We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial well-being is one of the most important aspects of leading a good life in today’s world. Since consumption has only been increasing globally, financial stability and well-being have gained the utmost importance. So, how do you begin on this journey of financial well-being? The answer is easy – Investment. But do you know What is Investment?

Investment can be defined as an asset or item that can be acquired by generating income or appreciation. For example, when a person purchases a good as an Investment, it does not mean that they want to spend it the right way. It means that they had bought that good only to use it in the future to create further wealth. If you want to learn more about this concept, read this blog and understand the basics of What is Investment and discover how to improve your financial life.

Table of Contents

1) What is Investment?

2) Types of Investments

3) What are the benefits of Investing?

4) How to start Investing?

5) Conclusion

What is Investment?

Whenever you perform a transaction that gives you better monetary returns over a period of time, that is called an Investment. In a general sense, Investment is the process of using a commodity to purchase an asset. With the passage of time, the said asset will help increase the value of the commodity you’ve used to initiate the transaction.

It also lays the groundwork with time, effort, money or an asset, which helps in build your wealth for the future. Therefore, an Investment can also be referred to as one of the ways to generate income even when you are not working.

There are several forms of financial Investments, and they focus on increasing the value of the money that you have Invested. Let's explore some of them below:

a) Mutual funds

b) Endowment plans

c) Investment plans

d) Stocks

e) Bonds

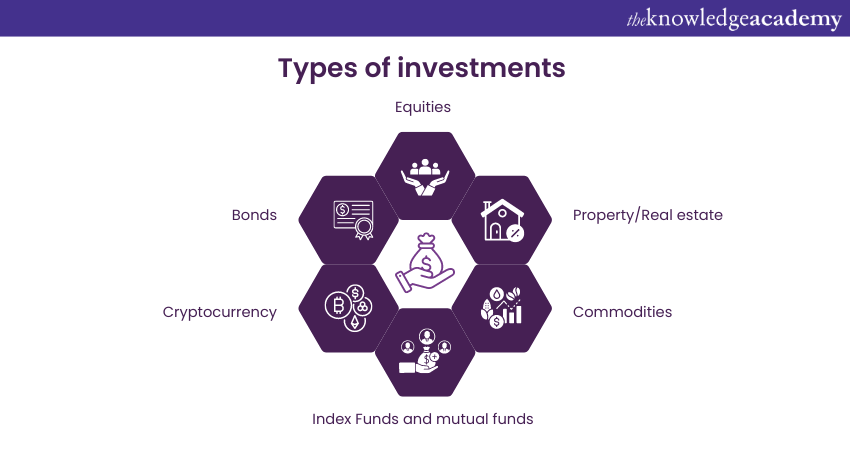

Types of Investments

With the passage of time and tremendous growth in technology, anyone can Invest in different assets today. Smartphones and portable PCs have made it way easier for people to begin Investing.While the accessibility that technology provides to commence Investment is a great addition, one must know about the assets that can be Invested in.

Over the years, assets alongside technology have evolved as well. This alone has led to increased participation from people across the globe. The proliferation of information through readily available sources and technologies has enabled people from all walks of life to commence Investing. It is no longer restricted to financial experts, Investment bankers, etc. The following are some common types of assets to Invest in:

Equities

When an Investor purchases a share or an ownership unit in a company’s stock, it is called equity. As an Investor, you possess not only a set of stocks in a company but also a share of the company itself. The ownership of an organisation is divided among Investors whenever they purchase a stock. The better an organisation performs, the more valuable its stocks become. Hence, more value is generated for the Investor.

At times, equity holders also possess the right to vote in major companies. They can vote to establish or change the board of directors. They can also receive dividends if the organisation makes a profit and decides to share it with the Investors. Organisations can also give Investors bonus shares at times, but that isn’t frequent.

Understand the intricacies of long-term Capital Management with our Investment Management Masterclass.

