We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In this blog, we will explore Excel for Finance, empowering you with essential skills and strategies to navigate the financial landscape effectively. Whether you're a seasoned finance professional or an aspiring analyst, this blog is tailored to equip you. Let's learn more to know how to excel in your financial endeavours.

Explore this blog on the power of Excel for Finance and discover essential tips and techniques for financial analysis and reporting. So, let's embark on this enlightening journey together and unlock the vast possibilities that Excel for Finance holds.

Table of Contents

1) What is Microsoft Excel?

2) Importance of Excel for Finance

3) Key Excel functions for Finance

4) The Appeal of Excel for Finance Teams

5) Conclusion

What is Microsoft Excel?

Microsoft Excel, developed by Microsoft, is a functional spreadsheet program that we can use to perform Data Analysis, calculation, and visualisation. The simple design and broad functionality of this make it the favourite choice for professionals in various fields and especially the financial sector. Excel enables financial modelling, budgeting and reporting tasks as it allows users to organise, transform and analyse information precisely, efficiently and in a better way.

Along with the balances and formulas, charts and pivot tables are tools that make it possible for users to make in-depth calculations and portray the insights well. The availability and ease of use of this technology are its biggest strengths and make it an irreplaceable tool for professionals to improve their work and make more informed decisions.

Importance of Excel for Finance

Excel finance for tasks like analysis, modelling, budgeting, and reporting. Its versatility allows finance professionals to handle complex calculations and manipulate data with ease. With user-friendly features like formulas and pivot tables, Excel simplifies financial tasks, enabling professionals to generate insights efficiently.

It is not only task-oriented but also gives users the opportunity to build their own financial models and reports which influence the decision-making process. In general Excel is a must-have tool for the preparation of financial documents that require efficiency and precision.

Master Excel with our comprehensive Microsoft Excel Course!

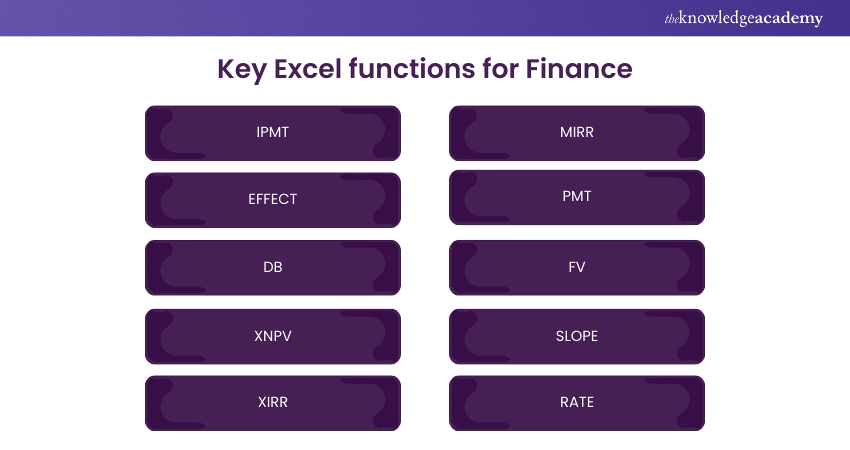

Key Excel functions for Finance

Here are essential Excel functions specifically selected for finance professionals, enhancing analytical capabilities and facilitating precise financial computations.

1) IPMT

IPMT calculates the interest component of a loan payment for a designated period. This is one of the functions which is very useful in debt repayment analysis that provides the information on how interest and principal are paid off by time.

Syntax: IPMT(rate, per, nper, pv, [fv], [type])

2) EFFECT

EFFECT computes the effective annual interest rate, which is essential for accurately comparing different loan or investment options. It considers the compounding frequency, providing a standardised measure reflecting the true cost or return over a year, facilitating informed financial decisions.

Syntax: EFFECT(nominal_rate, npery)

3) DB

The DB function in Excel is useful for calculating costs related to depreciation using various methods, such as linear or reducing balance. This allows finance professionals to successfully manage assets and share financial statements.

Syntax: DB(cost, salvage, life, period, [month])

4) XNPV

XNPV calculates the net present value of cash flows that occur at irregular intervals, adjusting for the time value of money. It aids in investment appraisal by providing a more accurate measure of project profitability and assisting in informed decision-making.

Syntax: XNPV(rate, values, Dates)

5) XIRR

XIRR calculates the internal rate of return for investments with varying cash flows occurring at irregular intervals. Accounting for the timing and magnitude of cash flows offers insights into the profitability and performance of projects or investments.

Syntax: XIRR(values, dates, [guess])

6) MIRR

Modified Internal Rate of Return (MIRR) adjusts for reinvestment rates and financing costs, overcoming limitations of traditional IRR by assuming reinvestment at the project's cost of capital and financing at the firm's borrowing rate.

Syntax: MIRR(values, finance_rate, reinvest_rate)

7) PMT

PMT, an Excel function, computes the fixed periodic payment required to repay a loan or investment, considering a constant payment amount and a fixed interest rate. This calculation aids in financial planning and budgeting for loan repayments or investment contributions.

Syntax: PMT(ratechar, nper, pv, [fv], [type])

8) FV

Future Value (FV) calculates the projected value of an investment or loan over time, considering factors like interest rates and compounding. This helps individuals and businesses plan for future financial goals and make informed investment decisions.

Syntax: FV(rate, nper, pmt, [pv], [type])

9) SLOPE

SLOPE calculates the slope of a linear regression line, aiding in analysing relationships between variables in financial data. Quantifying the rate of change between two sets of data points provides insights into the strength and direction of the relationship.

Syntax: SLOPE(known_ys, knoen_xs)

10) RATE

The RATE function in Excel calculates the interest rate per period for an annuity or loan. This facilitates financial analysis by allowing users to assess the cost of borrowing or the potential return on investment, aiding in decision-making processes.

