller, which are discussed below:

a) Risk mitigation: One of the primary advantages is the mitigation of risks for both parties. For the seller, the Letter of Credit ensures that they will receive payment as long as they meet the agreed-upon conditions. On the buyer's side, it provides a guarantee that payment will only be made when the necessary documents are presented, reducing the risk of non-delivery or substandard goods.

b) Global trust and credibility: In the realm of international trade, where parties may be unfamiliar with each other, the Letter of Credit acts as a trusted intermediary. It adds credibility to the buyer's commitment to payment and assures the seller of the financial capability of the buyer's bank.

c) Facilitation of trade: The use of Letters of Credit facilitates smoother cross-border transactions. By providing a secure method of payment, it motivates businesses to participate in international trade by reducing the risk of payment uncertainties, thereby promoting economic activities across the globe.

d) Compliance with trade regulations: In many cases, countries have specific trade regulations and requirements. A Letter of Credit helps ensure that both the buyer and the seller adhere to these regulations by detailing the necessary documents and conditions for payment, thus streamlining the customs and import/export processes.

e) Flexible payment options: Depending on the terms agreed upon, Letters of Credit can offer flexibility in payment. For instance, in a confirmed Letter of Credit, the seller may have the option to receive payment from a bank in their own country, providing an additional layer of convenience.

f) Dispute resolution: In cases of disagreements or disputes, the terms and conditions outlined in the Letter of Credit serve as a structured reference for resolution. This predefined framework minimizes the potential for misunderstandings and offers a straightforward approach to resolving conflicts.

g) Secondary payment assurance: In situations where the primary payment method fails, such as with a Standby Letter of Credit, the secondary assurance provided by the Letter of Credit ensures that the seller will still receive payment, offering an added layer of financial security.

Unlock the intricacies of Letters of Credit with our The Letters Of Credit Training Course for enhanced proficiency in accounting and finance!

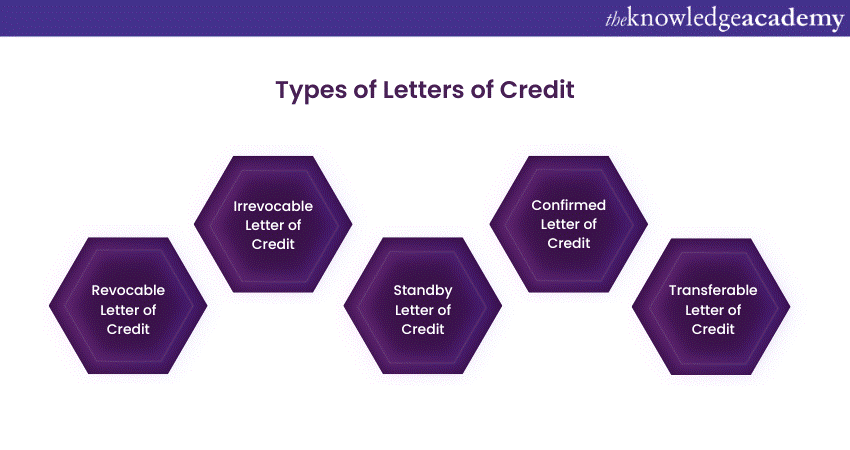

Types of Letters of Credit

Discussed below are the types of Letters of Credit used for global trade.

1) Revocable Letter of Credit

A Revocable Letter of Credit is a type that the issuing bank can modify or cancel at any time without providing prior notification to the beneficiary (the seller). However, it's important to note that this type of Letter of Credit is seldom used in practice due to the high level of uncertainty it introduces into the transaction process. Its lack of security for the seller makes it less popular in international trade scenarios.

2) Irrevocable Letter of Credit

An Irrevocable Letter of Credit, on the other hand, provides a higher level of security for both the buyer and the seller. Once issued, it cannot be altered or cancelled without the agreement of all parties involved. This type of Letter of Credit assures the seller that, if they meet the specified conditions, payment will be made, instilling confidence and trust in the transaction.

3) Standby Letter of Credit

A Standby Letter of Credit acts as a secondary payment mechanism, coming into play if the primary payment method fails. It serves as a guarantee that the seller will receive payment if the buyer is unable to fulfil their financial obligations. This type is often used in situations where there is a higher risk of default or non-payment.

Supercharge your financial expertise with our Accounting Masterclass for a confident stride in your career journey. Sign up now!

4) Confirmed Letter of Credit

In a Confirmed Letter of Credit, a second bank, typically in the seller's country, adds an extra layer of assurance by confirming the Letter of Credit issued by the buyer's bank. This confirmation serves to reduce the risk for the seller, especially when dealing with a less-known or less-trusted issuing bank. It provides an additional level of security in international transactions.

5) Transferable Letter of Credit

A Transferable Letter of Credit offers a unique level of flexibility. The initial beneficiary, often an intermediary, has the authority to transfer part or all of the credit to another party. This type is advantageous in complex trade scenarios involving multiple intermediaries, allowing for the distribution of risk and responsibilities among different entities.

Steps to apply for a Letter of Credit

Acquiring a Letter of Credit involves a meticulous process that must be adhered to for a seamless and prosperous transaction. Here is a comprehensive guide on how to apply for a Letter of Credit:

a) Negotiate terms with the buyer: Before initiating the Letter of Credit application, engage in negotiations with the buyer. This includes settling on crucial aspects such as the price, delivery date, and the chosen method of payment.

b) Choose a bank: Opt for a bank capable of issuing the Letter of Credit on your behalf. Preferably, choose a bank with expertise in international trade and an established network of correspondent banks in the buyer's country.

c) Provide required documents: Furnish the bank with all essential documents, including the purchase order, commercial invoice, and shipping documents. The bank meticulously reviews these documents to ensure they align with the stipulated requirements of the Letter of Credit.

d) Apply for the Letter of Credit: Complete the provided Letter of Credit application form with accurate and comprehensive information. Include details such as the Letter of Credit amount, the beneficiary (seller), and the applicant (buyer).

e) Pay the fees: The bank imposes a fee for issuing the Letter of Credit, often a percentage of the Letter of Credit amount. Promptly settle this fee to prevent any delays in the process.

f) Wait for the Letter of Credit to be issued: Following the bank's approval of the application and receipt of payment, the Letter of Credit will be issued. It is then forwarded to the beneficiary (seller), empowering them to utilise it to secure the agreed-upon payment.

By carefully following these steps, you can apply for the Letter of Credit application process with confidence, ensuring a smooth and secure transaction for all parties involved.

Conclusion

In simple terms, a Letter of Credit is like a reliable friend in global trade. It creates a safe structure for transactions, making things smoother between buyers and sellers. It's a crucial guarantee that ensures payment happens smoothly. Knowing What is Letter of Credit is reveals its important role in making international business trustworthy and secure.

Enhance your financial acumen with our Accounting and Finance Training Courses for a brighter career ahead!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

The Letters of Credit Training Course

The Letters of Credit Training Course

Fri 26th Jul 2024

Fri 27th Sep 2024

Fri 8th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please