We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The world of banking has changed drastically over the past few decades. Technology has revolutionised the way we access our finances, making it easier than ever to manage our money on the go. The advent of Artificial Intelligence (AI) in Banking has unlocked windows for many business giants like Standard Chartered, ZestMoney, Pine Labs, etc., making it easier for traditional financial institutions to offer banking services more efficiently and securely.

AI has allowed Fintech to move beyond simply replacing manual processes, to offering automated services that take advantage of data-driven insights and is expected to grow at 24.05% CAGR in the next five years as per the reports by Mordor Intelligence. For example, AI can detect and prevent fraud, improve customer experience through personalised product recommendations, and automate financial processes.

AI-driven Fintech solutions are also helping financial institutions to better manage risk. By using AI to identify patterns in customer data, institutions can detect potential fraud and tailor their risk-management strategies to each customer.

In this blog, we will discuss about the significance and the various ways Artificial Intelligence (AI) has changed and redefined the banking or the finance industry since its inception.

Table of Contents

1) Understanding AI in banking

a) Definition of AI and its core components.

b) The significance of AI in the banking sector

c) Benefits of AI adoption

d) Challenges associated with AI adoption

2) AI applications in Banking

a) Fraud detection and prevention

b) Risk assessment and management

c) Process automation and efficiency

3) AI implementation strategies

a) Building an AI infrastructure

b) Collaborations and partnerships

c) Regulatory and ethical considerations

4) Conclusion

Understanding AI in banking

As a powerful tool for understanding and predicting customer behaviours, AI is one of the most important tools available to the banking industry today. Since AI-based solutions are used to identify patterns in customer data, which undoubtedly gives it an ancillary edge to the organisations, such as spending habits and preferences, and to predict customer behaviour and make decisions based on those predictions.

The adoption of Artificial Intelligence in Banking eventually brings forth the power of advanced analytics to automate processes like customer service, fraud detection, and risk management.

Definition of AI and its core components

In its simplest forms, the combination of computer science and potent datasets to enable problem-oriented solutions defines the term Artificial Intelligence. It environs various applications and use cases to enhance efficiency, accuracy, and customer experience within the banking industry. Some of its core components are machine learning, Natural Language Processing (NLP), computer vision, neural networks, expert systems, robotics and much more.

The significance of AI in the banking sector

Recently it has been evident how AI has changed the entire course of the banking industry, from significant cost and risk reduction and improved customer experience to enhanced fraud detection and regulatory compliance.

Earlier, it used to be difficult to detect fraudsters, but due to the use of AI-driven algorithms now, it has become a lot easier to detect suspicious transactions and patterns of behaviour. AI-driven analytics is also helping banks to understand customer preferences and trends better, allowing them to anticipate customer needs and provide more personalised services

Benefits of AI adoption

Adopting AI has many advantages, ranging from improved accuracy to cost savings. AI technology can assist employees in concentrating on more important work, allowing them to work more freely and automating tedious duties. Additionally, AI can be a useful tool for companies to learn more about the wants and preferences of their clients.

Challenges associated with AI adoption

Though the advantages are numerous with the implementation of Artificial Intelligence in Banking, there are specific challenges associated with it. These challenges include the lack of qualified personnel, the cost of hardware and software investments, and the difficulty of integrating AI solutions into existing systems.

Improve your skillset in Artificial Intelligence (AI) with our Artificial Intelligence & Machine Learning Courses today!

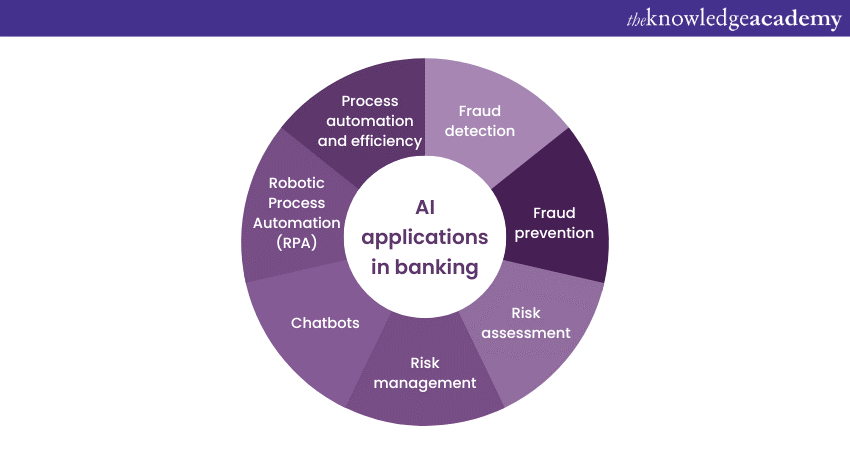

AI applications in banking

As AI is now an integral part of the business and the non-business world, banks are implementing it into their products and services. Some of the primary AI applications used in the banking industry today are - cybersecurity and fraud detection, chatbots, tracking market trends, data collection and analysis, loan and credit decisions, risk management, regulatory compliance, predictive analysis and more. Let's discuss these in detail.

Fraud detection and prevention

Numerous online transactions go about in the market daily, like billings, withdrawals, money deposits, check deposits, etc. This is why it demands a robust system to detect fraud and minimise or cease the risks to a greater level. That's when Artificial Intelligence comes into the picture. AI is developed with algorithms to detect loopholes and security issues, improving the security of digital finance. In addition to this, the process becomes swifter with the help of machine learning.

