We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Capital Markets involve trading financial securities such as bonds, stocks, shares, and debentures. Capital Market Interview Questions can be technically oriented and differ based on your experience level. Familiarising yourself with potential questions and crafting effective responses can enhance your preparation for the interview.

Capital Market Interview Questions evaluate a candidate's knowledge, analytical skills, and critical thinking abilities on various topics related to Capital Markets. In this blog, we explore the most commonly asked questions in a Capital Market Interview and offer illustrative answers to assist you in comprehending how to respond to these questions effectively during the interview. Read more to know more!

Table of Contents

1) Top 22 Capital Market Interview Questions

a) What does Capital Market mean? How does the company raise funds in the Capital Market?

b) What are the major elements/components of the Capital Market?

c) What are the major roles played by consultants in a Capital Market?

d) What is a credit rating?

e) What is capital budgeting?

f) What is a mutual fund?

g) What is a derivative?

h) What is an Index?

i) What are the limitations of capital budgeting?

j) What are the techniques available for evaluation of capital budgeting?

2) Conclusion

Top 22 Capital Market Interview Questions

Here are some leading Capital Market Interview Questions along with their answers, designed to assist you in preparing for your interview!

1) What does Capital Market mean? How does the company raise funds in the Capital Market?

The financial market, commonly called the Capital Market, is a platform for companies to secure long-term capital. Within this market, companies buy and sell long-term instruments such as equity shares and debt securities. The Capital Market comprises two main categories: the Primary market and the secondary market.

Capital Markets are crucial in directing savings and investments between entities or individuals with capital to invest in and those needing capital. These entities typically include banks and investors as suppliers, while businesses, governments, and individuals are among the primary capital seekers.

Companies employ four main methods to raise funds in the Capital Market. First, they may issue equity shares, also known as ordinary stock, to attract funds. Investors assess various factors, including financial statements, dividend distribution, and credit ratings, to determine their interest, expecting the value of shares to increase.

Another method is issuing bonds, where a specified amount is repaid at maturity. Bondholders receive regular interest payments at predetermined rates, and companies issue bonds due to the lower interest rates they must pay compared to borrowing. Bonds can also be sold to other investors before reaching their level of maturity.

Preference shares are chosen by companies seeking to raise capital, providing buyers with special status in case of financial difficulties. When profits are limited, owners of preference shares receive dividends after bondholders have received their interest.

2) What are the major elements/components of the Capital Market?

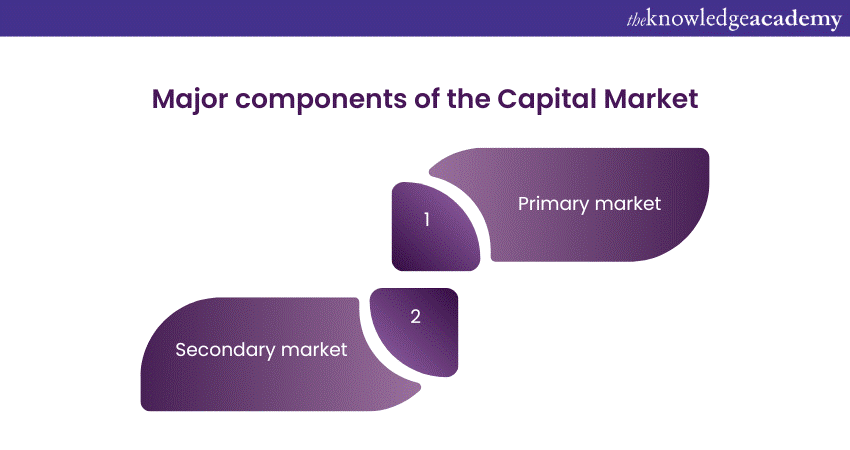

There are two significant components, namely:

Primary market: In the primary market, also known as the new or fresh issue market, only IPOs (Initial Public Offerings) are present. As the name suggests, securities or newly issued shares are sold exclusively in the primary market. Borrowed finance in the form of loans from financial institutions is not included in the primary market. Issuing a loan from a financial institution signifies the transformation of private capital into public capital. This process of converting borrowed capital into public capital is called going public. Common securities issued in the primary market include equity shares, preference shares, debentures, bonds, and other innovative securities.