Bonds

Bonds, for the most part, are issued by governments, corporations, municipalities, etc. to raise capital. They’re a form of debt security that works by taking Investments from lenders or Investors. Once the Investment is made, the issuer (read governments, organisations, municipalities, etc.) then pays a periodic interest over a period of time.

Here’s a step-by-step process that’ll explain how a bond works:

1) The issuer issues a bond to raise funds for various reasons, such as infrastructure projects, expansion of business activities, or funding operations. As mentioned above, the issuer here can be the government, an organisation, a municipality, or a corporation.

2) Every bond holds a face value that is nothing but the amount that it will reach in the future. Bear in mind that the value here is more along the lines of a promise than a commitment.

3) A bond is also equipped with a coupon rate. It is the annual interest rate that the issuer promises to pay the Investor or bondholder.

4) Each bond has a maturity date, which is nothing but the date on which a bond reaches its end. Since every bond works for a set term, bondholders are paid the face value of the bond that they’ve been promised.

5) A lot of times, the issuers are obligated to pay the face value of the bond to the bondholders. The bondholder will not receive any interest-based payments beyond the maturity date.

Property/Real estate

As the name suggests, Investing in a property allows you to hold either a piece of land or a combination of the plot and the accommodation constructed over it. This includes houses, bungalows, apartments, apartment buildings and complexes, and much more. You can not only purchase a piece of property and wait for time to increase its value, but you can also purchase and rent the property out to people or organisations.

This way, you’ll be able to generate a stream of income through rent and the price of the establishment itself. A number of business tycoons often buy pieces of property and then rent them out to organisations, people, and other parties.

Dissect the risks associated with Real Estate Investment with our Real Estate Risk Management Training.

Commodities

Commodities are things that can be divided into two categories: frequent usage-regular value and infrequent usage-high value. The former are the things commonly used in everyday life, while the latter are items that are not used as often but hold a higher value.

They can also be split into soft and hard types. The “soft” side of commodities includes edible items such as coffee beans, soybeans, wheat, and grains. The “hard” side of commodities includes inedible items such as fossil fuels, minerals, metals, etc.

Gold and silver are famous commodities that are traded quite frequently in the markets worldwide. While people do hold some amount of physical gold and silver, they’re more popular in commodity markets and are frequently traded for. Organisations also release bonds on commodities to help people Invest and take part in resource gathering and management.

Index Funds and mutual funds

Index Funds and mutual funds are both types of Investment vehicles. However, there are specific differences which make them unique from each other. These are:

a) Index funds are a type of mutual fund designed to follow how the components of a market index work.

b) Mutual Funds are professionally managed funds that gather money from Investors and purchase different securities like stocks, bonds, and other assets.

c) Index Funds are passively managed. This means these funds reflect the index they track, allowing professionals to manage their portfolios quickly.

d) Mutual Funds seek to provide higher returns through various strategic asset selections.

e) Index Funds have lower costs; that is, they have lower expense ratios as they are passively managed. Thus, they have lower transaction costs and lower management fees. On the other hand, mutual funds are costly, as their expense ratios are higher due to active management, which includes both transaction and management fees.

Cryptocurrency

Cryptocurrency is one of the most popular Investment methods. Its recent popularity has made it a lucrative opportunity for Investors. Cryptocurrency is a Blockchain-based currency used to transact or hold digital value. Cryptocurrency organisations issue coins or tokens whose value may be appreciated. These tokens can then be used for transactions or can be utilised for transactions only in specific networks.

Cryptocurrencies use different cryptographic techniques that secure transactions and control the creation of any new units. This level of security makes them immune to counterfeiting. The best part of Investing in Cryptocurrencies is that they can be used anywhere in the world anytime.

This accounts for lower transaction fees when compared to any other traditional banking and financial systems. Also, the value of cryptocurrencies is highly volatile, and they are subject to rapid changes according to market demand, Investor sentiment, and other factors.

What are the benefits of Investing?