Risk assessment and management

The banking and financial sectors are significantly impacted by external global variables such as exchange rate fluctuations, natural disasters, and political upheaval. Making business decisions with extra caution is essential in such uncertain times. AI-driven analytics can provide a pretty accurate forecast of future events, assisting you in being organised and making timely decisions.

AI also assists in identifying hazardous applications by calculating the likelihood that a client will default on a loan. It forecasts this future behaviour by examining historical behavioural patterns and smartphone data.

Process automation and efficiency

By automating time-consuming, repetitive processes, algorithms like Robotic Process Automation (RPA) boost or enhance these processes' operational efficiency and accuracy while lowering expenses. Users can now concentrate on more complex tasks that require human interaction.

Nowadays, RPA successfully helps banking organisations speed up transactions and improve efficiency. For instance, CoiN technology from JPMorgan Chase examines documents and extracts data from them faster than people can.

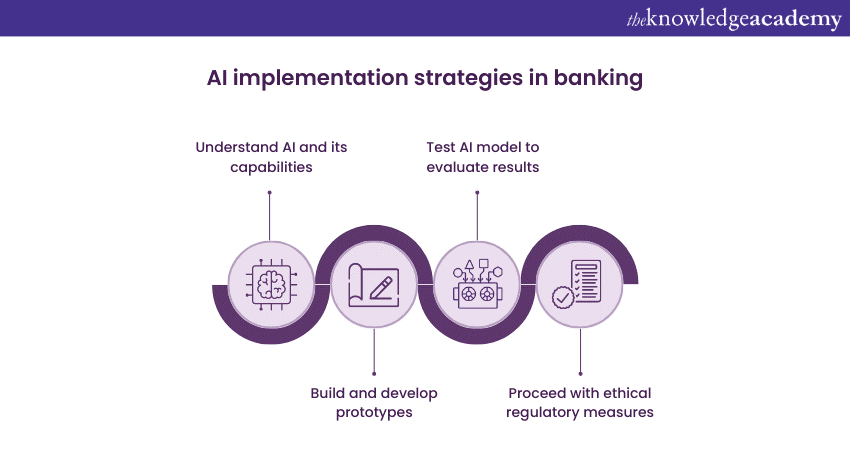

AI implementation strategies

Let’s discuss some of the proven steps banks should take to adopt AI implementation strategies on a broader scale while giving the four crucial components — people, governance, process, and technology — the attention they require.

Building an AI infrastructure

At first, banks must create prototypes to comprehend the limitations of the technology before creating full-fledged AI systems. Banks must gather pertinent data and submit it to the algorithm to test the prototypes. The data must be accurate because the AI model learns and develops from it.

Later, banks must test the AI model to evaluate the results after training. The development team will benefit from a trial like this to better understand how the model will function.

While focusing on the organisation's goals, objectives and beliefs, they should strategise the AI implementation process. Internal market research is essential to identify areas where people and processes are lacking. Ensure that the AI plan conforms with all applicable rules and laws. Banks can assess the existing global industry norms as well.

To successfully implement Ai in banks, the internal practices and policies relating to people, data, infrastructure, and algorithms must be refined as the last step in forming an AI strategy.

Collaborations and partnership

As the banking industry continues to evolve, collaborations and partnerships, including those involving AI, are becoming increasingly vital. AI is revolutionising the banking business in numerous ways, and organisations are forging strategic alliances to take full advantage of the potential that AI offers.

One of the most noteworthy partnerships involving AI in banking is between JPMorgan Chase and Microsoft. The two businesses are partnering to develop AI solutions to help the bank better manage its operations and customer experience. Microsoft is supplying the underlying technology, and JPMorgan Chase is leveraging its financial services and banking expertise to guarantee that the solutions are suited to their specific needs.

Regulatory and ethical considerations

Using AI through regulatory and ethical measures is always the right first step when implementing it into your banking systems. However, there is a certain set of standards banks should follow or consider.

First and foremost, always ensure the information derived from the customers is used and treated properly by applying certain limitations, is protected at all costs, and cannot be accessed by third parties.

Secondly, be constantly transparent about its use. Customers are more inclined towards an organisation when the company is upfront and honest in their methods.

And lastly, try to incorporate diversity and inclusivity by collecting a varied class of people from distinct backgrounds and having specific skills and experiences, which will help ensure that your models run correctly and are not based on human biases and chauvinism.

Enhance your understanding of the concept of robotics. Sign up for our Introduction To Artificial Intelligence Training Course now!

Conclusion

In addition to empowering banks by automating their knowledge workers, AI will make the entire automation process smart enough to eliminate cybersecurity issues and competition from FinTech competitors. Frontrunners in the banking industry have already adopted Artificial Intelligence in Banking and acted responsibly to gain these advantages.

Master the practical and theoretical concepts of SVM and SVR with our industry-relevant Machine Learning Training Course now!

Frequently Asked Questions

Upcoming Data, Analytics & AI Resources Batches & Dates

Date

Introduction to AI Course

Introduction to AI Course

Fri 2nd Aug 2024

Fri 15th Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please