We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Bank Guarantee vs Letter of Credit: two terms you might have heard in finance. But what's the difference? Well, a Bank Guarantee is like a promise from the bank to pay if someone can't, giving confidence in various situations. Meanwhile, a Letter of Credit is crucial in global trade, making sure payments happen smoothly between buyers and sellers.

These terms might sound fancy, but understanding them is like having financial expertise. In this blog, we discuss Bank Guarantee vs Letter of Credit, their definitions and different types to help you understand the differences.

Table of Contents

1) What is Bank Guarantee?

2) Types of Bank Guarantee

3) What is a Letter of Credit?

4) Types of Letters of Credit

5) Difference between Bank Guarantee and Letter of Credit

6) Conclusion

What is Bank Guarantee?

A Bank Guarantee is a contractual arrangement wherein the bank provides assurance to the beneficiary on behalf of the customer that it will assume responsibility for payment if the customer fails to fulfil their obligations. The Bank Guarantee serves to settle the debts of the debtor, ensuring that if the borrower defaults on the loan, the lender commits to making the payment.

Types of Bank Guarantee

There are three main types of bank guarantees that are discussed below:

a) Guaranteed payment assurance: This involves an unalterable commitment where the bank disburses a specified amount to the beneficiary on the client's behalf by a designated date.

b) Shipment guarantees: A documented assurance is provided to the carrier in cases where goods arrive prior to the receipt of shipping documents.

c) Financing assurances: When an entity issues a guarantee for a loan, it commits to assuming the financial responsibility in the event of the borrower's default.

What is a Letter of Credit?

A Letter of Credit functions as a financial instrument ensuring secure payments. It represents a commitment from the purchaser's bank to remit payment to the seller based on specified documents. When a bank issues a Letter of Credit, it acts as a guarantee to compensate the seller in case the buyer is unable to fulfil the required payment.

Types of Letters of Credit

Below are the primary types of Letters of Credit:

a) Irrevocable Letter of Credit: In the form of a letter, an irrevocable letter of credit serves as a bank guarantee, creating an agreement where the buyer's bank commits to paying the seller upon meeting specific transaction conditions.

b) Confirmed Letter of Credit: An additional assurance acquired by the borrower beyond the initial letter of credit obtained from a different bank to address concerns about the credibility of the first issuing bank.

c) Import Letter of Credit: Issued by the importer's bank on behalf of the importer and designating the exporter as the beneficiary, this type of Letter of Credit provides a guarantee that payment will be made to the seller/exporter.

d) Export Letter of Credit: When received by the exporter's bank, it is transformed into an export Letter of Credit. This indicates that the exporter will receive payment upon fulfilling specific terms, conditions, and providing the required documentation.

e) Revolving Letter of Credit: A single revolving letter of credit can encompass multiple transactions between the same buyer and seller, streamlining the process for ongoing business interactions.

Improve your financial acumen with our Accounting and Finance Training Courses for a brighter career ahead! Sign up now!