Secondary market: In the secondary market, all existing securities are traded. The company does not issue or trade securities to investors in the secondary market. Instead, existing investors sell securities to other investors. Sometimes, an investor needs cash, and another wants to buy company shares since they cannot acquire them directly from the company. In such cases, both investors can meet in the secondary market and exchange securities for cash through a broker intermediary.

3) What are the major roles played by consultants in a Capital Market?

A practitioner in the Capital Market should possess a comprehensive understanding of the stock markets, encompassing both market conditions and intricacies. Staying abreast of recent events to anticipate market movements precisely and contribute to trading shares, bonds, and securities is essential. They should adeptly counsel prominent individuals and organisations on optimal investments, the opportune moments to buy or sell, and strategies to enhance profits. Providing precise analytical advice and engaging in financial planning constitute pivotal aspects of the role in the Capital Market.

Get an understanding of equity markets, which provide valuable information about companies with our Accounting & Finance Training!

4) What is a credit rating?

A credit rating evaluates a company or institution's creditworthiness, estimating its net worth. This assessment is crucial for businesses as it is pivotal in determining their ability to repay debts. A positive credit rating is advantageous, facilitating companies in securing loans and garnering financial support from investors, banks, and external institutes. The process of calculating credit ratings involves a thorough examination of financial history and the verification of current assets and liabilities.

5) What is capital budgeting?

Capital budgeting is a fundamental financial process undertaken by businesses and organisations to assess and make decisions regarding long-term investments. This crucial aspect of Financial Management involves identifying potential investment opportunities, such as acquiring new equipment, developing facilities, or launching new product lines, and evaluating their profitability and viability. The process includes:

a) Estimating cash flows associated with each investment.

b) Assessing the associated risks.

c) Calculating key financial metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR).).

NPV involves discounting projected cash flows to their present value and subtracting the initial investment cost, with a positive NPV indicating financial viability. Meanwhile, IRR represents the discount rate at which the NPV becomes zero. Capital budgeting enables businesses to make well-informed decisions that are in sync with their strategic goals, thereby aiding in their long-term financial prosperity.

6) What is a mutual fund?

A mutual fund is an investment mechanism that aggregates funds from multiple investors to construct a diversified portfolio comprising stocks, bonds, or various other securities. This portfolio is managed by a professional Fund Manager. Investors in a mutual fund buy shares, or units, representing their ownership in the overall fund. The appeal of mutual funds lies in their ability to provide individual Investors access to a diversified and professionally managed investment portfolio, even with relatively small amounts of capital.

Mutual funds provide investors with an opportunity to distribute their risk across a range of assets and take advantage of the proficiency of Fund Managers in guiding investment choices. The performance of a mutual fund is monitored through its Net Asset Value (NAV), calculated as the market value of all the assets held by the fund, subtracted by its liabilities. The NAV sets the price at which investors are able to purchase or sell shares in the mutual fund.

7) What is a derivative?

A derivative denotes a financial contract between two parties, the value of which is dependent on the behaviour of an underlying entity, like an asset, index, or interest rate. It's important to note that derivatives do not signify ownership of the underlying asset, but rather set the terms for a financial agreement based on the future movements or values of the referenced entity. Common types of derivatives include futures contracts, options, and swaps. Futures contracts are binding agreements that require the customer to purchase and the seller to trade a quantity of the underlying asset at a set price on a predetermined future date.

