We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The Credit Controller is tasked with guaranteeing that an organisation's credit is handled in a manner that safeguards the company's financial interests. The Credit Controller Skillset encompasses the capacity to evaluate risk, negotiate payment terms, and uphold relationships with customers and creditors. A skilled Credit Controller will thoroughly understand the organisation's credit policy and apply it in a manner that reduces risk.

If you aspire to become a Credit Controller, gaining insights into the essential skills can assist in evaluating if this is the suitable career path for you. Keep reading to learn more!

Table of Contents

1) Skills required for a Credit Controller

a) Effective communication

b) Organisational proficiency

c) Time management expertise

d) Prioritisation abilities

e) Negotiation skills

f) Customer service aptitude

g) Problem-solving capabilities

h) Meticulous attention to detail

i) High level of accuracy

j) Flexibility and adaptability

2) Conclusion

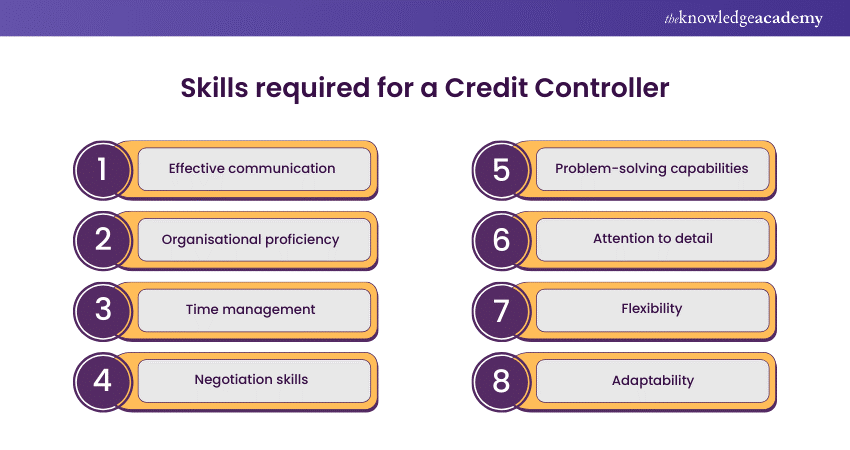

Skills required for a Credit Controller

The following are some of the Credit Controller Skills:

1) Effective communication

Effective communication is an important factor in the success of a Credit Controller. This skill involves conveying information clearly and listening attentively to understand the nuances of client communications.

Whether discussing payment terms, addressing concerns, or negotiating settlements, a Credit Controller's communication ability is crucial in building positive relationships and ensuring all stakeholders are on the same page.

2) Organisational proficiency

Credit Controller has multiple roles involving the management of diverse tasks simultaneously. Organisational skills are essential to streamline workflows, maintain accurate records, and meet deadlines. This skill extends to the effective use of tools and systems to track accounts, monitor payment schedules, and coordinate with other departments seamlessly.

3) Time management expertise

In credit control, time is of the essence. Credit Controllers must juggle various responsibilities, from monitoring payment timelines to resolving client inquiries promptly. Time management expertise ensures that tasks are prioritised based on urgency and importance, allowing Credit Controllers to meet deadlines, prevent overdue payments, and maintain the organisation's financial health.

4) Prioritisation abilities

Prioritisation is a skill that goes hand in hand with time management. Credit Controllers must assess the urgency and importance of various tasks to efficiently allocate their time and resources. Identifying high-priority accounts, addressing potential risks, and focusing on critical issues contribute to a more strategic and impactful approach to credit control.

5) Negotiation skills

Negotiation is an art that Credit Controllers must master. Practical negotiation skills are crucial when discussing payment plans, settling overdue accounts, or making complicated financial arrangements.

The ability to find common ground, propose viable solutions, and maintain positive relationships during negotiations is a valuable asset for Credit Controllers seeking to balance the organisation's financial interests with client satisfaction.

6) Customer service aptitude

Beyond numbers and transactions, Credit Controllers are often the face of the organisation in financial interactions. A customer service-oriented approach is essential for building and maintaining positive client relationships.

This involves not only resolving issues promptly but also providing assistance, information, and guidance in a manner that fosters trust and cooperation.

