Baltimore, a city in the state of Maryland, has a current population that totals an average of roughly 621,000 spread across 92.1 square miles of land. At The Knowledge Academy we offer over 50,000 classroom based training courses in Baltimore, in order to enhance people’s learning in an array of subject areas. Education in the USA is provided by both public and private schools, and is mandatory until the age of 16. Pupils conducting their schooling within the USA start off at preschool, followed by elementary school, then middle school, before finishing at high school. At age 18, US citizens are able to engage in higher education. Higher education in the USA normally comes in the form of a college, undergraduate school, or a community college – that latter of which doesn’t normally cost anything to attend. Candidates participating in a course at a college will gain credits towards a bachelor’s degree, whilst candidates participating a course at a community college will be earning credits in order to achieve an associate’s degree.

Free Wi-Fi

To make sure you’re always connected we offer completely free and easy to access wi-fi.

Back to course information

Back to course information

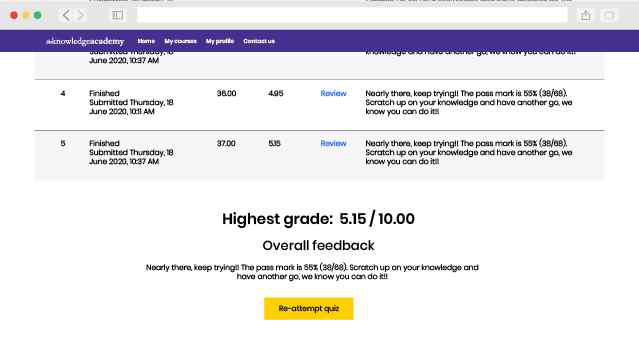

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please