Exchanges involve the deal of cash flows or other financial instruments between two parties. Derivatives are utilised for various purposes, including hedging against price fluctuations, speculating on market movements, and managing risk in financial portfolios. While derivatives offer valuable tools for risk management and investment strategies, their complexity requires a thorough understanding of financial markets and instruments by those who engage in trading or investing in these financial products.

Stay ahead of the learning curve with our SWIFT Payments Operate Alliance Access And Entry Training!

8) What is an Index?

In the financial context, an index is a statistical measure that gauges the performance of a specific market, sector, or group of assets. It serves as a benchmark, reflecting the underlying components' overall movement or value changes. Typically composed of stocks, bonds, or other financial instruments, an index provides investors and analysts with a way to assess the broader market trends and evaluate the performance of their investments relative to the market as a whole.

The most well-known examples of financial indices include the S&P 500, representing a cross-section of large-cap U.S. stocks, and the Dow Jones Industrial Average, which tracks 30 major American companies. Indices are constructed using various methodologies, such as market capitalisation or price weighting, depending on the specific criteria set by the index provider.

9) What are the limitations of capital budgeting?

While integral to effective financial decision-making, the capital budgeting process has limitations. Firstly, it relies heavily on estimates and projections, which are inherently uncertain and subject to change. For instance, the accuracy of cash flow predictions can be influenced by various factors such as market conditions, economic trends, and unforeseen events, introducing a level of risk into the decision-making process.

Secondly, the capital budgeting process often assumes a stable economic environment throughout the life of the investment. However, real-world conditions can be dynamic, and changes in interest rates, inflation, or other macroeconomic factors may impact the project's profitability.

Focusing on financial metrics like Net Present Value (NPV) and Internal Rate of Return (IRR) may not capture non-financial considerations crucial for decision-making. The quantitative capital budgeting analysis may need to adequately reflect environmental impact, social responsibility, and strategic alignment.

10. What are the techniques available for evaluation of capital budgeting?

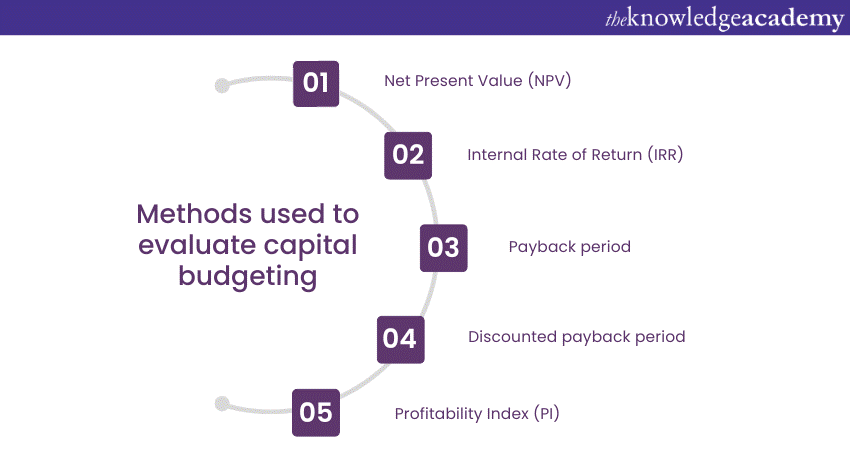

Several techniques are available for evaluating capital budgeting decisions, each offering a unique perspective on the feasibility and profitability of potential investments. Here are some commonly used methods:

1) Net Present Value (NPV): NPV is a fundamental technique that calculates the present value of expected cash inflows and outflows over the life of an investment.

2) Internal Rate of Return (IRR): It represents the project's rate of return, and a higher IRR generally indicates a more attractive investment.

3) Payback period: This method measures the time it takes for the initial investment to be recovered from the project's cash inflows.

4) Discounted payback period: Like the payback period, this method considers the time value of money by discounting future cash flows. It provides a more accurate assessment of the time required to recover the initial investment.

5) Profitability Index (PI): Also known as the benefit-cost ratio, the PI is the ratio of the present value of cash inflows to the present value of cash outflows. A PI more significant than 1 indicates a potentially profitable investment.

