We may not have the course you’re looking for. If you enquire or give us a call on +41 315281584 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Excel is like a trusty toolbox filled with powerful tools. Just as a skilled carpenter relies on their tools to build sturdy structures, accountants rely on Excel to construct accurate financial models and reports. Within this toolbox lie 13 essential skills that can transform an accountant's proficiency.

From basic calculations to complex data analysis, mastering these Excel skills is akin to sharpening each tool, enabling accountants to work efficiently and produce reliable financial insights.

Table of Contents

1) Important Excel Skills for Accountants

a) Using pivot tables

b) Sorting

c) Confirming data

d) Checking formulas

e) Advanced Find and Replace for Smart Users

f) Organising Data into Tables

g) What If analysis

h) Using templates

i) Creating Custom Lists

j) Filtering by Color

2) Conclusion

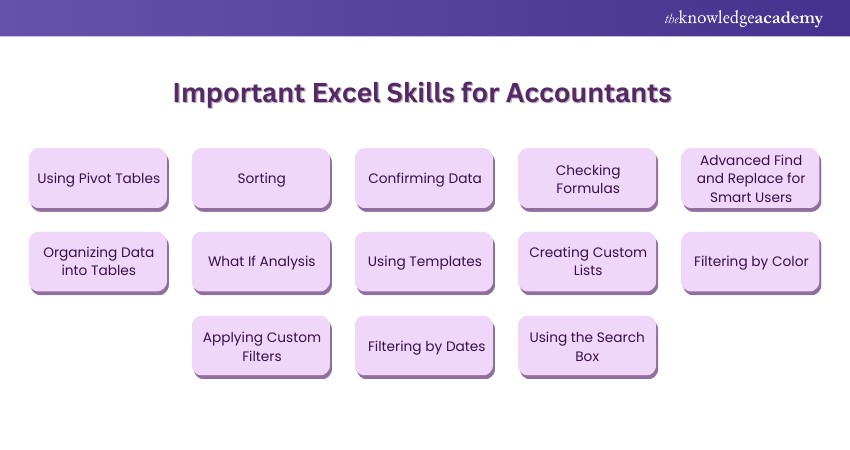

Important Excel Skills for Accountants

Let's learn about the significance of mastering important Excel skills for accountants and why they are indispensable in finance. Excel proficiency goes beyond data manipulation; it empowers accountants to efficiently manage financial tasks, conduct analysis, and generate insights critical for informed decision-making. These skills enhance productivity and ensure accuracy and precision in financial reporting, making them vital for accountants navigating the complexities of modern finance.

1) Using Pivot Tables

Pivot tables are indispensable for accountants when analysing large datasets. They allow accountants to summarise and manipulate data quickly. With pivot tables, accountants can easily create customised reports, analyse trends, and identify patterns within financial data. Understanding how to create pivot tables, add fields, apply filters, and format results is crucial for accountants to extract meaningful insights from complex datasets efficiently.

2) Sorting

Sorting data is fundamental for organising financial information in Excel. Accountants often deal with extensive lists of transactions, invoices, and accounts, which require proper sorting to facilitate analysis and decision-making. Excel provides various sorting options, such as by value, text, date, or custom criteria, enabling accountants to quickly arrange data in the desired order.

3) Confirming Data

Accurate financial reporting relies on reliable data. Accountants need to ensure the integrity and accuracy of data in Excel spreadsheets. This involves verifying data entry, reconciling balances, and cross-referencing information with source documents. Excel offers tools like data validation and auditing features to help accountants confirm data accuracy, detect errors, and maintain data integrity throughout financial processes.

4) Checking Formulas

Formulas are the backbone of financial calculations in Excel. Accountants must validate formulas to prevent errors that could lead to inaccuracies in financial reports. Excel provides auditing tools such as formula auditing, error checking, and formula evaluation, allowing accountants to review and troubleshoot complex formulas efficiently. Regularly checking formulas ensures the reliability and precision of financial calculations.

5) Advanced Find and Replace for Smart Users

Excel's Find and Replace feature goes beyond simple text search and replace operations. Accountants can utilise advanced Find and Replace options to perform intricate data manipulations. This includes searching with wildcards, using advanced filtering criteria, and replacing data selectively based on specific conditions. Mastering these advanced capabilities enables accountants to expedite data cleaning, formatting, and manipulation tasks with precision.

