MoR® 4 Practitioner Risk Management Certification Overview

MoR® 4 Practitioner Risk Management Certification Outline

This four-day MoR practitioner course will teach the following:

Unit 1: Understand the Purpose & Principles of Risk Management

Module 1: Describe Risk, Risk Management and Why Risk Management it is Used, Including the Difference and Relationship Between Risks and Issues

- What is Risk and Risk Management?

- Why Use Risk Management?

Module 2: Describe How Risk Management Supports Corporate Governance and Enterprise Risk Management, and Describe the Relationship Between them

- Corporate Governance and Enterprise Risk Management

Module 3: Explain the Different Risk Management Challenges that a Product Orientated Organisation Faces

- Challenges of Applying Risk Management

Module 4: Assess How Risk Management is Affected by Functional Orientated and Product Orientated Organisations

- Functional- and Product-Oriented Operating Models

Module 5: Describe the Purpose of Principles and Why they need to be Applied in Risk Management

- Overview of the M_o_R®4 Principles

Module 6: Apply and Analyse the Principles

- Aligns with Objectives

- Fits the Context

- Engages Stakeholders

- Provides Clear Guidance

- Informs Decision-Making

- Facilitates Continual Improvement

- Creates a Supportive Culture

- Achieves Measurable Value

Unit 2: Understand How Risk Management Applies within the 6 Perspectives

Module 1: Explain the Purpose of Risk Management in Each of the 6 Perspectives

- Purpose of Risk Management in the Strategic Perspective

- Purpose of Risk Management in the Portfolio Perspective

- Purpose of Risk Management in the Programme Perspective

- Purpose of Risk Management in the Project Perspective

- Purpose of Risk Management in the Product Perspective

- Purpose of Risk Management in the Operational Perspective

Module 2: Explain How and Why the Perspectives are Integrated

- Integrating Risk Management Across the M_o_R®4 Perspectives

- Overview of M_o_R®4 Perspectives

- Escalation and Delegation

- Aggregation

Module 3: Analyse the Calibration of Qualitative Scales Across Perspectives

- Calibration of Qualitative Scales

Module 4: Apply the ‘Strategic’ Perspective and its Related Practices and Controls, including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Strategic Perspective

- Related Practices and Controls in the Strategic Perspective

Module 5: Apply the ‘Portfolio’ Perspective and its Related Practices and Controls, including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Portfolio Perspective

- Related Practices and Controls in the Portfolio Perspective

Module 6: Apply the ‘Programme’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Programme Perspective

- Related Practices and Controls in the Programme Perspective

Module 7(a): Apply the ‘Project’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Project Perspective

- Related Practices and Controls in the Project Perspective

Module 7(b): Describe How Risk Management is Influenced by Different Modes of Delivery

- Linear/Sequential Project Delivery Mode

- Iterative/Agile Project Delivery Mode

- Hybrid Project Delivery Mode

- Continual Improvement

Module 8: Apply the ‘Product’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Product Perspective

- Related Practices and Controls in the Product Perspective

Module 9: Apply the ‘Operational’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

- Typical Roles in the Operational Perspective

- Related Practices and Controls in the Operational Perspective

Unit 3: Understand How People and Culture Influence Effective Risk Management

Module 1: Describe Why and How People and/or Cultural Considerations Influence Risk Management

- Overview of People Considerations

Module 2(a): How Engaging Stakeholders Ensures Effective Risk Management

- Engaging Stakeholders

Module 2(b): How to Address Decision Biases

- Working with Decision Bias

Module 2(c): How Individual Competence Creates and Combats Bias in Risk-Based Decision-Making

- Building Individual Competence

Module 3: Analyse How the Aspects of Risk Culture Influence Effective Risk Management