Syntax: RATE(nper, pmt, pv, [fv], [type], [guess])

Unlock the power of Excel VBA and Macros now with our Microsoft Excel VBA And Macro Training!

The Appeal of Excel for Finance Teams

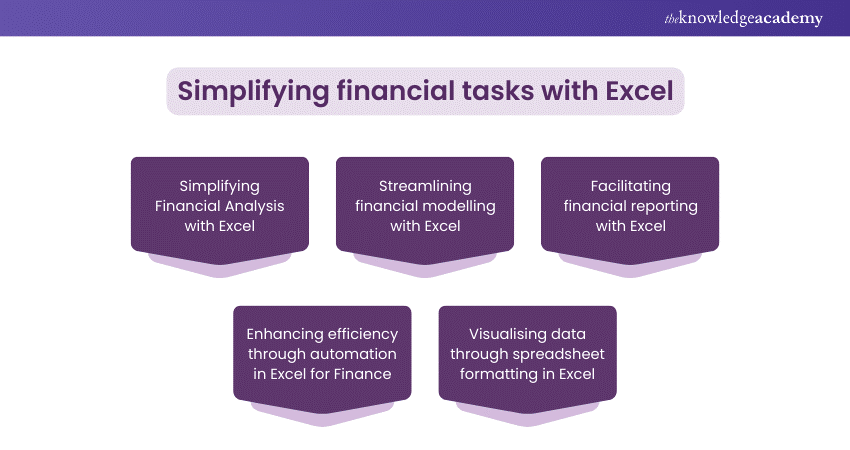

The following are the ways in which Excel simplifies financial tasks:

1) Simplifying Financial Analysis with Excel

Excel's advanced calculation features and adjustable formulae make financial analysis easier by allowing users to do complex calculations quickly. Excel gives the abilities required to quickly create insightful reports, whether studying trends, evaluating investment opportunities, or monitoring financial performance.

This speeds the analysis process, allowing finance professionals to confidently make choices based on data. Users can gain useful insights into their financial data by taking advantage of Excel's ability, resulting in improved organisational decision-making and strategic planning.

2) Streamlining financial modelling with Excel

Excel's flexible modelling tools allow finance teams to create complex financial models for forecasting and performance review. Excel improves the modelling process by combining variables and assumptions, making it easier to create reliable projections.

This allows teams to make more informed strategic decisions, predict possible outcomes, and adjust their financial strategy accordingly. Overall, Excel's modelling features improve efficiency and accuracy, providing finance professionals with useful insights for making efficient decisions in business environments.

3) Facilitating financial reporting with Excel

The formatting and graphical options of Excel make it easier to create accurate financial reports. Users can present data in attractive presentations using adjustable elements, which improves stakeholder engagement.

Excel clearly represents financial data, whether in the form of income statements, balance sheets, or financial reports. This not only increases comprehension but also facilitates the effective transfer of essential financial information, allowing stakeholders to make informed decisions.

4) Enhancing efficiency through automation in Excel for Finance

Excel's automation features, like macros and advanced functions, optimise repetitive tasks and data processing in finance. By automating routine processes, teams enhance efficiency, minimise errors, and allocate more time to strategic initiatives.

Macros allow for the recording and playback of repetitive actions, while advanced functions enable complex calculations to be executed automatically. Automation accelerates workflow and ensures accuracy, consistency, and freeing resources for higher-value activities essential for organisational growth.

5) Visualising data through spreadsheet formatting in Excel

Excel's spreadsheet formatting allows finance teams to present their data with customised charts, graphs, and pivot tables. This feature allows users to show complex financial information in a simple and understandable manner, enabling communication and understanding among stakeholders.

Finance professionals can use Excel's visualisation tools to better data interpretation and identify key trends, resulting in organisational success.

Enhance your skills with Excel Training with Gantt Charts now!

Conclusion

Microsoft Excel is an important tool for those working in finance, providing unmatched data processing, modelling, and reporting abilities. Its importance in finance cannot be overstated, as it allows for advanced calculations, effective data visualisation, and efficient operations. Finance teams may improve productivity, decision-making, and overall organisational success by using the power of Excel.

Elevate your accounting skills with our Excel for Accounting Course today!

Frequently Asked Questions

The time required to become proficient in Excel differs based on the individual's learning speed and goals. However, continuous practice and determination usually result in proficiency within a few months.

Yes, Excel can be used as a powerful financial calculator. Excel simplifies various financial calculations by providing a wide range of built-in functions and customisable formulas to help in decision-making.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Microsoft Excel Training & Certification Course, including Microsoft Excel Course, Microsoft Excel VBA and Macro Training and Excel for Accounting Course. These courses cater to different skill levels, providing comprehensive insights into Excel Data Visualisation.

Our Office Applications Blogs cover a range of topics related to the Microsoft Excel, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Microsoft Excel skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Office Applications Resources Batches & Dates

Date

Microsoft Excel Course

Microsoft Excel Course

Mon 5th Aug 2024

Mon 19th Aug 2024

Mon 2nd Sep 2024

Mon 16th Sep 2024

Mon 7th Oct 2024

Mon 21st Oct 2024

Mon 4th Nov 2024

Mon 18th Nov 2024

Mon 2nd Dec 2024

Mon 9th Dec 2024

Mon 16th Dec 2024

Mon 13th Jan 2025

Mon 3rd Feb 2025

Mon 10th Mar 2025

Mon 7th Apr 2025

Mon 19th May 2025

Mon 9th Jun 2025

Mon 14th Jul 2025

Mon 4th Aug 2025

Mon 8th Sep 2025

Mon 6th Oct 2025

Mon 10th Nov 2025

Mon 1st Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please