We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

QuickBooks has emerged as an efficient and accurate Financial Management and Accounting software in today's fast-paced business landscape. It is a boon for businesses of all sizes, helping them streamline their financial processes. Therefore, it’s crucial to learn How to Use QuickBooks effectively.

According to Global Newswire, the accounting software market is expected to reach a value of £37 billion by 2028, at a CAGR of more than 19.4% over the forecast period of 2022–2028. So, if you want to organise your finance or optimise your accounting practices, investing in learning QuickBooks can benefit you.

Want to know how learning to use this software can benefit you? Read this blog to learn about How to Use QuickBooks. Also, explore a step-by-step approach to harness the software's power effectively. Join us as we demystify the world of accounting.

Table of Contents

1) What is QuickBooks?

2) What are the benefits of using QuickBooks?

3) How to Use QuickBooks?

a) Set up your QuickBooks account

b) Navigate the QuickBooks dashboard

c) Add your company information

d) Set up Chart of Accounts

e) Connect bank accounts and credit cards

f) Record income and expenses

g) Manage payroll

h) Generate financial reports

4) Conclusion

What is QuickBooks?

QuickBooks is a robust and versatile Financial Management software that empowers businesses and individuals to streamline their accounting processes. Developed by Intuit, QuickBooks has established itself as a trusted and widely used solution for managing financial transactions, bookkeeping, and reporting.

At its core, QuickBooks serves as a digital hub for all financial activities. It offers several tools that simplify tasks such as invoicing, expense tracking, payroll management, and generating financial reports. This software caters to various user needs, whether you're a small business owner, freelancer, or even an individual looking to manage personal finances more effectively.

Moreover, QuickBooks provides a comprehensive suite of Financial Management tools covering various aspects of accounting. From invoicing and expense tracking to payroll management and bank reconciliation, it offers solutions to meet the varied needs of businesses. Users can conveniently handle day-to-day financial tasks and gain insights into their financial health through detailed reports and analytics.

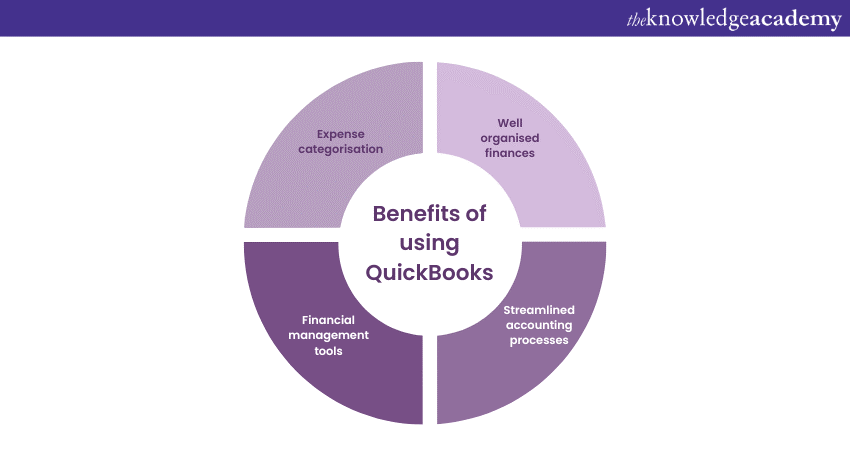

What are the benefits of using QuickBooks?

QuickBooks offers many benefits contributing to effective Financial Management and streamlined Accounting processes for businesses and individuals alike. Let's have a look at some of its benefits:

Well organised finances

QuickBooks excels in structuring financial data systematically. It provides a centralised platform to record income, expenses, assets, and liabilities accurately. This organisation ensures that important financial information is readily accessible, promoting better decision-making, easing audits, and facilitating in-depth financial analysis.

Streamlined Accounting processes

The automation prowess of QuickBooks is a game-changer. Manual Accounting tasks that were once time-consuming are now automated, from transaction recording to account reconciliation. This streamlining not only saves time but also minimises the potential for errors, resulting in more reliable financial data.

Financial Management tools

QuickBooks boasts a range of tools that cover various aspects of Financial Management. From generating professional invoices to efficiently processing payrolls and accurately calculating taxes, these tools simplify complex financial tasks, ensuring compliance, accuracy, and efficiency.

Expense categorisation

Categorising expenses accurately is essential for budgeting and financial analysis. QuickBooks makes this process effortless by enabling users to categorise expenses with precision. This feature not only ensures meticulous record-keeping but also empowers users to identify opportunities for cost-saving measures.

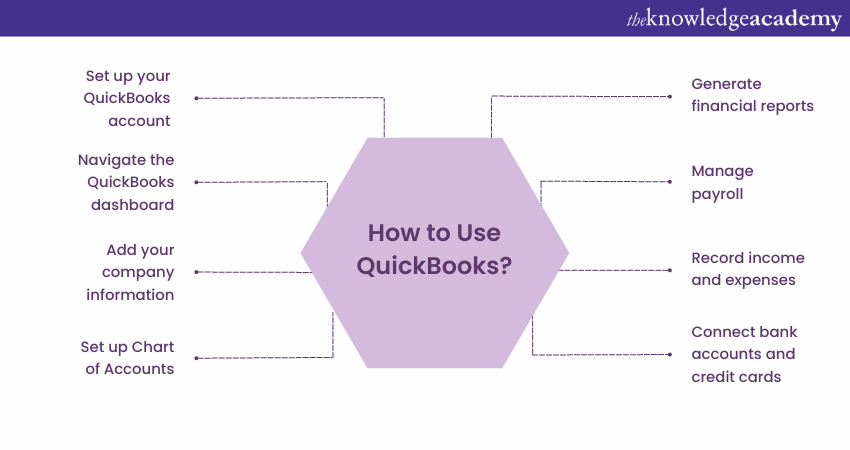

How to Use QuickBooks?