- Shaping a Supportive Risk Culture

Module 4: Assess How to Establish or Contribute to the Right Risk Culture

- Overcoming Common Challenges in Application

Unit 4: How to apply the 8 Processes of Risk Management

Module 1: Describe the Purpose and Objectives of Each Process

- Define Context and Objectives

- Identify Threats and Opportunities

- Prioritise Risks

- Assess Combined Risk Profile

- Plan Responses

- Agree Contingency

- Monitor and Report Progress

- Review and Adapt

Module 2: Apply the ‘Define the Context and Objectives’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 3: Apply the ‘Identify Threats and Opportunities’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 4: Apply the ‘Prioritise Risks’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 5: Apply the ‘Assess Combined Risk Profile’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 6: Apply the ‘Plan Responses’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 7: Apply the ‘Agree Contingency’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 8: Apply the ‘Monitor and Report Progress’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Module 9: Apply the ‘Review and Adapt’ Process, Demonstrating an Understanding

- Activities

- Techniques

- Documents to Support the Process

- Focus of Key Roles for the Process

Who should attend this MoR® 4 Practitioner Risk Management Certification Course?

The MoR® (Management of Risk) Practitioner Risk Management Certification is designed for professionals who are involved in or responsible for managing risks within organisations. This certification is particularly beneficial for:

- Project Managers

- Risk Managers

- Business Analysts

- Compliance Officers

- Finance Professionals

- Operations Managers

- IT Managers

- Change Managers

- Government Officials

- Quality Assurance Professionals

Prerequisites of the MoR® 4 Practitioner Risk Management Certification Course

There are no formal prerequisites for attending this MoR® 4 Practitioner Risk Management Certification.

MoR® 4 Practitioner Risk Management Certification Overview

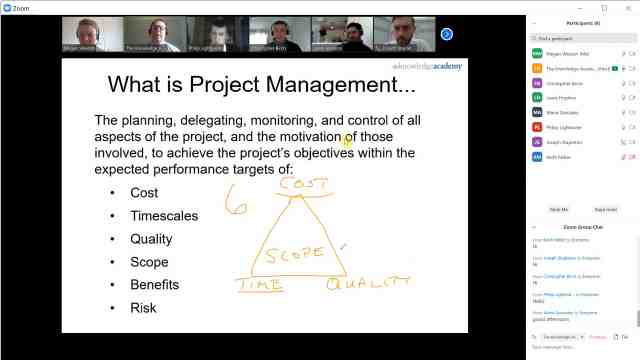

Risk management is the process of discovering, assessing, and controlling threats to an organisation's capital and revenues. Explore the art of risk management with our MoR® 4 Practitioner Certification, delving into the intricacies of risk assessment and mitigation. Understand its relevance across industries and how effective risk management can bolster organisational resilience.

Mastering this course is crucial for professionals seeking to navigate uncertainties in today's dynamic business landscape. Taking this training will be essential for organisations to increase the chances of success for change initiatives. This course caters to Project Managers, risk professionals, and decision-makers, ensuring they can adeptly handle challenges and safeguard organisational goals.

The 4-day MoR® Practitioner Certification by the Knowledge Academy equips delegates with practical skills to identify, assess, and control risks effectively. They will also understand how to enable the aggregation and escalation of risks explicitly at the strategic level. This course offers a comprehensive understanding of the MoR® framework, preparing participants for the examination.

Course Objectives:

- To establish a simple process and associated vocabulary of terms.

- To learn the purpose of risk management from the portfolio perspective.

- To understand the outcome of satisfying the principle of engaging stakeholders.

- To add value to and achieve the entire organisation's objectives.

- To provide expert support to operational managers and leaders.

- To recognise people's perceptions as a significant factor for success.

Upon completion of this MoR® Practitioner Training Course, delegates will be able to engages stakeholders in an inclusive and collaborative way. They will also be able to manage structured approach to managing risk that can be tailored to the specific context.

