BCS Foundation Certificate in Organisational Behaviour Overview

BCS Foundation Certificate in Organizational Behavior Course Outline

Module 1: Organizational Principles

- Explain Delivering Value

- Competitive Advantage – Porter’s Five Forces

- Value Proposition

- Value Stream Analysis (Not LEAN)

- Explain Organization Structuring

- Elements of Organization Structure

- The Six Structure Levels

- The Leavitt Diamond

- Explain Budgets and Departmentalized Businesses

- The Purpose of Budgets

- Reasons for Departmentalization

- Cost Centers and Profit Centers

- Describe Types of Jobs

- Work Specialization

- Flat and Tall Hierarchies

- Span of Control

- Describe Line Management, Staff and Functional Relationships

- Explain Formalization of Rules and Procedures

- Explain Centralization Vs Decentralization

- Advantages

- Disadvantages

Module 2. Operating Models

- Explain Organization Structures and Their Characteristics

- Functional

- Divisional – Product or Service/ Geography/ Customer

- Matrix

- Team-Based – Cross Functional/ Project

- Recognize Organizational Boundaries

- Boundaryless Organizations

- Outsourcing

- Offshoring

- Hollow Organization Structures

- Modular Organization Structures

- Virtual Organizations

- Collaborations and Strategic Alliances

- Agile Organizations

Module 3: Organizational Motivation, Behavior and Culture

- Explain Organizational Motivation (Object Management Group (OMG) Business Motivation Model)

- Describe The Organizational Behavior Field Map.

- Explain Organizational Effectiveness and The Balanced Scorecard.

- Describe Understanding and Analyzing Culture

- Organizational Cultural Types

- Deal and Kennedy Model of Corporate Culture

- Handy’s Model of Organizational Culture

- Strong, Weak and Appropriate Cultures

- Groysberg’s Internal and External Company Factors

- National Cultures

- Brooks Factors Affecting National Culture

- Hofstede Five Dimensions of National Culture

- The Cultural Web

Module 4: Group Formation

- Overview of Groups

- Characteristics of Group

- Group Dynamics

- Types of Group Tasks

- Formal and Informal Organization

- Social Networks of Informal Groups

- Homan’s Theory of Group Formation

- Tuckman and Jensen’s Theory of Group Development

Module 5. Principles of Financial Reporting

- Finance Fundamentals

- Key Financial Terms

- Financial Reports

- Statement of Financial Position

- Income Statement

- Cash Flow

- Costing and Pricing

- Types of Cost

- Break Even and Contribution Analysis

Module 6. Project Finance

- Financial Case

- Costs and Benefits

- Benefits Categories

- Investment and Appraisal Techniques

Who should attend this BCS Foundation Certificate in Organizational Behavior Course?

The BCS Foundation Certificate in Organizational Behavior Course is a part of our wide range of Business Analysis Courses in the United States provides a foundational understanding of organizational behavior, benefiting professionals seeking to gain insights into human behavior within an organizational context. This Business Analysis Certification Course is beneficial for a diverse range of professionals, including:

- Managers and Team Leaders

- Human Resources Professionals

- Business Analysts

- Project Managers

- Consultants and Trainers

- Change Management Professionals

Prerequisites of the BCS Foundation Certificate in Organizational Behavior Course

There are no formal prerequisites for attending the BCS Foundation Certificate in Organizational Behavior Course. However, a basic understanding of organizational structures and business operations can be advantageous for pursuing this Business Analysis Course.

BCS Foundation Certificate in Organizational Behavior Course Overview

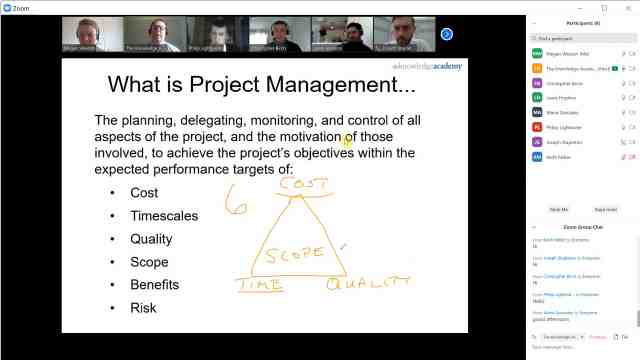

In today's dynamic business landscape, proficiency in Organizational Behavior (OB) holds immense significance. OB Course in the United States encompasses the study of human behavior within organizational settings, the intricate relationship between individual behavior and organizations, and the organizations themselves. OB Researchers delve into how individuals behave within their roles in various organizational contexts.

Proficiency in organizational behavior is essential for various professionals, including Project Managers, Business Analysts, HR Professionals, and managers at all levels. This Business Analysis Certification in the United States covers essential topics such as organizational design, operating models, individual and group performance, and the foundational principles governing culture and behavior within organizational contexts.

