We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

From pandemic to supply chain constraints, there are a lot of threats and risks to businesses. Risk Management is a crucial process that helps you detect, analyse and minimise potential risks. It helps protect your profits and resources as well as ensure business continuity. Moreover, it has a lot of benefits and can help improve your business growth.

According to the 2022 Global Risk Survey, participants responded effective Risk Management practices have resulted in an 11 per cent growth in revenue. So having effective strategies to manage risks is the key to success. In this blog, you will learn what is Risk Management, its various steps, standards and frameworks, and its benefits.

Table of Contents

1) What is Risk Management?

2) Steps of Risk Management

3) Risk Management Standards and Frameworks

4) Benefits of Risk Management

5) Conclusion

What is Risk Management?

Risk Management is the systematic process of identifying, analysing, and responding to risks to achieve organisational objectives and minimise adverse effects. Here's how it can help your organisation:

a) It helps understand potential threats and risks for the organisation

b) It helps evaluate their likelihood and impact

c) It helps implement appropriate strategies to mitigate them

It is a comprehensive process involving several key elements to identify, evaluate, and control organisational risks effectively. These elements ensure a proactive and holistic approach to Risk Management.

What is the importance of Risk Management?

Risk Management is paramount for organisations in today's dynamic and uncertain business landscape. Neglecting it can lead to financial losses, reputational damage, legal issues, and potential business failure. Here's how proactively managing risks can help your business:

a) Protect resources: By identifying potential risks early on, you can safeguard your resources from threats.

b) Preserve profits: By effectively managing your risks, you can protect your accumulated profits and avoid any unnecessary losses.

c) Create a culture of resilience: By managing risks efficiently, you can create a culture of resilience focusing on long-term success.

It enables organisations to make informed decisions, optimise opportunities, and navigate uncertainties successfully. Therefore, organisations must prioritise Risk Management as an integral part of their strategic decision-making process.

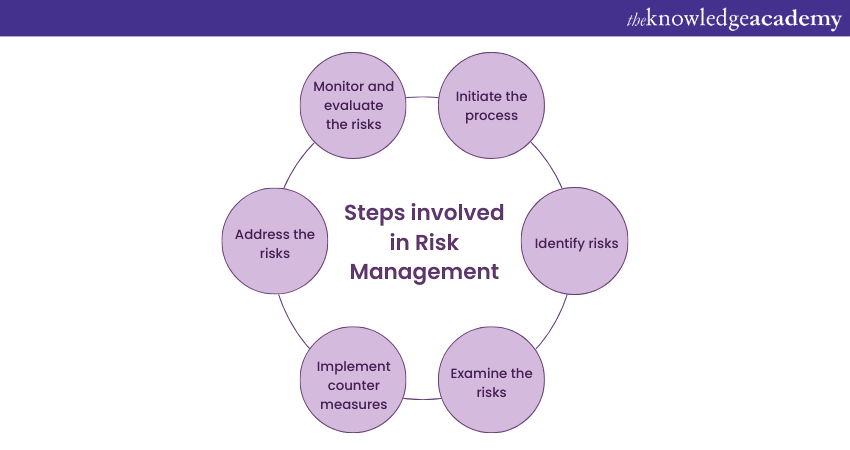

Steps of Risk Management

The Risk Management process is systematic and proactive approach organisations undertake to identify, evaluate, control, and mitigate risks that could impact their objectives. It involves a series of steps that guide the effectively managing risks in the organisation. Its process includes the following stages:

Establishing the context

In this initial stage, organisations define the Risk Management process's objectives, scope, and criteria. They establish the context within which risks will be identified, evaluated, and managed. This involves considering internal and external factors influencing the organisation's risk landscape.

Risk identification

The second stage involves identifying potential risks that may arise within the organisation. This includes the internal and external risks that could affect the achievement of objectives. The goal is to identify all relevant risks comprehensively, and here are the techniques to do that:

a) Brainstorming sessions: By conducting brainstorming sessions and involving all the stakeholders, you can get different ideas for identifying the risks.

b) Data analysis: You can harvest the power of data analysis to take logical decisions for detecting potential risks well in advance.

c) Expert opinions: Ask for guidance from professionals and experts in the field for devising strategies to detect risks.

d) Historical information: You can use historical data to identify patterns and trends to detect how and why various threats and risks arise.

Risk assessment

Once risks are detected, the next step is to examine their likelihood of occurrence and potential impact on the organisation. Risk assessment involves evaluating the severity of consequences and the probability of risks materialising. This helps prioritise risks based on significance, allowing organisations to allocate resources effectively.

