Get a custom course package

We may not have any package deals available including this course. If you enquire or give us a call on +1 7204454674 and speak to our training experts, we should be able to help you with your requirements.

Module 1: Introduction to SAP R/3

Module 2: Financial Accounting Basic Settings

Module 3: General Ledger Accounting

Module 4: Accounts Payable

Module 5: Accounts Receivable

Module 6: Bank Accounting

Module 7: Asset Accounting

Module 8: New General Ledger Accounting

Module 9: Reports

Module 10: Basic Settings for Controlling

Module 11: Cost Element Accounting

Module 12: Cost Center Accounting

Module 13: Period - End Activities

Module 14: Internal Orders

Module 15: Profit Centre Accounting

Module 16: Profitability Analysis

Module 17: Product Costing Planning

Module 18: Financial Accounting with Materials Management

Module 19: Financial Accounting with Sales and Distribution

Module 20: Validations and Substitutions with Sets

Module 21: Sales Tax

Module 22: Year -End Closing and Month-End Closing

Module 23: Trading Partner

Module 24: Mass Maintenance

Module 25: SM37 – SAP Background Jobs

Module 26: Idocs

Module 27: ASAP Methodology

Module 28: Real-Time Documentation

The SAP FICO Certification Course in the United States has been curated to provide participants with the essential skills to utilise SAP's FICO modules proficiently. These modules are critical in an organisation's financial, managerial, and accounting solutions. This SAP Finance and Controlling Course can be beneficial to a wide range of professionals, including:

There are no formal prerequisites for the SAP Finance and Controlling Course. However, a foundational understanding of finance, budgeting, and planning concepts can significantly benefit the delegates.

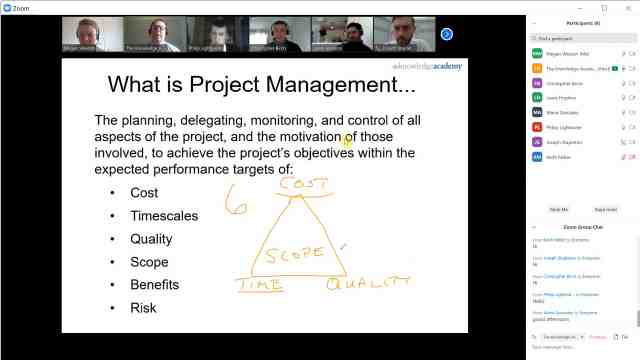

The SAP Finance and Controlling (FICO) Training Course in the United States provides a comprehensive insight into managing financial processes and controlling organizational functions using SAP software. With businesses increasingly adopting SAP solutions, mastering FICO becomes crucial for professionals seeking lucrative opportunities in finance and accounting domains.

Proficiency in this SAP Course Online in the United States is essential for finance professionals, accountants, and consultants aiming to streamline financial operations, optimize reporting processes, and enhance decision-making. Mastery in this subject enables individuals to navigate complex financial landscapes effectively, ensuring compliance and driving organizational success.

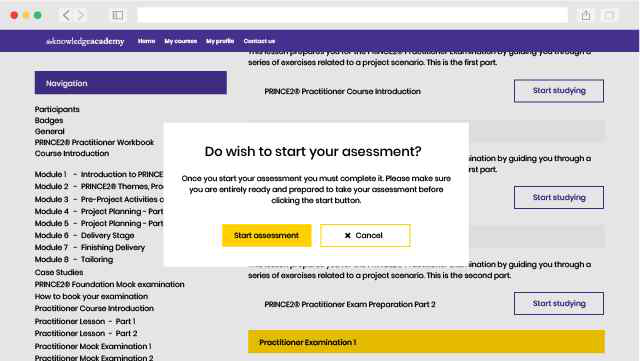

This intensive 5-day SAP Training in the United States equips delegates with practical skills to efficiently utilize SAP FICO modules, including General Ledger Accounting, Accounts Payable, Accounts Receivable, Asset Accounting, and Controlling. Participants will gain hands-on experience configuring, implementing, and troubleshooting financial processes, empowering them to contribute significantly to their organization's financial management objectives.