This section of the blog will provide you with a step-by-step guide on How to Use QuickBooks. So, let’s have a quick look at all of these:

Set up your QuickBooks account

Setting up your QuickBooks account is the crucial first step on your Financial Management journey. Adhere to the following steps to set up your QuickBooks account:

1) Register: Begin by visiting the QuickBooks website and sign up for an account. Provide the required information and choose a secure password.

2) Select subscription: Select the appropriate subscription level based on your business needs. Consider factors like the number of users and required features.

3) Personalise your account: Personalise your account by entering your company details. This includes your business name, address, and contact information.

Navigate the QuickBooks dashboard

Upon logging in, you'll land on the QuickBooks dashboard – your command centre for financial tasks. Adhere to the following steps to navigate the QuickBooks dashboard:

1) Log in: Access your QuickBooks account using your registered email and password.

2) Explore dashboard: Explore the main dashboard, which offers an overview of your business's financial status through graphs and charts.

3) Explore navigation menu: Familiarise yourself with the navigation menu on the left. This menu provides access to various features like invoicing, expenses, and reports.

Add your company information

Accurate company details are essential. Follow these steps to add your company information:

1) Add company details: Go to "Company Settings" option and enter accurate information about your business, including its legal name, address, and contact details.

2) Add company logo: Enhance professionalism by uploading your company logo. This logo will appear on invoices and reports, giving your business a consistent identity.

Register for our Finance For Non Financial Managers Course and unlock your potential in the field of Financial Management!

Set up Chart of Accounts

Creating a well-structured Chart of Accounts is fundamental for accurate bookkeeping. This serves as your financial framework, categorising income, expenses, assets, and liabilities. Follow these steps to set up a Chart of Accounts:

1) Understand the Chart of Accounts: Learn about the Chart of Accounts, which categorises your financial transactions into various accounts.

2) Customise to your business’s specific needs: Create accounts that suit your business's specific needs. Tailor them to match your industry and operations.

3) Organise logically: Organise accounts logically within your Chart of Accounts. This ensures that financial tracking is accurate and straightforward.

Connect bank accounts and credit cards

QuickBooks' efficiency shines when you connect your bank accounts and credit cards. Follow these steps to connect your bank accounts and credit cards:

1) Link accounts: Integrate your bank accounts and credit cards with QuickBooks. This allows for automated transaction syncing.

2) Set up bank feeds: Set up bank feeds to ensure that your QuickBooks transactions remain up to date with your actual bank transactions.

3) Reconcile your transactions: Regularly reconcile your transactions with your bank statements to verify the accuracy of your financial data.

Take a significant step towards mastering your financial expertise! Join our Accounting & Finance Training now!

Record income and expenses

Using QuickBooks, you can record income as well as expenses. Adhere to the following steps:

1) Record income transactions: Record all sources of income accurately. Include details such as the date, amount, and source of the income.

2) Track expenses: Enter your expenses and categorise them appropriately. This practice aids in budgeting and financial analysis.

3) Accept receipts: Attach receipts to expense transactions for proper documentation and potential future audits.

Manage payroll

If you have employees, QuickBooks' payroll management simplifies the process. QuickBooks helps calculate taxes, making payroll less daunting. Always ensure compliance by submitting accurate payroll taxes on time. Follow these steps to manage your payroll efficiently:

1) Input employee information: Input employee details into QuickBooks, including their names, payment details, and tax information.

2) Process payroll efficiently: Use QuickBooks to process payroll efficiently. Generate payslips for your employees and ensure timely payments.

3) Calculate tax: QuickBooks can help calculate payroll taxes accurately, reducing the risk of errors.

Generate financial reports

QuickBooks empowers you with insightful financial reports. Run balance sheets, income, and cash flow statements to comprehend your business's financial health. Further, analyse trends and make informed decisions based on these reports. This data-driven approach supports growth and stability. Follow these steps to generate financial reports on QuickBooks:

1) Select type of report: Access the reporting section in QuickBooks and choose the type of report you need, such as balance sheets, income statements, or cash flow statements.

2) Review the reports: Review the generated reports to understand your business's financial health. Identify trends and areas for improvement.

3) Make informed decisions: Make informed decisions depending on the insights these reports provide. Adjust your business strategies as needed.

Conclusion

To sum it up, QuickBooks is a valuable tool for simplifying Financial Management. Mastering the tool is of great help to individuals as well as businesses. By learning How to Use QuickBooks, you'll be equipped with the knowledge to navigate the software efficiently and use its features to streamline your Accounting processes.

Ready to become a QuickBooks pro? Register now for our comprehensive QuickBooks Masterclass.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

QuickBooks Training

QuickBooks Training

Fri 27th Sep 2024

Fri 22nd Nov 2024

Fri 10th Jan 2025

Fri 14th Mar 2025

Fri 9th May 2025

Fri 11th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please