We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial Management is a key element of any successful business. It involves planning, organising, directing, and controlling the financial activities of an organisation. Do you know what the driving force behind the effective Management of Finances is? It is the Principles of Financial Management that serve as the cornerstone for sound decision-making.

These Principles ensure financial stability, growth, and long-term sustainability. However, if you are unaware of these driving forces, let’s learn about them through this blog. In this blog, you will read about the 10 essential Principles of Financial Management that drive excellence in business operations.

Table of content

1) Importance of Financial Management

2) Essential Principles of Financial Management

a) Clear financial goals and objectives

b) Budgeting and planning

c) Efficient cash flow management

d) Strategic investments

e) Cost control and expense management

f) Debt management

g) Risk management and insurance

h) Financial reporting and analysis

i) Compliance with regulatory requirements

j) Continuous monitoring and adaptation

3) Conclusion

Importance of Financial Management

Financial Management is vital in the success and sustainability of any organisation. The following are the key reasons highlighting the importance of Financial Management:

1) Resource allocation: Financial Management helps in allocating resources efficiently. It ensures that funds are directed to areas where they can generate the highest returns. This helps contribute to the overall growth of the organisation.

2) Goal achievement: Clear financial goals and objectives are crucial for the success of a business. Financial Management provides the framework for setting and achieving these goals, aligning them with the broader mission and vision of the organisation.

3) Risk management: Financial Management involves assessing and mitigating risks. This includes identifying potential financial risks, implementing strategies to minimise them, and having contingency plans in place.

4) Decision-making support: Sound financial information is essential for effective decision-making. Financial Management provides accurate and timely data. It enables management to make informed choices regarding investments, operations, and strategic initiatives.

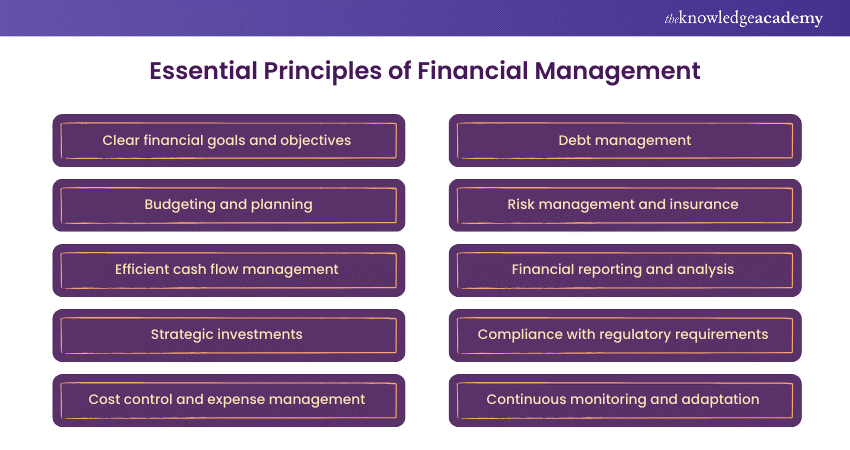

Essential Principles of Financial Management

The following are the top 10 Principles of Financial Management that every organisation must know and adhere to:

Principle 1: Clear financial goals and objectives

One of the foundational Principles of Financial Management is setting clear financial goals and objectives. They provide a roadmap for the organisation, offering a clear sense of purpose and direction.

Organisations must adhere to these goals, which should be based on the SMART criteria. They must ensure that these goals are Specific, Measurable, Achievable, relevant, and Time-bound. By setting well-defined financial goals, businesses can better track their progress and make informed decisions. More importantly, these goals should align seamlessly with the broader objectives of the organisation, whether it be expansion, profitability, or debt reduction.

Principle 2: Budgeting and planning

The Principle of budgeting and planning is a fundamental aspect of sound Financial Management. It involves the systematic creation and utilisation of financial plans to effectively allocate resources.

Budgets act as comprehensive financial roadmaps, outlining expected revenues and expenses over a specified period. Effective budgeting ensures that financial resources are utilised efficiently. It supports strategic objectives and prevents unnecessary expenditures.

Unlock the secrets of financial acumen with our Accounting Masterclass!