This intensive 2-day Business Analysis Course in the United States is designed to provide delegates with the knowledge and skills necessary to navigate and excel in today's complex organizational environments. Delegates will be will equipped with the expertise needed to thrive in the realm of Business Analysis and organizational management.

Course Objectives

- To provide delegates with a foundational understanding of key concepts in Organizational Behavior

- To explore the intricacies of organizational design and operating models

- To enable delegates to analyze and enhance individual and group performance within organizations

- To impart knowledge of the fundamental principles governing culture and behavior in organizational contexts

- To prepare delegates for the BCS Foundation Certificate in Organizational Behavior exam

- To equip professionals with the skills needed to contribute effectively to organizational success through insightful analysis and informed decision-making

Upon completing this Business Analysis Course, delegates in the United States will possess a solid foundation in Organizational Behavior, enabling them to contribute more effectively to their organizations by understanding and influencing the complex dynamics of workplace behavior and culture.

What’s included in the BCS Foundation Certificate in Organizational Behavior Course?

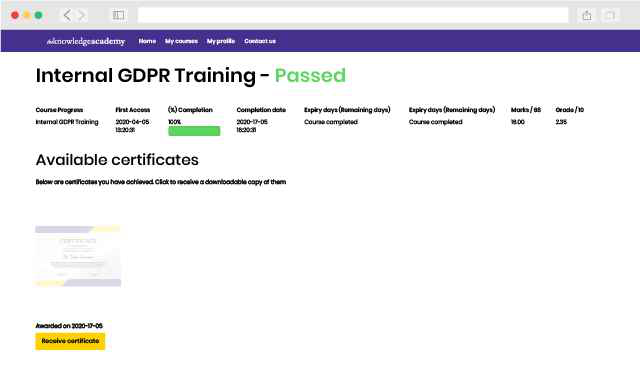

- BCS Foundation Certificate in Organizational Behavior Examination

- World-class training sessions from Experienced Instructors

- BCS Foundation Certificate in Organizational Behavior Certificate

- Digital Delegate Pack

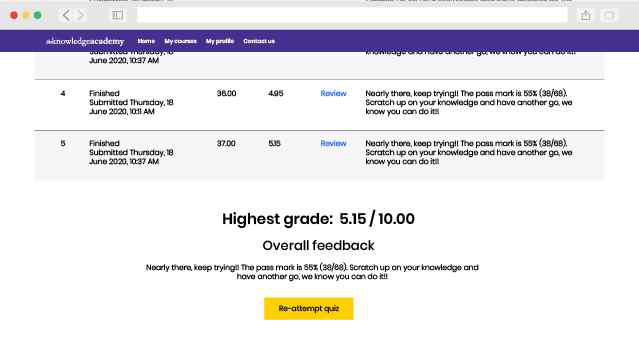

Official BCS Foundation Certificate in Organisational Behaviour Exam Information

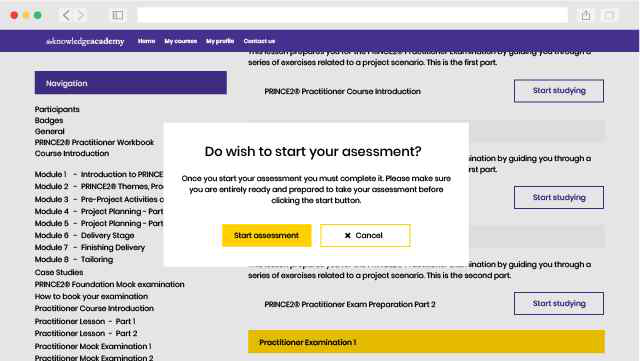

The BCS Foundation Certificate in Organisational Behaviour exam assesses participants' understanding of foundational principles and concepts related to organisational behavior. The format of the exam is as follows:

- Question Type: Multiple Choice

- Total Questions: 40

- Total Marks: 40 Marks

- Pass Mark: 65%, or 26/40 Marks

- Duration: 60 minutes

- Open Book/ Closed Book: Closed Book

Why choose us

Ways to take this course

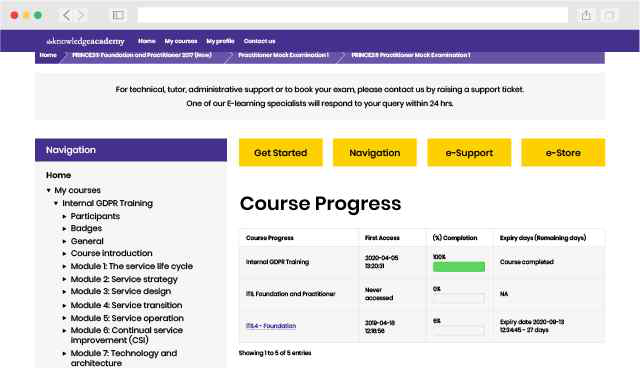

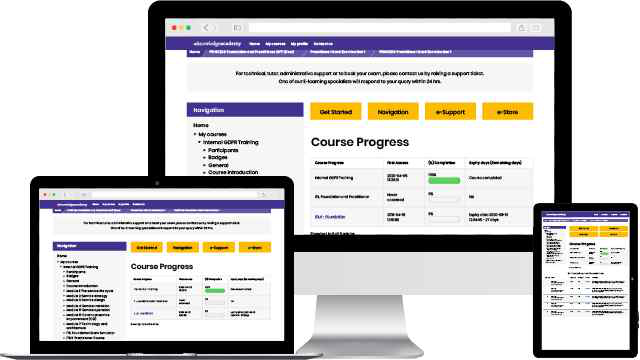

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led BCS Foundation Certificate in Organisational Behaviour. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's BCS Foundation Certificate in Organisational Behaviour, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

What our customers are saying

Such an amazing experience

Violet Osunde

Vicky has been the best instructor so far. Very engaging, friendly and clearly explained the content.

Ben Lavin

Vicky has great presence, a smooth voice and I especially liked her approach to going over what was covered in a unit of learning. The pace was good on both days.

Cristina Simmonds

BCS Foundation Certificate in Organisational Behaviour FAQs

There hasn't been any questions asked about this Topic

Why choose us

Best price in the industry

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Trusted & Approved

Our Business Analysis training is accredited by BCS

Many delivery methods

Flexible delivery methods are available depending on your learning style.

High quality resources

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Looking for more information on Business Analysis Courses?

History of Business Analysis

History of Business Analysis Business Analysis Methodologies

Business Analysis Methodologies Benefits of Business Analysis for Businesses and Employers

Benefits of Business Analysis for Businesses and Employers Benefits of Business Analysis for Individuals

Benefits of Business Analysis for Individuals Business Analysis Certifications

Business Analysis Certifications Business Analysis Examinations

Business Analysis Examinations What if I fail a Business Analysis exam?

What if I fail a Business Analysis exam? How to get my Business Analysis results

How to get my Business Analysis results How do I book a Business Analysis course?

How do I book a Business Analysis course? What is BCS Membership?

What is BCS Membership? What organisations use Business Analysis?

What organisations use Business Analysis? Business Analysis Job Roles

Business Analysis Job Roles What sectors use Business Analysis?

What sectors use Business Analysis? How to add Business Analysis to your CV

How to add Business Analysis to your CV How to add your Business Analysis Certification to your LinkedIn

How to add your Business Analysis Certification to your LinkedIn

BCS Foundation Certificate In Organisational Behaviour in United States

Atlanta

Atlanta New York

New York Houston

Houston Dallas

Dallas Denver

Denver Seattle

Seattle Los Angeles

Los Angeles Chicago

Chicago San Francisco

San Francisco Philadelphia

Philadelphia San Diego

San Diego Phoenix

Phoenix Boston

Boston Austin

Austin Detroit

Detroit San Jose

San Jose Tampa

Tampa Colorado Springs

Colorado Springs Portland

Portland Sacramento

Sacramento Minneapolis

Minneapolis San Antonio

San Antonio Irvine

Irvine Las Vegas

Las Vegas Miami

Miami Bellevue

Bellevue Pittsburgh

Pittsburgh Baltimore

Baltimore Fairfax

Fairfax Orlando

Orlando Raleigh

Raleigh Salt Lake City

Salt Lake City Columbus

Columbus Oklahoma City

Oklahoma City Nashville

Nashville Charleston

Charleston Columbia

Columbia Cleveland

Cleveland Cincinnati

Cincinnati Memphis

Memphis Richmond

Richmond Virginia Beach

Virginia Beach Louisville

Louisville Fort Lauderdale

Fort Lauderdale Indianapolis

Indianapolis Des Moines

Des Moines Grand Rapids

Grand Rapids New Orleans

New Orleans Wichita

Wichita Charlotte

Charlotte Hartford

Hartford New Jersey

New Jersey Anchorage

Anchorage Omaha

Omaha Honolulu

Honolulu Albuquerque

Albuquerque Baton Rouge

Baton Rouge Iowa City

Iowa City Albany, NY

Albany, NY Boise

Boise Milwaukee

Milwaukee Tucson

Tucson Kansas City

Kansas City St Louis

St Louis Jacksonville

Jacksonville

Back to course information

Back to course information

BCS International Diploma in Business Analysis (Full Certification)

Save upto 35%Included courses:

BCS Certificate in Business Analysis Practice$3995

BCS Practitioner Certificate in Requirements Engineering$2495

BCS Practitioner Certificate in Modelling Business Processes Training$2795

Total without package: $11780

Package price: $7695 (Save $4085)

Limited budget?

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please