7) Problem-solving capabilities

Credit Controllers encounter many challenges, from resolving payment disputes to addressing billing discrepancies. Problem-solving capabilities are essential for navigating these complexities.

A Credit Controller should be adept at analysing situations, identifying root causes, and implementing effective solutions that contribute to the smooth functioning of credit management processes.

8) Meticulous attention to detail

Credit Controllers deal with financial transactions, invoices, and records that demand meticulous attention to detail. A small error in data entry or oversight in reviewing financial documents can have significant repercussions. Attention to detail is a fundamental skill for maintaining accuracy and preventing costly mistakes.

Stay ahead of the learning curve with our SWIFT Payments Operate Alliance Access And Entry Training!

9) High level of accuracy

Accuracy is not just about paying attention to details but ensuring that all financial transactions are executed precisely. Accuracy is imperative for Credit Controllers, as mistakes in invoicing, payment processing, or recording financial data can lead to financial discrepancies, strained client relationships, and potential legal implications.

10) Flexibility and adaptability

The financial domain is dynamic, with regulations, policies, and market conditions subject to change. Credit Controllers must exhibit flexibility and adaptability to navigate these shifts effectively. Being open to learning, embracing new technologies, and adjusting credit control strategies in response to evolving circumstances are crucial for success.

11) Financial analysis competence

A solid foundation in financial analysis is an important skill for Credit Controllers. Understanding financial statements, assessing creditworthiness, and analysing risk factors are integral aspects of the job. Credit Controllers should be trained to interpret complex financial data accurately and use it to make informed decisions that align with the organisation's financial goals.

12) Expertise in Credit Risk Analysis

Credit risk is inherent in credit control, and Credit Controllers must assess and manage it effectively. This involves evaluating the creditworthiness of clients, monitoring changes in financial situations, and implementing risk mitigation strategies. A thorough understanding of credit risk allows Credit Controllers to make informed decisions that protect the organisation from potential financial losses.

Attain the knowledge of how to analyse financial statements and various techniques with our Financial Management Training!

13) Collections management Skills

Collections management is a specialised skill set within credit control. It involves the strategic pursuit of overdue payments while maintaining positive client relationships. Credit Controllers with strong collections management skills can implement effective strategies, balancing assertiveness with professionalism. Timely and diplomatic collections management minimises bad debt and ensures a healthy cash flow.

14) Analytical skills

Analytical skills form a crucial part of Credit Controllers’ skillset. It encompasses interpreting complex financial data, identifying trends, and drawing meaningful insights. By analysing financial information comprehensively, Credit Controllers can make informed decisions, implement targeted credit control strategies, and optimise the organisation's overall financial performance.

15) Intuitive decision-making

While data and analysis are crucial, intuitive decision-making is also valuable in credit control. Credit Controllers should be able to synthesise information quickly, assess situations, and make sound decisions, especially when faced with time-sensitive issues.

Intuition, backed by experience and expertise, can contribute to effective and agile decision-making, ensuring that Credit Controllers are well-equipped to handle dynamic and unpredictable situations.

16) Diligent work ethic

A diligent work ethic is the glue that binds all these skills together. Credit Controllers often handle sensitive financial matters that require a strong sense of responsibility and commitment.

Diligence ensures that tasks are completed precisely, deadlines are consistently met, and the organisation's financial interests are safeguarded. It involves a commitment to excellence and a proactive approach to addressing challenges, ultimately contributing to the overall success of credit control efforts.

Become familiar with investment banking firms that provide financial consulting services with our Capital Market Training!

Conclusion

Credit Controllers are important in managing an organisation's financial health by overseeing credit and accounts receivable. The success of a Credit Controller is rooted in their ability to navigate the delicate balance between financial skills and effective interpersonal communication. We hope that you have understood essential Credit Controller Skills that can help you make informed decisions about pursuing a career in this field.

Understand the different Tasks within the Payroll Cycle with our Introduction To Payroll Course!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Credit Control

Introduction to Credit Control

Fri 21st Jun 2024

Fri 30th Aug 2024

Fri 18th Oct 2024

Fri 20th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please