11) What is IRR and ARR?

The Internal Rate of Return (IRR) is a financial metric used to assess the profitability of an investment. In other words, the rate of return makes the present value of the expected cash inflows equal to the present value of the cash outflows. A higher IRR is generally indicative of a more attractive investment opportunity. Investors and analysts compare the IRR to the cost of capital or a hurdle rate to determine whether a project is financially viable. IRR has limitations, such as potential multiple IRRs in complex cash flow patterns and reinvestment assumption at the IRR rate.

The Accounting Rate of Return (ARR) is a financial value that measures the average accounting profit of an investment as a percentage of the average investment. ARR is a simple method that uses accounting measures, such as net income and average book value, to evaluate the profitability of a project. The formula for ARR is the average accounting profit divided by the average investment. While ARR is easy to calculate and understand, it has limitations, including its failure to account for the time value of money and its dependence on accounting measures, which may only sometimes reflect economic reality. Despite these limitations, ARR can quickly assess a project's financial performance from an accounting perspective.

12) What are zero coupon bonds?

Zero coupon or discount bonds are a debt instrument that distinguishes itself by the absence of periodic interest payments standard to traditional bonds. Instead, these bonds are issued at a discounted price relative to their face value, with the difference between the issue price and face value representing the implicit interest accumulating over the bond's lifespan. The hallmark feature of zero-coupon bonds is their non-payment of interest throughout the bond's tenure, offering investors a return through capital appreciation. At maturity, the bondholder receives the total face value of the bond. The predetermined maturity date and fixed face value make these bonds appealing to investors seeking a predictable lump sum return at a future date.

Attain the knowledge of how to analyse financial statements and various techniques with our Financial Management Training!

13) What are deep discount bonds?

They are also known as zero coupon bonds, and represent a unique category of debt securities that deviate from the conventional structure of bonds. These financial instruments are characterised by their issuance at a significant discount to their face value, and unlike traditional bonds, they do not make periodic interest payments.

When a company or government issues deep discount bonds, investors purchase these bonds at a fraction of their face value, and the difference between the purchase price and the face value serves as the implicit interest that accrues over the bond's life. Essentially, investors receive the return on their investment as capital appreciation as the bonds mature at total face value.

Deep discount bonds have a fixed maturity date, at which point investors receive the face value of the bond. The absence of periodic interest payments distinguishes them from regular bonds, making them attractive to investors seeking a lump sum return at a future date. Despite not generating regular interest income, investors may have tax obligations on the accrued interest each year, even though it is only received at maturity.

Investors often utilise these bonds with specific financial objectives, such as funding future educational expenses or planning for retirement.

14) Explain how you would value a company.

Valuing a company involves assessing its worth, often done through methods like Discounted Cash Flow (DCF) analysis, Comparable Company Analysis (CCA), and Precedent Transaction Analysis. DCF estimates future cash flows, discounted to present value, while CCA compares the company to similar ones in the market. Precedent Transaction Analysis looks at prices paid for comparable companies in past acquisitions. Asset-based valuation considers net asset value, and market capitalisation reflects the company's perceived value by the market. Qualitative factors, including management, industry trends, and growth prospects, are also crucial. A comprehensive valuation considers quantitative and qualitative aspects, recognising that different methods may yield varied results.

15) What is the difference between debt and equity?

Debt involves borrowing funds that must be repaid with interest over a specified period. It represents a contractual obligation and does not confer ownership rights to creditors. In contrast, equity involves selling ownership stakes in the company to investors, who become shareholders. Equity holders share in the company's profits but also bear the risks. Debt provides a fixed cost and interest obligation, while equity involves a share of profits and voting rights in decision-making. The key distinction lies in the ownership structure and financial burdens associated with each form of financing.

16) What are the different types of derivatives?

