We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Wealth Management Interview Questions are designed to evaluate your understanding of financial markets, ability to develop investment strategies, and skills in building strong client relationships. Anticipating common questions and crafting well-structured responses is crucial to succeed in these interviews.

Wealth Management is a highly personalised service that requires a deep understanding of an individual's financial situation, goals, and aspirations. Effective wealth managers are trusted advisors who guide clients in achieving their short-term and long-term financial goals and help them secure their financial future. In this blog, you will learn about some of the common Wealth Management Interview Questions and sample answers to help you prepare for an interview.

Table of Contents

1) Common Wealth Management Interview Questions

a) What do you understand by Wealth Management?

b) How do you help clients plan and set financial goals?

c) How do you differentiate between nominal yields and real yields? What does this mean for the treasuries?

d) How do you stay updated on current financial policies and tax regulations?

e) Can you tell the reason that is driving equity markets right now?

f) What are the attributes of a Private Wealth Manager?

2) Tips and strategies to crack Wealth Management Interviews

3) Conclusion

Common Wealth Management Interview Questions

The following questions will give you a general idea of the type of questions that are usually asked in these interviews. We have provided you with some sample answers as well, which you can refer to:

What do you understand by Wealth Management?

You can use this to answer this question - “You can use this to answer this question - “Wealth Management is a comprehensive approach to financial planning and investment guidance to help individuals achieve their financial goals. It consists of numerous types of services, such as:

a) Financial planning: Developing a personalised financial plan that aligns with an individual's unique circumstances, objectives, and risk tolerance.

b) Investment management: Constructing and managing investment portfolios that align with the client's financial goals and risk tolerance, considering current market conditions and long-term trends.

c) Estate planning: Assisting clients in developing strategies to protect and transfer assets, minimise tax liabilities, and ensure a smooth wealth transition to beneficiaries.

d) Risk management: Identifying, assessing, and mitigating potential financial risks that could impact an individual's financial well-being.

e) Tax planning: Collaborating with tax professionals to develop strategies that minimise tax liabilities and maximise tax benefits.”

How do you help clients plan and set financial goals?

You can answer this question in this way - “As a Wealth Manager, I play a crucial role in guiding clients through the process of planning and setting realistic, achievable financial goals. My approach involves a collaborative and consultation process that gives clients more clarity to make informed decisions about their financial future. This is how I assist clients in Wealth Management:

a) I begin by conducting in-depth conversations with clients to gain a cohesive understanding of their current financial situation, short-term and long-term goals, risk tolerance, and any other specific financial concerns they may have.

b) I work with them to identify and prioritise their financial goals, ensuring they are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). This involves breaking down the larger goals into smaller and more manageable steps. This provides a clear roadmap for achieving them.

c) I assist clients in creating a detailed financial plan that outlines their income, expenses, assets, liabilities, and cash flow. This helps them understand their current financial standing and identify areas for improvement or potential pitfalls.

d) Based on the client's risk tolerance and financial goals, I develop a tailored investment strategy that aligns with their risk appetite and long-term objectives. This may involve diversifying their portfolio across various asset classes, which include stocks, bonds, and real estate.

e) I maintain regular communication with clients to review their progress towards their financial goals, assess any changes in their circumstances or objectives, and make necessary adjustments to their financial plans and investment strategies.

Throughout this process, I emphasise the importance of financial education and empower clients to make informed decisions about their finances. I provide them with resources, tools, and guidance to enhance their financial literacy and help them actively manage their financial well-being.”

How do you differentiate between nominal yields and real yields?