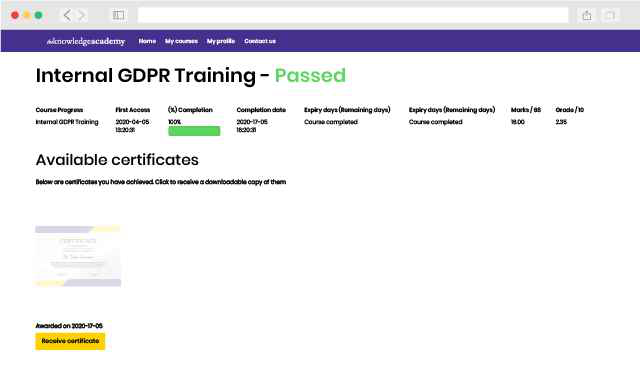

What's included in this MoR® 4 Practitioner Risk Management Certification Course?

- Mor® Practitioner Examination

- World-Class Training Sessions from Experienced Instructors

- Mor® 4 Practitioner Risk Management Certificate

- Digital Delegate Pack

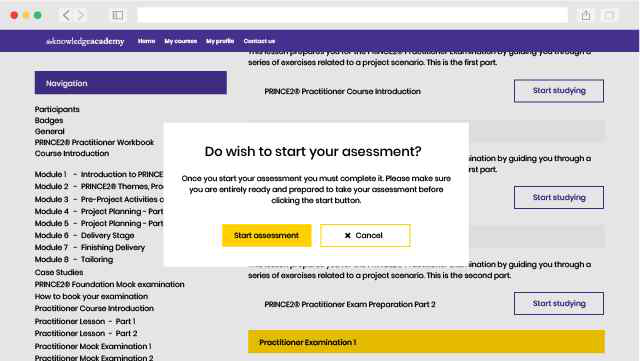

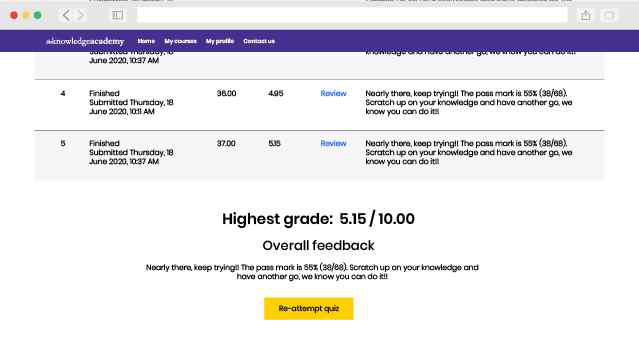

MoR® 4 Practitioner Risk Managment Certification Exam Information

The MoR® 4 Practitioner Risk Management exam is a professional certification exam that tests your knowledge and understanding of the MoR® methodology. It is designed for anyone who wants to demonstrate their expertise in using MoR® to manage organisational change. The following information showcases the structure of the MoR® 4 Practitioner Risk Management.

