We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

When it comes to investing your money, you have many options to choose from. Among them, the Money Market and Capital Market are some of the most popular segments that offer great potential for returns. However, choosing between these two can be hectic, as they have different characteristics, advantages, and disadvantages. To make an informed decision, you first need to understand the differences between Money Market vs Capital Market.

That’s exactly what this blog is about. In this blog, we will help you understand the ten major differences between Money Market vs. Capital Market. Let's dive in deeper!

Table of Contents

1) What is the Money Market?

2) Different types of Money Market

3) What is the Capital Market?

4) Different types of Capital Market

5) Differences between the Money Market and Capital Market

6) Conclusion

What is the Money Market?

The Money Market is a financial market segment where short-term financial assets are traded. These assets have a maturity period of less than one year and are used to meet the borrowers' and lenders' short-term liquidity needs. The Money Market is also known as the cash or discount market.

Different types of Money Market

The Money Market can be classified into two types: the organised segment and the unorganised segment. Let’s explore more about them here:

1) Organised segment

The organised segment of the Money Market consists of the formal institutions and intermediaries that regulate and facilitate the trading of Money Market Instruments. Here are some examples of this segment:

1) Central Banks

2) Commercial banks

3) Non-Banking Financial Companies (NBFCs)

4) Financial institutions

5) Money Market mutual funds

6) Discount houses

7) Brokers and dealers

Some of the common Money Market Instruments traded in the organised segment are treasury bills, commercial papers, and certificates of deposits. Moreover, it also includes bankers’ acceptances, repurchase agreements, and interbank call money.

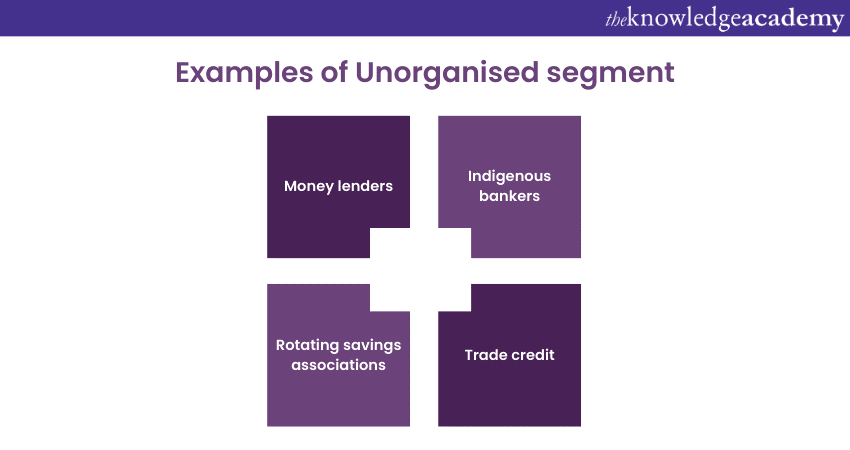

2) Unorganised segment

The unorganised segment of the Money Market consists of the informal and unregulated entities that operate outside the purview of the central bank and the government. These include the money lenders, the indigenous bankers, the rotating savings associations, and the trade credit. These entities provide short-term finance to borrowers at high interest rates and without much collateral.

What is Capital Market?

The Capital Market is a financial market segment where long-term financial assets are traded. These assets have a maturity period of more than one year and are used to raise long-term funds for the borrowers and provide long-term investment opportunities for the lenders. The Capital Market is also known as the securities or investment market.

Different types of Capital Market

The Capital Market can be classified into two types: the primary market and the secondary market. Let’s take a look at them below:

1) Primary market

The primary market is the market where new securities are issued for the first time by the borrowers to the lenders. The borrowers can be the government, the public sector undertakings, the private sector companies, or the financial institutions. The lenders can be the individuals, the institutional investors, the foreign investors, or the public at large. The primary market is also known as the new issue market or the initial public offering market.

2) Secondary market

The secondary market is where existing securities are traded among the lenders. The lenders can buy or sell the securities from other lenders or intermediaries such as stock exchanges, brokers, dealers, and market makers. The secondary market is also known as the stock market or the aftermarket.

Discover the secrets of Capital Markets with our Capital Market Training – Sign up now!

Differences between the Money Market and Capital Market

In this section, we will explore the differences between the Money Market and Capital Market in detail. Let's explore the differences between the Money Market and the Capital Market:

1) Definition

The Money Market is where short-term financial assets are traded, while the Capital Market is where long-term financial assets are traded.

2) Maturity of instruments

The Money Market Instruments have a maturity period of less than one year. This means that they are repaid or redeemed within a short period. The maturity period of the Money Market Instruments ranges from one day to one year. For example, treasury bills have a maturity period of 91 days, 182 days, or 364 days, while commercial papers have a maturity period of up to 270 days.

