Get a custom course package

We may not have any package deals available including this course. If you enquire or give us a call on +1 6474932992 and speak to our training experts, we should be able to help you with your requirements.

Module 1: Revision of the Standardised Approach for Credit Risk

Module 2: Future of the IRB Approach

Module 3: New Standardised Approach to Measure Counterparty Credit Risk (SA-CCR)

Module 4: New Basel Securitisation Framework and Basel IV for Funds

Module 5: New Framework for Market Risks

Module 6: CVA Risk Capital Charge Framework

Module 7: New Basel Framework for Large Exposures

Module 8: TLAC and MREL

The Introduction to Basel IV Course is designed for professionals in the financial sector seeking to understand the latest regulatory framework and its implications. This Compliance Training can be beneficial for a wide range of professionals, including:

There are no formal prerequisites for this Introduction to Basel IV Course. However, a basic understanding of banking and finance can be beneficial for the delegates.

Basel IV represents the latest phase in the Basel Accords, aiming to refine and enhance banking regulatory frameworks worldwide. Its implementation is pivotal for ensuring financial stability and promoting risk management practices across the banking sector. Understanding Basel IV is crucial for navigating the complexities of modern banking regulations.

Mastering Basel IV is essential for risk management, compliance, and financial reporting professionals within the banking industry. Proficiency in this area ensures institutions can effectively meet regulatory requirements, manage financial risks, and optimise capital efficiency. This course particularly benefits bankers, financial analysts, and regulatory professionals seeking to enhance their expertise.

This 1-day training course is designed to equip delegates with a comprehensive understanding of Basel IV's key components, including its regulatory scope and the implications for capital requirements. Delegates will gain insights into the practical application of these standards, enabling them to implement effective compliance and risk management strategies within their organisations.

Course Objectives

After completing Compliance Courses, delegates will receive a certification affirming their proficiency in Basel IV. This certification demonstrates a commitment to regulatory compliance in banking. With this accreditation, individuals will be better positioned to contribute to their organisation's strategic objectives and regulatory adherence.

Why choose us

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led Introduction to Basel IV Training. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

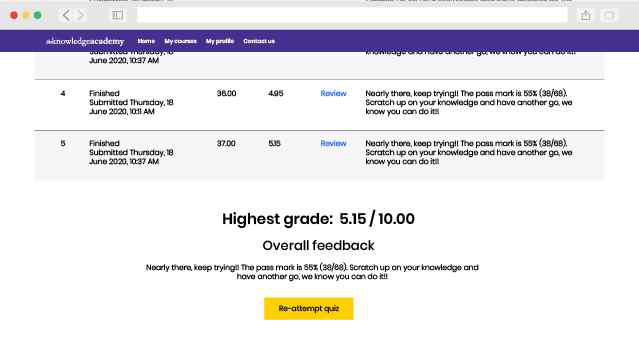

Unlock your potential with The Knowledge Academy's Introduction to Basel IV Training, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on +1 6474932992 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information