- Question Type: Objective Testing

- Total Questions: 65

- Total Marks: 65 Marks

- Pass Mark: 50%, 33/65 Marks

- Duration: 2 Hours and 15 Minutes

- Open Book/ Closed Book: Open Book

Why choose us

Ways to take this course

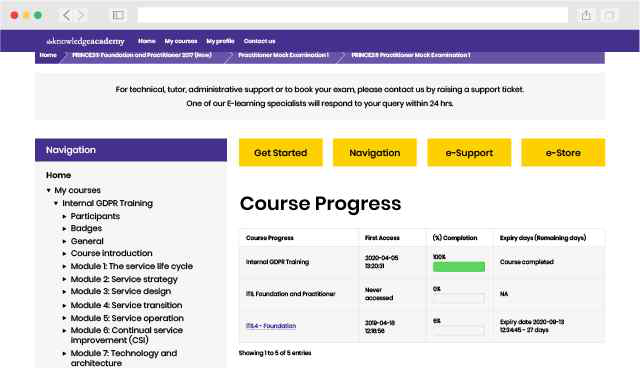

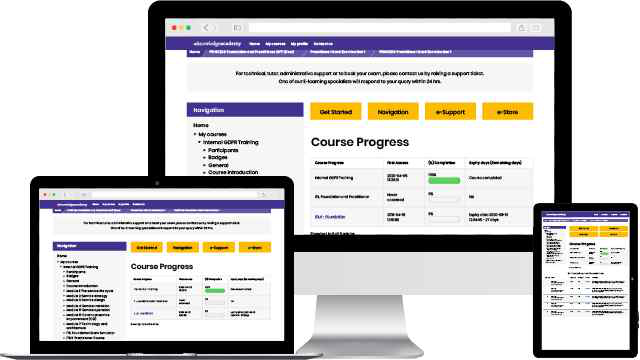

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led MoR® 4 Practitioner Risk Management Certification. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's MoR® 4 Practitioner Risk Management Certification, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

What our customers are saying

Pradeep D is a brilliant trainer - really friendly and approachable. Explained the course content and went through the course material with clear explanation and examples. Really knowledgeable about the course and was able to answer any questions asked. He gave guidance for revision / exam preparation and explained the exam structure and the people cert portal. I thoroughly enjoyed the course - Thank you Pradeep D!

Krupa Hema Patel

Ok

Elizabeth Jane Pergande

Warren is very knowledgeable and approachable. He took time to make sure all attendees understood each section and gave reassurance when it was needed.

Rebecca Parker

MoR® 4 Practitioner Risk Management Certification FAQs

Why choose us

Best price in the industry

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Trusted & Approved

The Knowledge Academy's M_o_R® courses are fully accredited by PeopleCert, on behalf of AXELOS.

Many delivery methods

Flexible delivery methods are available depending on your learning style.

High quality resources

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

MoR® 4 Practitioner Risk Management Certification in United States

Atlanta

Atlanta New York

New York Houston

Houston Dallas

Dallas Denver

Denver Seattle

Seattle Los Angeles

Los Angeles Chicago

Chicago San Francisco

San Francisco Philadelphia

Philadelphia San Diego

San Diego Phoenix

Phoenix Boston

Boston Austin

Austin Detroit

Detroit San Jose

San Jose Tampa

Tampa Colorado Springs

Colorado Springs Portland

Portland Sacramento

Sacramento Minneapolis

Minneapolis San Antonio

San Antonio Irvine

Irvine Las Vegas

Las Vegas Miami

Miami Bellevue

Bellevue Pittsburgh

Pittsburgh Baltimore

Baltimore Fairfax

Fairfax Orlando

Orlando Raleigh

Raleigh Salt Lake City

Salt Lake City Columbus

Columbus Oklahoma City

Oklahoma City Nashville

Nashville Charleston

Charleston Columbia

Columbia Cleveland

Cleveland Cincinnati

Cincinnati Memphis

Memphis Richmond

Richmond Virginia Beach

Virginia Beach Louisville

Louisville Fort Lauderdale

Fort Lauderdale Indianapolis

Indianapolis Des Moines

Des Moines Grand Rapids

Grand Rapids New Orleans

New Orleans Wichita

Wichita Charlotte

Charlotte Hartford

Hartford New Jersey

New Jersey Anchorage

Anchorage Omaha

Omaha Honolulu

Honolulu Albuquerque

Albuquerque Baton Rouge

Baton Rouge Iowa City

Iowa City Albany, NY

Albany, NY Boise

Boise Milwaukee

Milwaukee Tucson

Tucson Kansas City

Kansas City St Louis

St Louis Jacksonville

Jacksonville

Back to course information

Back to course information

Complete Risk Management Certification

Save upto 40%Included courses:

MoR® 4 Practitioner Risk Management Certification$6995

Certified in Risk and Information Systems Control (CRISC)$4395

Total without package: $14285

Package price: $8595 (Save $5690)

AXELOS ProPath Project Expert

Save upto 35%Included courses:

PRINCE2® Foundation & Practitioner Training Course$5995

Total without package: $18985

Package price: $12395 (Save $6590)

AXELOS ProPath Agile Project Expert

Save upto 40%Included courses:

MSP® Foundation & Practitioner$5995

Total without package: $18985

Package price: $11395 (Save $7590)

Limited budget?

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please