The Capital Market Instruments have a maturity period of more than one year. This means that they are repaid or redeemed over a long period. The maturity period of the Capital Market Instruments can range from one year to infinity. For example, bonds have a maturity period of 10 years, 20 years, or 30 years, while stocks have no maturity period and can be held indefinitely.

3) Purpose served

The Money Market serves the purpose of meeting the short-term liquidity needs of the borrowers and lenders. The borrowers use the Money Market Instruments to finance their current operations, such as paying wages, salaries, taxes, bills, etc. The lenders use the Money Market Instruments to park their surplus funds for a short period of time, such as overnight, weekly, or monthly. The Money Market helps maintain the equilibrium between the demand and supply of money in the economy.

The Capital Market serves the purpose of raising long-term funds for the borrowers and providing long-term investment opportunities for the lenders. The borrowers use Capital Market Instruments to finance their long-term projects, such as expansion, diversification, acquisition, etc.

The lenders use Capital Market Instruments to earn a return on their savings for a long period of time, such as yearly, biannually, or quarterly. The Capital Market helps mobilise savings and investments in the economy.

4) Market nature

The Money Market is a wholesale market where large amounts of money are traded among the institutional players. At the same time, the Capital Market is a retail market where small amounts of money are traded among individual investors.

5) Instruments involved

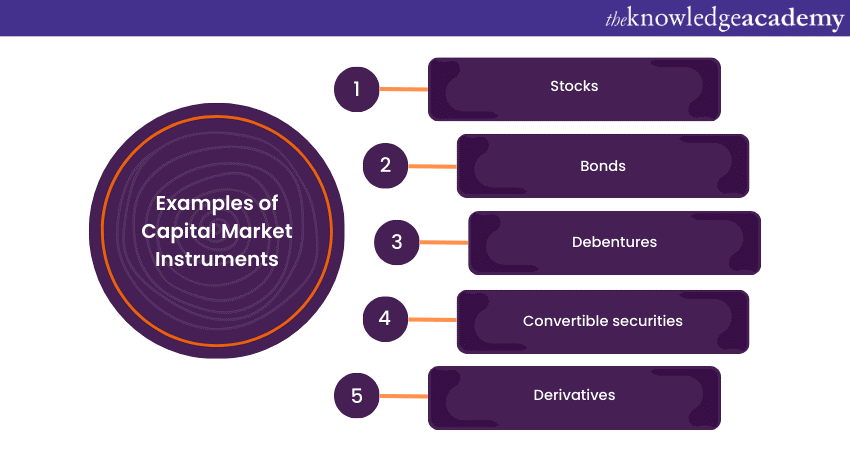

The Money Market Instruments include treasury bills, commercial papers, certificates of deposit, bankers’ acceptances, repurchase agreements, and interbank call money. In contrast, the Capital Market Instruments include stocks, bonds, debentures, preference shares, convertible securities, and derivatives.

6) Investor types

The Money Market investors are mainly the central bank, the commercial banks, the non-banking financial companies, the financial institutions, the Money Market mutual funds, the discount houses, the brokers, and the dealers. In contrast, the Capital Market investors are mainly the individuals, the institutional investors, the foreign investors, and the public at large.

7) Market liquidity

The Money Market is highly liquid, as the instruments can be easily converted into cash within a short period. At the same time, the Capital Market is less liquid, as the instruments have a longer maturity period and may not be easily sold in the market.

8) Risk involved

The Money Market is less risky, as the instruments have a low default risk and a low interest rate risk, while the Capital Market is riskier, as the instruments have a high default risk and a high interest rate risk.

9) Functions served

The Money Market serves the function of providing a mechanism for the transmission of monetary policy, facilitating the management of cash flow, and maintaining the financial system's stability. In contrast, the Capital Market provides a mechanism for allocating capital, facilitating the economy's growth, and promoting the development of the financial sector.

10) Return on Investment achieved

The Money Market provides a low return on investment, as the instruments have a low interest rate and a low profit margin. In contrast, the Capital Market provides a high return on investment, as the instruments have a high interest rate and a high profit margin.

Empower your financial decisions with our Financial Modelling and Forecasting Training – Sign up now!

Conclusion

We hope you read and understand the differences between Money Market vs Capital Market. They are two important segments of the financial market that serve different purposes and cater to different types of investors. They also differ in various aspects, such as maturity, purpose, nature, instruments, investors, liquidity, risk, functions, and market return. By understanding these differences, one can make informed decisions about investing in the Money Market or the Capital Market.

Enhance your expertise in finance with our Accounting & Finance Training – Sign up now!

Frequently Asked Questions

Upcoming Career Growth Batches & Dates

Date

Capital Market Course

Capital Market Course

Fri 24th May 2024

Fri 9th Aug 2024

Fri 6th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please