Course Objectives

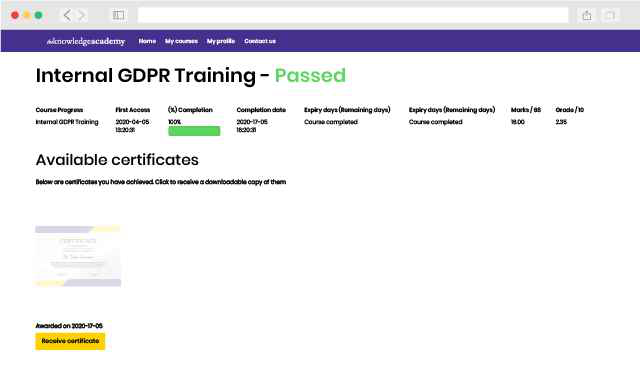

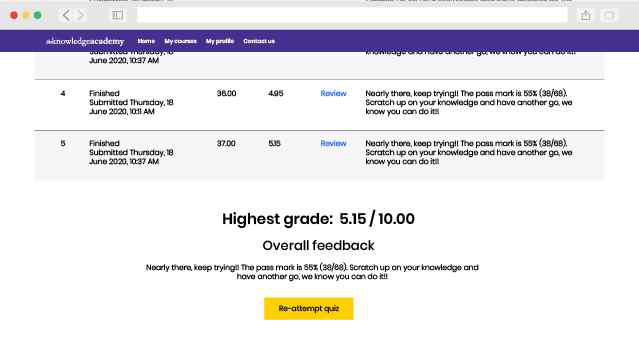

After completing this SAP Course Online in the United States, delegates will receive a certification attesting to their proficiency in SAP Finance and Controlling (FICO). This SAP Certification validates their skills and knowledge, enhancing their credibility in the job market and opening up new career opportunities in finance, accounting, and consulting roles.

Why choose us

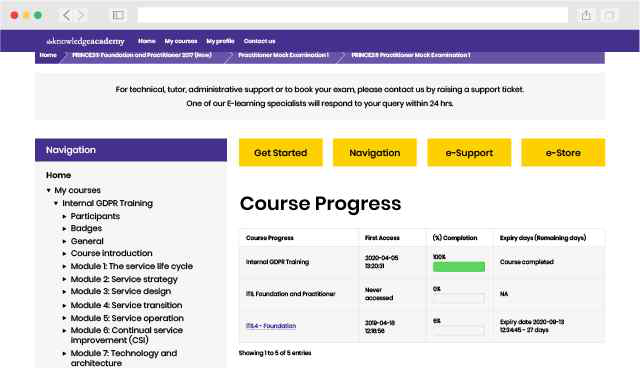

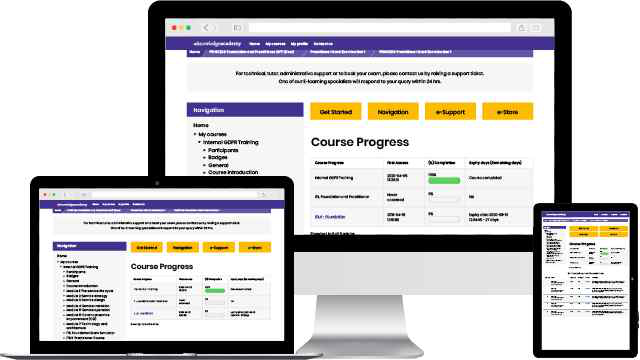

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led SAP Finance and Controlling FICO Training. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's SAP Finance and Controlling FICO Training, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Atlanta

Atlanta New York

New York Houston

Houston Dallas

Dallas Denver

Denver Seattle

Seattle Los Angeles

Los Angeles Chicago

Chicago San Francisco

San Francisco Philadelphia

Philadelphia San Diego

San Diego Phoenix

Phoenix Boston

Boston Austin

Austin Detroit

Detroit San Jose

San Jose Tampa

Tampa Colorado Springs

Colorado Springs Portland

Portland Sacramento

Sacramento Minneapolis

Minneapolis San Antonio

San Antonio Irvine

Irvine Las Vegas

Las Vegas Miami

Miami Bellevue

Bellevue Pittsburgh

Pittsburgh Baltimore

Baltimore Fairfax

Fairfax Orlando

Orlando Raleigh

Raleigh Salt Lake City

Salt Lake City Columbus

Columbus Oklahoma City

Oklahoma City Nashville

Nashville Charleston

Charleston Columbia

Columbia Cleveland

Cleveland Cincinnati

Cincinnati Memphis

Memphis Richmond

Richmond Virginia Beach

Virginia Beach Louisville

Louisville Fort Lauderdale

Fort Lauderdale Indianapolis

Indianapolis Des Moines

Des Moines Grand Rapids

Grand Rapids New Orleans

New Orleans Wichita

Wichita Charlotte

Charlotte Hartford

Hartford New Jersey

New Jersey Anchorage

Anchorage Omaha

Omaha Honolulu

Honolulu Albuquerque

Albuquerque Baton Rouge

Baton Rouge Iowa City

Iowa City Albany, NY

Albany, NY Boise

Boise Milwaukee

Milwaukee Tucson

Tucson Kansas City

Kansas City St Louis

St Louis Jacksonville

Jacksonville

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on +1 7204454674 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information