Risk control measures

After assessing risks, organisations develop and implement strategies to control and manage them. Risk control measures aim to reduce the likelihood or impact of identified risks. This may involve implementing policies, procedures, and controls to mitigate risks. The aim is to choose the most suitable risk treatment options, such as risk avoidance, reduction, transfer, or acceptance.

Risk action and management

This stage involves taking concrete actions to address identified risks and actively manage them throughout the organisation. It also involves monitoring and reviewing risk mitigation measures to ensure their ongoing effectiveness. Here's how it can help your organisation:

a) Roles and responsibilities: It helps establish clear roles and responsibilities for everyone involved in the organisation.

b) Define processes: It helps create and define Risk Management processes and how to implement them.

c) Stakeholder involvement: It helps ensure effective communication and collaboration among stakeholders.

Risk monitoring and review

Continuous monitoring and review are essential for effective Risk Management. Organisations regularly assess the effectiveness of such strategies, monitor changes in the risk landscape, and identify emerging risks. This allows them to adapt their approach as needed, ensuring it remains relevant and effective.

The Risk Management process is cyclical and iterative, where each stage informs and influences the others. It requires ongoing commitment, involvement, and engagement from all levels of the organisation. By following a systematic process, organisations can proactively identify, evaluate, and mitigate risks, protecting their resources and enhancing their overall resilience.

Enhance your Risk Management skills with MoR® 4 Practitioner Risk Management Certification and take the next step in your career – Signup now!

Risk Management Standards and Frameworks

Risk Management standards and frameworks provide organisations with guidance and best practices to implement such processes effectively. These standards and frameworks offer structured approaches to identify, evaluate, control, and mitigate risks.

They provide a common framework and set of principles that organisations can adopt to enhance their Risk Management practices. The following are some of its prominent standards and frameworks:

ISO 31000:2018

ISO 31000 is an international standard used for the management of risks. It provides techniques, a framework, and a process for managing risks effectively. The standard emphasises integrating Risk Management into an organisation's governance and decision-making processes. ISO 31000 promotes a systematic approach to managing risks and helps organisations create a risk-aware culture.

COSO ERM Framework

The Committee of Sponsoring Organisations of the Treadway Commission Enterprise Risk Management (COSO ERM) Framework is widely recognised and used globally. It offers a comprehensive framework for managing risks across the organisation. The framework emphasises integrating the process of managing risks with strategy-setting and performance management processes, promoting a holistic approach.

PMI's PMBOK Guide

The Project Management Institute's (PMI) Project Management Body of Knowledge (PMBOK) Guide includes a section on Risk Management. It provides project managers with a structured approach to identify, analyse, and respond to risks specific to project environments. The PMBOK Guide outlines processes, tools, and techniques for effectively managing project’s risks.

NIST Cybersecurity Framework

The National Institute of Standards and Technology (NIST) Cybersecurity Framework is designed to help organisations manage cybersecurity risks. It provides a framework for analysing and improving an organisation's cybersecurity posture. The framework focuses on identifying, protecting, detecting, responding to, and recovering from cybersecurity risks and incidents.

IEC 31010 Risk Assessment Techniques

IEC 31010 is a standard that guides various risk assessment techniques. It offers a range of methods and tools to assess risks, including quantitative and qualitative approaches. The standard helps organisations select appropriate risk assessment techniques based on their specific needs and objectives.

These standards and frameworks serve as valuable resources for organisations seeking to enhance their Risk Management capabilities. By adopting and implementing these frameworks, organisations can establish consistent practices for managing risks, improve decision-making processes, and strengthen their overall culture of managing risks.

Take your Risk Management expertise to the next level with our Certified Risk Management Professional CRMP course – Signup today!

