Boston is the capital city of the state of Massachusetts, USA. It has an estimated population of 655,000 people, making it the 24th largest city in America. Boston is one of the oldest cities in America and was the battle ground for many key events in the American Revolution, such as the Boston Tea Party and the Battle of Bunker Hill.

Education in the USA is provided by both public and private schools, and is mandatory until the age of 16. Pupils conducting their schooling within the USA start off at preschool, followed by elementary school, then middle school, before finishing at high school. At age 18, US citizens are able to engage in higher education. Higher education in the USA normally comes in the form of a college, undergraduate school, or a community college – that latter of which doesn’t normally cost anything to attend. Candidates participating in a course at a college will gain credits towards a bachelor’s degree, whilst candidates participating a course at a community college will be earning credits in order to achieve an associate’s degree.

Boston was home to Americas first public school, Boston Latin School. Boston also operates the United States' second oldest public high school, and its oldest public elementary school.

Boston is considered to be an international area of higher education and medicine. Some of the most famous universities in America and indeed the world are located in Boston. It is the home of both Harvard and MIT (Massachusetts Institute of Technology). These are the top two universities in the world. Universities, research institutes and hospitals receive more funding in Boston than any other are in America. In 2013 they received around $1.8 billion.

Harvard was established in 1636 and is a private Ivy League research university. It is the United States oldest institute of higher education. Harvard has had eight United States presidents graduate from the university. This includes current U.S president Barack Obama.

At The Knowledge Academy we offer over 50,000 classroom based training courses in the United States, including popular locations such as Boston.

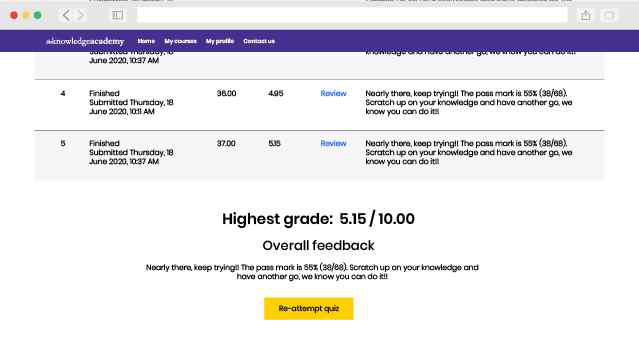

Back to course information

Back to course information

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please