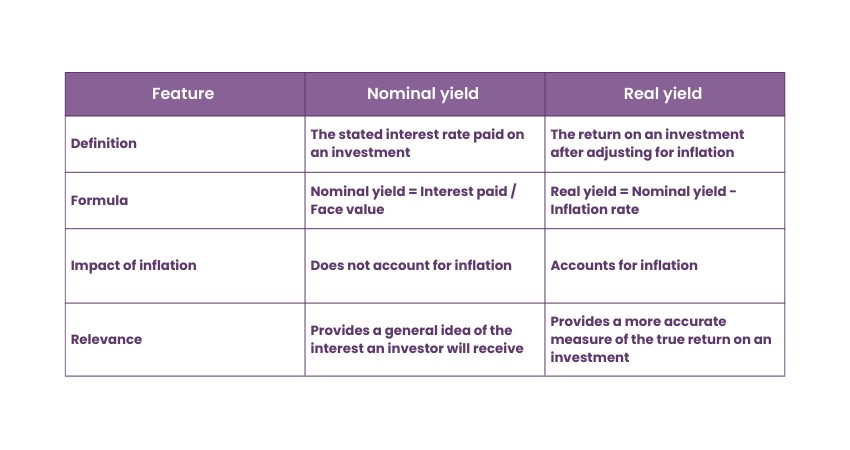

This is how you can answer this question - “As a Wealth Manager, I understand the distinction between nominal and real yields, as they play a significant role in evaluating investment returns and assessing the impact of inflation on purchasing power. Here is how I differentiate between nominal and real yields:

a) Nominal yield: The nominal yield, also known as the coupon rate, is the stated interest rate paid on an investment, such as a bond or a Certificate of Deposit (CD). It is typically expressed as a percentage of the face value of the investment and represents the amount of interest an investor will receive over the investment's term.

b) Real yield: On the other hand, the real yield considers the impact of inflation on the nominal yield. It represents the true return on an investment after adjusting for inflation. The formula for calculating the real yield is:

Real yield = Nominal yield - inflation rate

I can explain this further with this example: If a bond has a nominal yield of 5% and the inflation rate is 2%, the real yield would be 3%. This means the investor's purchasing power would increase by 3% over the bond's term.”

How are you updated on financial policies and tax regulations?

You can use this as your answer to this question - “I stay updated with the current financial policies and tax regulations as it is important to provide clients with sound financial advice and ensure that their portfolios are aligned with the latest regulations. Here's how I maintain my knowledge of financial policies and tax regulations:

1) I subscribe to leading financial publications, like The Wall Street Journal, Financial Times, and Bloomberg Businessweek, to stay informed about current financial news, market trends, and regulatory developments. These publications provide in-depth analysis and expert commentary on numerous financial topics, including tax legislation, economic policies, and industry trends.

2) I regularly check the websites of government agencies, such as the U.S. Treasury Department, the Internal Revenue Service (IRS), and the Securities and Exchange Commission (SEC), ensuring that I have access to the latest official announcements, regulatory updates, and tax law changes. These websites provide detailed information on proposed and enacted regulations, tax implications, and investor protection measures.

3) I participate in industry conferences, seminars, and webinars, which allows me to network with other Wealth Managers, financial experts, and regulatory professionals. These events provide opportunities to learn about emerging trends, discuss complex regulatory issues, and gain insights from industry leaders.

4) Being an active member of professional associations, like the Financial Planning Association (FPA) and the Chartered Financial Analyst (CFA) Institute, provides access to valuable resources, including newsletters, whitepapers, and webinars. These organisations also offer continuing education programs that update me on the latest financial planning techniques, regulatory changes, and industry best practices.

5) I make use of online tools and databases, such as Bloomberg Professional Services and Thomson Reuters Eikon that provides me access to real-time market data, financial research, and regulatory information. These platforms let me stay informed about specific tax implications, investment regulations, and economic indicators relevant to my clients' portfolios. Being an important part of Wealth Management, I believe this is one of the most important steps that I can take to keep myself updated.

6) I maintain regular communication with colleagues, industry experts, and tax professionals allows me to share knowledge, exchange insights, and stay updated with emerging trends or regulatory changes that may impact my clients. These interactions provide valuable perspectives and help me identify potential risks or opportunities for my clients.

7) When dealing with complex tax matters, I collaborate with tax professionals to ensure that my client's tax returns are filed accurately and that they take advantage of all available tax benefits. This collaboration helps to minimise tax liabilities and maximise tax savings.

Do you want to learn how to improve your financial skills to help your business grow? Register now for our Accounting & Finance Training!

Can you tell the reason driving equity markets right now?

This is how you can answer this question - “The main drivers of equity markets right now are:

a) Interest rates: The Federal Reserve is expected to continue raising interest rates to combat inflation. This could lead to slow economic growth and lower corporate profits, putting downward pressure on stock prices.

b) Inflation: Inflation is at a 40-year high, putting pressure on consumer spending and corporate profits. This could also lead to lower stock prices

c) Geopolitical tensions: Wars and other geopolitical tensions create uncertainty in the global economy. This could make investors more risk-averse and lead them to sell stocks.