Derivatives are financial instruments with values derived from an underlying asset, index, or rate. The main types include:

1) Futures contracts obligate buying or selling at a future date.

2) Options provide the right to buy or sell at a predetermined price.

3) Swaps involve the exchange of cash flows or other financial instruments.

These instruments are used for risk management, speculation, and portfolio diversification. Derivatives play a crucial role in financial markets, allowing investors to hedge against price fluctuations, capitalise on market movements, and customise their investment strategies.

17) When should a company buy back stock?

A company may buy back its stock when it believes it will benefit shareholders and enhance overall value. Common motivations include signalling that the stock is undervalued, using excess cash efficiently, or offsetting dilution from employee stock options. Buybacks can also be tax-efficient in returning capital to shareholders compared to dividends. Repurchasing stock should align with the company's strategic goals, financial health, and growth prospects. It is often considered when the management believes the market undervalues the company's shares, presenting an opportunity to deploy funds to benefit existing shareholders.

18) Cost of debt or equity higher?

Debt represents borrowed funds with a fixed interest rate, providing a predictable cost. On the other hand, equity involves a return to shareholders through dividends and capital appreciation, often perceived as riskier by investors. Companies typically face higher financing costs with equity, as investors require a higher return to compensate for the greater risk and uncertainty associated with owning a share of the company. While debt may offer a lower cost, it also introduces obligations for interest payments and repayment, impacting the company's financial flexibility.

19) What is monetary policy?

Monetary policy refers to the activities undertaken by a country's central bank to manage its money supply and interest rates, with the overarching goal of achieving economic stability. Through tools like open market operations, reserve requirements, and interest rate adjustments, central banks influence borrowing costs, spending, and investment to achieve targeted inflation levels, employment, and overall economic stability. Monetary policy is critical in shaping a nation's economic conditions and is a key component of the broader economic policy framework.

20) What is underwriting, and what is its role?

Underwriting is a financial process where an underwriter assesses the risk of insuring or investing in securities. In the context of insurance, underwriters evaluate applicants' risks to determine policy terms and premiums. In the context of securities, underwriters guarantee the sale of newly issued stocks or bonds, assuming the financial risk of selling these securities to the public. The role of underwriting is to manage and mitigate risk, ensuring a fair balance between risk and return for insurers and investors.

21) What is venture capital?

It is a form of private equity financing provided to startup and emerging companies with high growth potential. VC invests in these early-stage businesses in exchange for an ownership stake, often taking an active role in management to help guide the company. Venture capital aims to support innovative and high-potential ventures that may face challenges securing traditional financing. This form of funding is prevalent in technology, biotech, and other sectors where rapid expansion and innovation are common. The venture capital ecosystem plays a crucial role in fostering entrepreneurship and driving economic growth by supporting the development of new and promising enterprises.

22) What do you understand by SWIFT?

SWIFT is a global messaging network that facilitates secure, standardised communication among financial institutions. Established to improve the efficiency and security of international financial transactions, SWIFT enables banks and other financial entities to exchange information such as payment instructions, trade finance documents, and securities transactions. SWIFT codes identify banks and financial institutions globally, streamlining the process of international money transfers and promoting standardised communication protocols. The network is crucial in ensuring the smooth and secure global flow of financial information.

Become familiar with investment banking firms that provide financial consulting services with our Capital Market Training!

Conclusion

This blog has outlined key Capital Market Interview Questions frequently posed by recruiters. By grasping these questions and formulating considerate responses, you can demonstrate your expertise, skills, and experience effectively to make a positive impression on the interviewer. We trust that these insights and questions assist you in excelling in your Capital Market interview and advancing in your career. Best of luck!

Understand the different Tasks within the Payroll Cycle with our Introduction To Payroll Course!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Accounting and Financial Statement Analysis Training

Accounting and Financial Statement Analysis Training

Fri 14th Jun 2024

Fri 30th Aug 2024

Fri 4th Oct 2024

Fri 8th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please