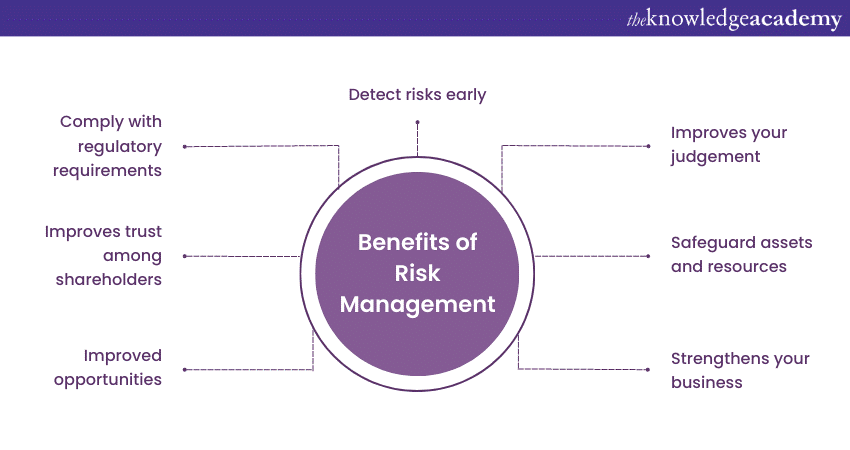

Benefits of Risk Management

Risk Management plays a pivotal role in safeguarding the success and sustainability of organisations across various sectors. By implementing such practices effectively, businesses can enjoy several key benefits. Some of its significant advantages include:

Proactive risk identification

Risk Management enables organisations to identify potential risks before they escalate into major issues. By systematically assessing and analysing risks, businesses can anticipate challenges and take proactive measures to mitigate them. Here's how it can help your organisation:

a) Helps prevent and minimise the impact of risks

b) Reduces potential losses

c) Prevents disruptions

Improved decision making

Risk Management provides organisations with valuable insights to make informed decisions. It allows decision-makers to consider potential risks and their associated consequences when evaluating options. By factoring in risks, organisations can make better decisions that align with their objectives, leading to improved outcomes and reduced uncertainty.

Protection of resources and assets

Effective Risk Management helps protect an organisation's valuable resources and assets. By identifying and addressing potential risks, businesses can prevent financial losses, damage to physical assets, or reputational harm. Strategies like insurance coverage and robust security measures can safeguard resources and ensure business continuity.

Enhanced business resilience

Risk Management fosters business resilience by equipping organisations with the capability to withstand and recover from adverse events. This resilience allows organisations to adapt, recover, and continue operations, even in challenging circumstances. Here's how preparing for potential risks can help your businesses:

a) Develops contingency plans

b) Establishes response mechanisms

c) Helps allocate resources efficiently during times of crisis

Optimised opportunities

Risk Management focuses on mitigating threats and enables organisations to seize opportunities. Businesses can make calculated decisions to pursue opportunities with favourable risk-reward ratios by evaluating risks and potential rewards. Its practices can help organisations capitalise on emerging trends, innovate, and gain a competitive edge in the market.

Stakeholder confidence

Implementing robust Risk Management practices instils confidence in stakeholders, including investors, customers, and partners. Demonstrating a proactive approach to managing risks demonstrates commitment towards responsible and sustainable business practices. This enhances trust, credibility, and long-term relationships with stakeholders, contributing to the overall success and reputation of the organisation.

Regulatory compliance

Many industries are subject to regulatory requirements related to Risk Management. Effectively implementing the practices of managing risks ensures compliance with legal and regulatory obligations. Meeting these standards can prevent your organisation from the following consequences such as:

a) Penalties: Following regulations help your organisation avoid penalties from regulatory bodies.

b) Litigation: Lawsuits are no fun, and following guidelines and standards can save you from potential lawsuits.

c) Reputational damage: By complying with regulation, you can protect your reputation that took years to build.

In summary, Risk Management offers numerous benefits to organisations, and it is crucial for navigating challenges in these turbulent times. By embracing it as an integral part of their operations, businesses can navigate uncertainties, seize opportunities, and achieve sustainable growth.

Discover effective Risk Management strategies with MoR® Management of Risk courses and enhance your risk management skills – Signup now!

Conclusion

We hope you enjoyed reading this blog explaining Risk Management and its various steps. Today, the way the risks are managed in a workplace is crucial because it saves the company from different potential threats that could affect its operations, profitability, and survival in the industry.

Start your Risk Management journey with our MoR® Management of Risk courses. Join now!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

MoR® 4 Practitioner Risk Management Certification

MoR® 4 Practitioner Risk Management Certification

Mon 10th Jun 2024

Mon 8th Jul 2024

Mon 12th Aug 2024

Mon 9th Sep 2024

Mon 14th Oct 2024

Mon 11th Nov 2024

Mon 9th Dec 2024

Mon 20th Jan 2025

Mon 17th Feb 2025

Mon 17th Mar 2025

Tue 22nd Apr 2025

Mon 19th May 2025

Mon 16th Jun 2025

Mon 21st Jul 2025

Mon 18th Aug 2025

Mon 15th Sep 2025

Mon 20th Oct 2025

Mon 17th Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please