Get a custom course package

We may not have any package deals available including this course. If you enquire or give us a call on +1 6474932992 and speak to our training experts, we should be able to help you with your requirements.

Module 1: Financial Services Regulation Ethics (FSRE)

Module 2: Regulatory Framework

Module 3: Regulating Financial Services

Module 4: Advanced Financial Advice (AFA)

Module 5: Pension and Retirement Planning

The Diploma for Financial Advisers (DipFA) Training Course aims to provide professionals with an in-depth exploration of the essential financial planning knowledge, skills, and regulatory understanding needed to become a proficient financial adviser. This course can be beneficial for various professionals, including:

There are no formal prerequisites required for the Diploma for Financial Advisers DipFA Training Course.

The "Diploma for Financial Advisers (DipFA)" is a professional qualification designed to equip individuals with the knowledge and skills necessary to excel in the field of financial advice. It is a comprehensive course that covers various aspects of financial planning, investment, and client communication. The DipFA Certification is recognised and respected within the financial services industry and is often a prerequisite for individuals seeking a career as a financial adviser.

One of the key benefits of obtaining the DipFA Qualification is the enhanced career prospects it offers. Financial advisers with a DipFA certification are often more attractive to employers and clients alike, as they demonstrate a commitment to professional development and a high level of competence. Additionally, DipFA holders are better equipped to provide sound financial advice to clients, helping them achieve their financial goals and secure their financial future.

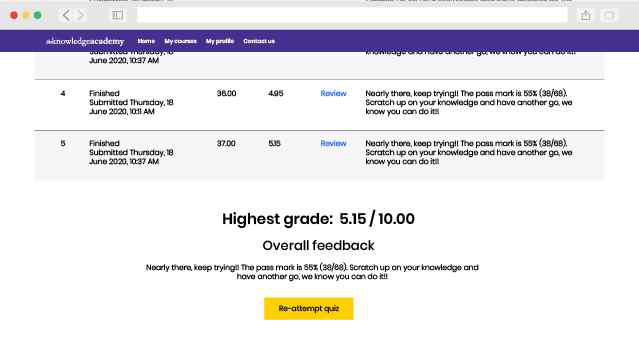

The Knowledge Academy's 1-day DipFA Training Course enhances the benefits of the DipFA qualification by offering structured and comprehensive training to prepare individuals for the DipFA exam. This course provides candidates with valuable exam preparation resources, practice assessments, and expert guidance, increasing their chances of passing the DipFA exam successfully.

Course Objectives

Completing the course objectives will equip individuals with the necessary skills and knowledge to excel in the field of financial advising, ensuring they can provide clients with sound financial guidance and navigate the complex world of finance with confidence.

Why choose us

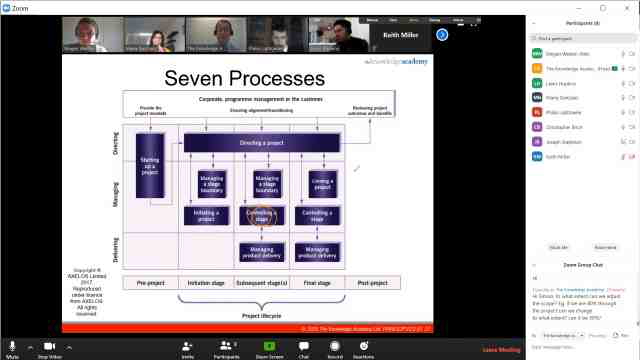

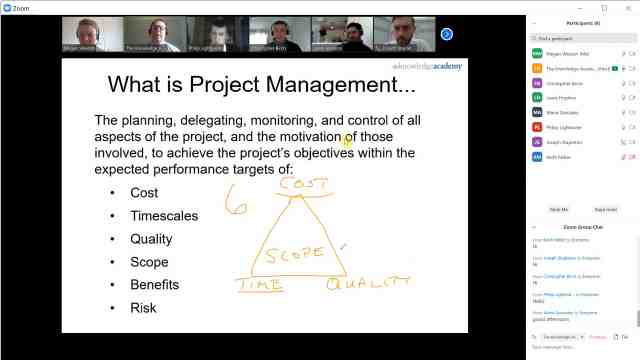

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led Diploma for Financial Advisers DipFA Training. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's Diploma for Financial Advisers DipFA Training, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

She shared her wealth of knowledge with us. She impacted us

very calm and professional

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on +1 6474932992 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information