Principle 3: Efficient cash flow management

Efficient cash flow management stands as one of the key Principles of Financial Management, emphasising the necessity of maintaining a healthy balance between incoming and outgoing funds.

This Principle involves a keen understanding of the timing of cash inflows and outflows. This helps ensure that the organisation has sufficient liquidity to meet its short-term obligations.

Efficient cash flow management goes beyond profitability, focusing on the actual movement of cash within the business. It involves strategic practices such as timely invoicing, prudent inventory management, and negotiating favourable credit terms with suppliers.

Principle 4: Strategic investments

Strategic investments are integral to Financial Management, emphasising the careful evaluation and allocation of financial resources for optimal returns. Strategic investments involve a systematic approach to identifying opportunities that align with the organisation's goals and risk tolerance.

This Principle encourages a comprehensive risk and return analysis, considering factors such as market trends, potential for growth, and diversification strategies. By making informed investment decisions, organisations can enhance their financial performance and set themselves up for long-term success.

Supercharge your career in finance with our Quantitative Finance Training - join today!

Principle 5: Cost control and expense management

Cost control and expense management focus on the efficient allocation and oversight of financial resources. This Principle involves the identification and monitoring of costs across various business activities.

It emphasises the importance of maintaining a balance between cost efficiency and quality to ensure sustainable operations. Organisations must employ strategies to identify unnecessary expenses, streamline processes, and negotiate favourable terms with suppliers without compromising product or service standards.

Principle 6: Debt management

Debt management focuses on the strategic use and responsible handling of borrowed funds. This Principle emphasises that organisations must have an in-depth understanding of the different types of debt. They must evaluate the costs and benefits associated with borrowing and implement effective debt repayment strategies. Responsible borrowing ensures that debt is used to finance opportunities that yield positive returns, such as expansion projects or investments in strategic initiatives.

Ready to excel in Financial Modelling? Join our Financial Modelling Training and acquire the skills to navigate complex financial scenarios with confidence.

Principle 7: Risk management and insurance

The Principle of risk management and insurance emphasises the proactive identification, assessment, and mitigation of potential financial risks. This Principle involves a systematic approach to recognising various risks, including market fluctuations, operational challenges, and unforeseen events, and implementing strategies to minimise their impact.

Insurance plays a key role in this Principle, providing a financial safety net against potential losses. Businesses must conduct thorough risk assessments, develop risk mitigation strategies, and ensure appropriate insurance coverage to protect against uncertainties.

Principle 8: Financial reporting and analysis

Financial reporting and analysis are integral Principles of Financial Management, focusing on the accurate and transparent communication of an organisation's financial performance. These Principles involve the timely preparation and dissemination of financial statements, such as income statements, cash flow statements and balance sheets. Financial analysis complements this process by interpreting these statements, assessing trends, and extracting insights to guide decision-making.

Principle 9: Compliance with regulatory requirements

The Principle of compliance with regulatory requirements underscores the importance of adhering to rules and regulations governing financial practices. This Principle involves a thorough understanding of relevant local, national, and international financial regulations, as well as industry-specific compliance standards. Organisations must establish robust internal controls and processes to ensure compliance, preventing legal issues and reputational damage.

Ready to elevate your Financial Management skills? Join our comprehensive Financial Management Training now!

Principle 10: Continuous monitoring and adaptation

Continuous monitoring and adaptation are dynamic and essential components of effective Financial Management. It emphasises the need for ongoing vigilance, evaluation, and adaptation of financial strategies to align with changing business environments.

Continuous monitoring involves regularly assessing financial performance, tracking key metrics, and comparing actual outcomes with planned objectives. This Principle encourages organisations to stay agile and responsive to emerging trends, market fluctuations, and internal changes.

Conclusion

The 10 essential Principles of Financial Management collectively form a comprehensive framework that drives excellence in organisational financial practices. From setting clear financial goals and embracing strategic investments to ensuring compliance with regulatory requirements and fostering a culture of continuous monitoring and adaptation, these principles lay the groundwork for effective financial stewardship.

Transform your career with our comprehensive Accounting & Finance Training.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 28th Jun 2024

Fri 23rd Aug 2024

Fri 25th Oct 2024

Fri 27th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please