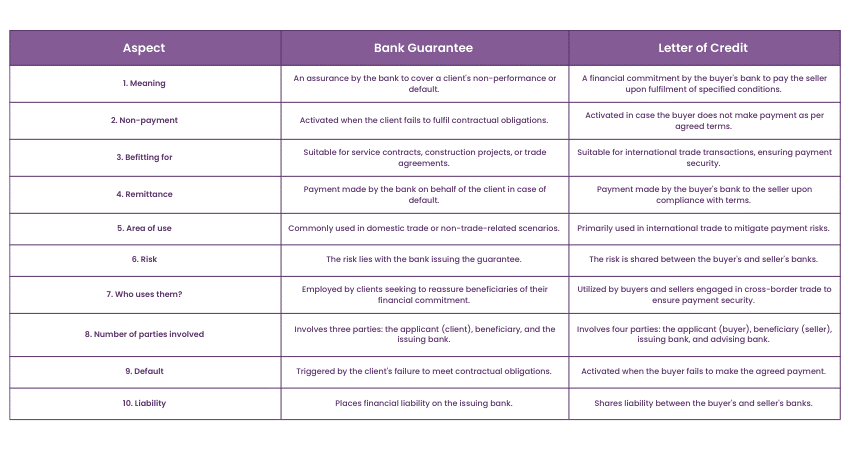

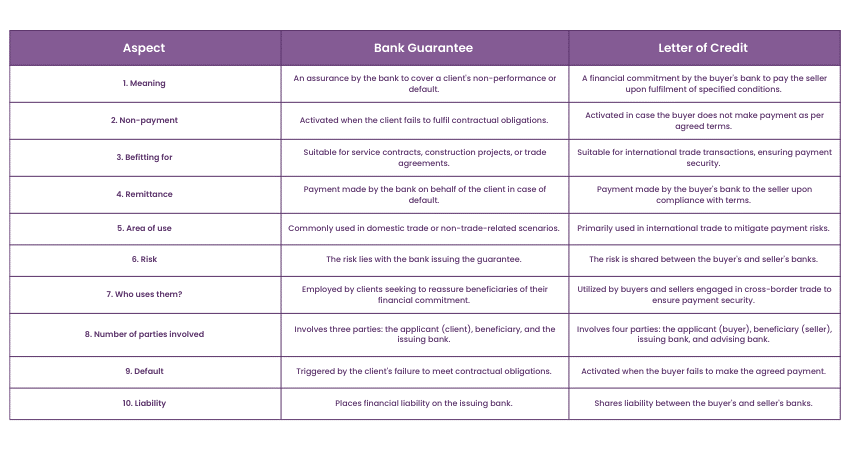

Difference between Bank Guarantee and Letter of Credit

Meaning

Bank Guarantee involves a bank providing assurance to cover a client's non-performance or default, creating a commitment where the bank agrees to pay on behalf of the client if certain contractual obligations are not met. In contrast, a Letter of Credit is a financial commitment issued by the buyer's bank, ensuring payment to the seller upon fulfilling specified conditions.

Non-payment

A Bank Guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. Conversely, a Letter of Credit is triggered if the buyer does not adhere to agreed-upon payment terms, leading the buyer's bank to pay the seller.

Befitting for

Bank guarantees are suitable for various scenarios, such as service contracts, construction projects, or any situation where a client needs to reassure beneficiaries of their financial commitment. Letters of Credit are primarily used in international trade transactions to ensure payment security between buyers and sellers.

Remittance

In Bank Guarantees, the bank makes the payment on behalf of the client when default occurs. With Letters of Credit, the buyer's bank pays the seller upon compliance with specified terms and conditions.

Enhance your financial expertise with our Accounting Masterclass for a confident stride in your career journey. Sign up now!

Area of use

Bank Guarantees are commonly employed in domestic trade or non-trade-related contexts where financial commitments need assurance. Letters of Credit are extensively used in international trade to mitigate payment risks associated with cross-border transactions.

Risk

The risk in Bank Guarantees primarily lies with the bank issuing the guarantee, which assumes the responsibility for payment in case of default by the client. In Letters of Credit, the risk is shared between the buyer's and seller's banks, each having specific obligations to fulfil.

Who uses them?

Bank Guarantees are utilised by clients seeking to provide reassurance to beneficiaries regarding their financial capability to meet obligations. Letters of Credit are commonly employed by buyers and sellers engaged in cross-border trade to ensure a secure and guaranteed method of payment.

Number of parties involved

Bank Guarantees typically involve three parties:

a) The applicant (client)

b) Beneficiary (who receives the guarantee)

c) The issuing bank (which provides the guarantee)

Letters of Credit, in contrast, involve four parties:

a) The applicant (buyer)

b) Beneficiary (seller)

c) Issuing bank (buyer's bank)

d) Advising bank (seller's bank)

Default

Activating a Bank Guarantee occurs when the client fails to fulfil contractual obligations, leading to the bank making the necessary payment. On the other hand, a Letter of Credit is triggered when the buyer fails to make the agreed-upon payment, prompting the buyer's bank to execute the payment on their behalf.

Liability

In the case of Bank Guarantee, the financial liability primarily rests with the issuing bank, as it commits to making the payment in case of default by the client. In Letters of Credit, the liability is shared between the buyer's and seller's banks, with each having specific responsibilities in the transaction.

Conclusion

In conclusion, the comparison between Bank Guarantee vs Letter of Credit underscores their distinctive roles in facilitating secure financial transactions. Bank Guarantee serves as a commitment from the bank to cover a client's default, providing assurance to beneficiaries, particularly in domestic scenarios. On the other hand, a Letter of Credit plays a pivotal role in international trade, ensuring a guaranteed payment mechanism between buyers and sellers, with shared liabilities between the respective banks.

Unlock the complexities of Letters of Credit with our The Letters Of Credit Training Course for enhanced proficiency in accounting and finance!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

The Letters of Credit Training Course

The Letters of Credit Training Course

Fri 26th Jul 2024

Fri 27th Sep 2024

Fri 8th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please