Despite these challenges, some positive factors could support equity markets. For example, corporate earnings have been strong, and the unemployment rate is low. Additionally, the stock market has historically performed well over the long term.”

What are the attributes of a Private Wealth Manager?

You can answer this question: "Private Wealth Managers have technical expertise in wealth management, interpersonal skills, and ethical principles. They manage the complex financial needs of high-net-worth individuals and families. Here are some of the key attributes that distinguish successful Private Wealth Managers:

a) Technical skills: Private Wealth Managers must have strong technical skills to understand complex financial products and markets. They also need to be able to analyse financial data and make sound investment decisions.

b) Communication skills: They need to communicate efficiently with their clients in person and in writing. They need to be able to explain complex financial concepts in a manner that can be understood by anyone.

c) Relationship skills: They need to build and maintain strong relationships with clients. They must understand clients' needs and goals and provide them with personalised advice.

d) Problem-solving skills: They need to be able to solve complex financial problems. They also need to be able to think creatively and come up with solutions that are in the best interests of their clients.

e) Ethics and professionalism: They need to be ethical and professional. They must put their client's interests first and always act in their best interests.”

Are you interested in learning how to analyse your financial statements and make a difference in your business operations? Sign up for our Financial Management Training!

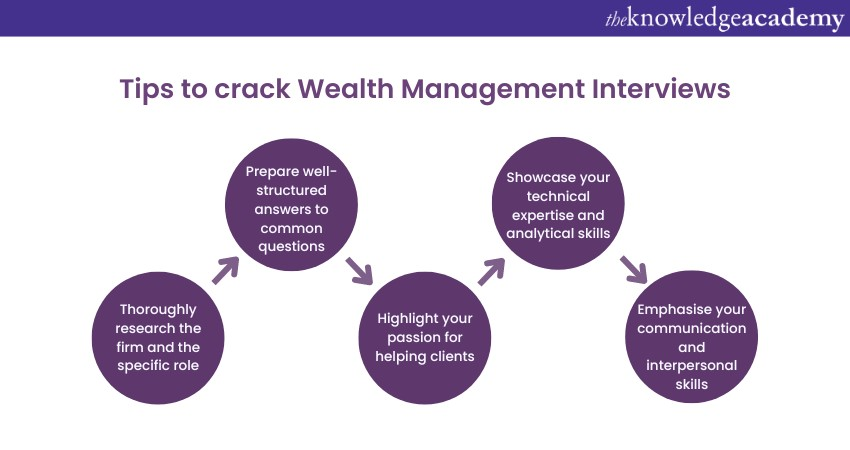

Tips and strategies to crack Wealth Management Interviews

Here are some tips and strategies to help you crack your interviews:

a) Understand the firm's history, values, investment philosophy, and target clientele.

b) Research the specific role's responsibilities, required skills, and expectations.

c) Demonstrate your knowledge of the firm's products, services, and industry trends.

d) Practice answering questions about your investment philosophy, risk management approach, and client relationship skills.

e) Be ready to discuss your experience in financial planning, portfolio management, and estate planning.

f) Demonstrate your understanding of current market conditions, economic trends, and regulatory changes.

g) Please share examples of how you have successfully guided clients towards their financial objectives.

h) Convey your belief in the importance of financial planning and Wealth Management.

i) Express your enthusiasm for working with clients to build their financial future.

j) Discuss your experience using financial modelling tools and investment research platforms.

Improve your skills to give the best financial advice to your clients with our Diploma for Financial Advisers DipFA Training! Sign up today!

Conclusion

We hope that you understand what you need to prepare for your interviews. These Wealth Management Interview Questions and sample answers will help you prepare, and the tips and strategies will also help you to stand apart from other candidates. Understanding the fundamentals of Wealth Management is crucial for becoming a successful Wealth Manager.

Learn how to trade successfully with our Accounting Masterclass. Register now!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Financial Modelling Course

Financial Modelling Course

Fri 7th Jun 2024

Fri 2nd Aug 2024

Fri 4th Oct 2024

Fri 6th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please