Get a custom course package

We may not have any package deals available including this course. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we should be able to help you with your requirements.

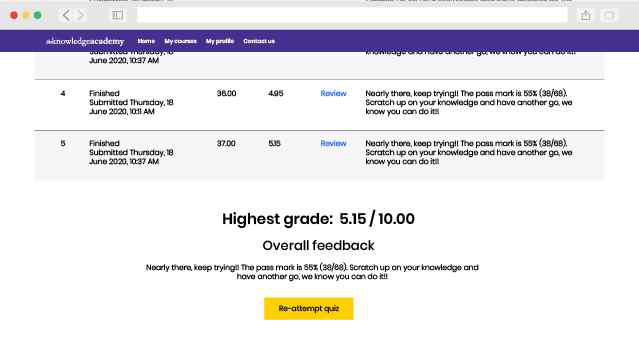

Module 1: Introduction to Payroll

Module 2: Payroll Obligations and Requirements

Module 3: Payroll Cycle

Module 4: PAYE

Module 5: Tax Codes and Tables

Module 6: Statutory Sick Pay

Module 7: Statutory Maternity

Module 8: Pensions and Student Loans

Module 9: Student Loans

Module 10: Reports and Record Keeping

This Payroll Training Course is designed for individuals seeking to develop their understanding in the fundamentals of Payroll. This course will benefit a wide range of professionals, including:

There are no formal prerequisites to attend this Payroll Training Course.

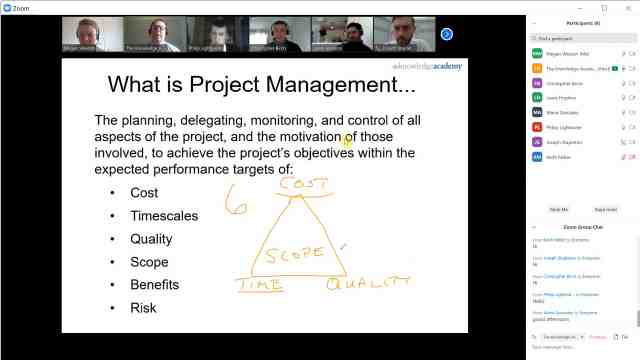

This Payroll Course offers an essential overview of payroll management, which is a critical aspect of business operations. This course covers the basics of calculating wages, managing employee records, understanding legal compliance, and processing payroll taxes and deductions. It is designed to equip learners with the foundational knowledge required to effectively manage and oversee the payroll function in a business.

The benefits of a Payroll Course extend beyond mere operational knowledge. Firstly, it empowers individuals with the skills necessary for accurate and efficient payroll processing, which is vital for employee satisfaction and legal compliance. Secondly, the course enhances one’s understanding of financial principles related to payroll, such as tax implications and budgeting for salaries.

The Knowledge Academy's Payroll Course offers specific benefits that are instrumental for career growth and development in the field of human resources and finance. Delegates gain practical skills that are immediately applicable in the workplace, enhancing their job prospects and professional credibility. This course is particularly beneficial for those aspiring to roles in HR, accounting, or small business management, as it provides a solid foundation in a key area of business operations.

Course Objectives

The Payroll Course aims to equip learners with both theoretical and practical insights into payroll management. It is designed to provide a thorough understanding of the complexities involved in payroll processing, legal compliance, and the use of modern technology, thus preparing delegates for effective and efficient payroll administration in various business settings.

Why choose us

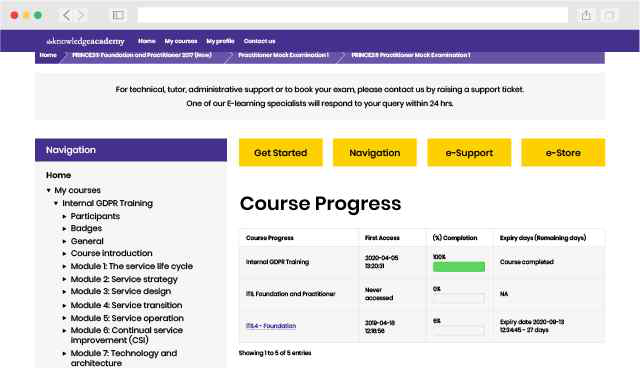

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led Payroll Course. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's Payroll Course, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

Experience the most sought-after learning style with The Knowledge Academy's Payroll Course. Available in 490+ locations across 190+ countries, our hand-picked Classroom venues offer an invaluable human touch. Immerse yourself in a comprehensive, interactive experience with our expert-led Payroll Course sessions.

Boost your skills with our expert trainers, boasting 10+ years of real-world experience, ensuring an engaging and informative training experience

We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction-free as possible

Our Classroom courses with limited class sizes foster discussions and provide a personalised, interactive learning environment

Achieve certification without breaking the bank. Find a lower price elsewhere? We'll match it to guarantee you the best value

Streamline large-scale training requirements with The Knowledge Academy’s In-house/Onsite Payroll Course at your business premises. Experience expert-led classroom learning from the comfort of your workplace and engage professional development.

Leverage benefits offered from a certification that fits your unique business or project needs

Cut unnecessary costs and focus your entire budget on what really matters, the training.

Our Payroll Course offers a unique chance for your team to bond and engage in discussions, enriching the learning experience beyond traditional classroom settings

The course know-how will help you track and evaluate your employees' progression and performance with relative ease

She was really good.

Nikita was very helpful and friendly

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information