There are numerous benefits that come associated with making Investments. Let’s take a look at the following to understand why they’re essential in today’s economic ecosystem:

1) Wealth accumulation and generation: The first and foremost reason why a person Invests is to generate income and expand their pool of wealth. Obviously, the more wealth you possess, the more accessible solutions become for you. With the passage of time, you can not only increase your initial Investment amount but also diversify it.

2) Enhanced financial objectives: When you commence Investing in assets, it helps you establish your financial goals. With enough time, you can strengthen your financial goals and establish objectives to meet them.

3) Compounding: Compounding refers to an increment that happens at an exponential rate against the commodity Invested. Making 2X or 4X on initial Investment is what it usually boils down to. The more you Invest with time, the better your chances become of making significant profit margins. It does require thorough research of the assets involved, though and can also be risky at times. But it is profitable, nonetheless.

4) Creating an inflation shield: The rising prices of commodities are a bitter pill to swallow. With time, the power of the money you hold decreases, which makes it imperative to multiply it for the unforeseeable future. With Investments, you can ensure that you’ll be equipped with the right amount of money to help you through the rough phases. Emergencies can be catered to quite efficiently if you have a promising Investment portfolio.

5) Retirement planning: As mentioned above, a diversified Investment portfolio not only caters to the present needs but also prepares your vault for the future. Everyone wants an easy retirement, but that requires discipline and extensive research. When you Invest in assets, you create an income source not only for yourself but also for the ones you love. Your spouse, parents, and children can be covered efficiently if your Investments have been done right over the years. Once again, the process has its ups and downs, but the results are favourable.

How to start Investing?

If you are still wondering how to start Investing, follow the below-mentioned steps, which will explain to you more in detail about how to create an Investment portfolio:

a) Research is the best way to begin. It should be your first step before you start Investing in assets. A sound knowledge of the concept of Investment, types of Investment, assets that you can Invest in, risk factors, etc., is necessary for you to know. Before buying a single share of a company, understand the company's future and then buy the share.

b) Plan your spending. Decide why you are putting your money away and how to ensure that monthly expenses do not interfere with your emergency fund. Before Investing, make sure that it does not interfere with your lifestyle.

c) Study about liquidity restrictions. Some Investments may be locked in for quite some time and cannot be liquidated, that is, sold at any time you want. Before you Invest, learn if they can be sold or bought at any time.

d) Taxes are the most important part of your financial journey. It would be best if you always researched tax implications. You need to formulate strategies that can extend beyond what the product can hold and the tax vehicle they Invest in.

e) Decide on how much you are ready to risk. You need to be comfortable with how your financial power will allow you to take risks. Strategies are ways in which you can reduce risks and explore ways to mitigate any risks.

Conclusion

We hope that from this blog, you have understood What is Investment and why it is important for your financial journey. In this blog, we also discussed some of the important types, benefits and steps that you can take to start Investing, especially if you are a beginner in this domain. Having the right mindset, confidence and clarity on Investments will help you build a successful financial future.

Waiting to start off your Investment journey but don’t know where to begin? Here’s the Investment and Trading Training to help you get started!

Frequently Asked Questions

You can start Investing with limited funds by focusing on low-cost Investment options. You can also consider opening a high-yield savings account, Investing in fractional shares of stocks or ETFs, contributing to a Roth IRA, or using apps that allow you to Invest small amounts regularly.

Investing risks include market volatility, liquidity issues, inflation, and individual asset risk. You can mitigate these by diversifying your portfolio across various asset classes, Investing in index or mutual funds for broad exposure, regularly reviewing and adjusting your Investments, and adopting a long-term perspective to ride out market fluctuations.

The Knowledge Academy offers various Investment and Trading Training, including Investment Banking Training, Cryptocurrency Trading Training and Investment Management Masterclass. These courses cater to different skill levels, providing comprehensive insights into Capital Investment.

Our Business Skills Blogs cover a range of topics related to Investment and Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 24th May 2024

Fri 27th Sep 2024

Fri 13th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please