6) Organising Data into Tables

Excel tables offer a structured way to organise and manage financial data effectively. Accountants can convert ranges of data into tables, which provide built-in features such as automatic filtering, sorting, and calculated columns. By organising data into tables, accountants can streamline data entry, analysis, and reporting processes, while also improving the visibility and usability of financial information.

7) What If Analysis

What If analysis allows accountants to explore different scenarios and assess the impact of various variables on financial outcomes. Excel's What If analysis tools, such as Goal Seek, Scenario Manager, and Data Tables, enable accountants to perform sensitivity analysis, scenario modeling, and goal optimisation. By conducting What If analysis, accountants can make informed decisions, forecast future performance, and mitigate risks effectively.

8) Using Templates

Excel templates provide pre-designed formats and layouts for various financial tasks, such as budgeting, forecasting, and financial reporting. Accountants can leverage Excel templates to standardise processes, save time on document creation, and ensure consistency across reports. Customising templates to suit specific accounting needs enhances productivity and facilitates accurate financial analysis and reporting.

Enhance your knowledge of Charts in Excel with our Excel Training with Gantt Charts - sign up now!

9) Creating Custom Lists

Custom lists in Excel allow accountants to define custom sequences of data, such as months, days, or accounting codes. This feature is particularly useful for automating repetitive tasks, such as filling data series or sorting information in a specific order. By creating custom lists, accountants can streamline data entry, improve workflow efficiency, and maintain consistency in financial records.

10) Filtering by Color

Excel's conditional formatting enables accountants to highlight important data points visually using color-coded formatting rules. Filtering by color allows accountants to focus on specific categories or exceptions within financial datasets quickly. By applying color filters, accountants can identify trends, outliers, or discrepancies, facilitating insightful analysis and decision-making.

11) Applying Custom Filters

Excel's filter functionality allows accountants to narrow down data based on specific criteria, such as values, text, or dates. Applying custom filters enables accountants to extract relevant information from large datasets efficiently. Whether filtering transactions by amount, invoices by customer, or expenses by category, custom filters help accountants analyse data with precision and relevance.

Enhance your knowledge of business analytics with our Business Analytics With Excel Course - sign up now!

12) Filtering by Dates

Date filtering is a critical skill for accountants working with time-series financial data. Excel provides various options for filtering data by dates, including date ranges, specific dates, or relative date periods. Accountants can use date filters to analyse financial performance over specific time intervals, track deadlines, or compare trends across different periods effectively.

13) Using the Search Box

Excel's search box simplifies the process of locating specific data within large spreadsheets. Accountants can enter search terms directly into the search box to instantly find occurrences of text, numbers, or formulas within the workbook. This feature saves time and effort when navigating through extensive financial documents, enabling accountants to locate information swiftly and focus on analysis tasks.

Conclusion

Mastering these 13 essential Excel skills empowers accountants to understand financial complexities with precision and efficiency, ensuring accurate analysis and informed decision-making in the dynamic world of finance. Elevate your financial management game by honing these skills and unlock the full potential of Excel in your accounting practice.

Master your Excel shortcut skills with our Excel for Accountants Masterclass - register today!

Frequently Asked Questions

Excel is used in the accounting profession for tasks such as data entry, financial analysis, budgeting, and reporting, offering versatility and efficiency in managing financial information. Its functions, formulas, and features enable accountants to organise data, perform calculations, and generate insights crucial for informed decision-making in accounting practices.

Excel streamlines accounting tasks by automating calculations, organising data efficiently, and providing tools for analysis, resulting in improved accuracy and productivity for accountants. Its versatility allows for customisable solutions tailored to individual accounting needs, simplifying complex financial processes.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Microsoft Excel Training & Certification Course, including Microsoft Excel Masterclass, Excel for Accountants Masterclass, and Business Analytics With Excel Masterclass. These courses cater to different skill levels, providing comprehensive insights into Excel methodologies.

Our Office Applications Blogs cover a range of topics related to Microsoft Excel, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Excel skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Office Applications Resources Batches & Dates

Date

Excel for Accounting Course

Excel for Accounting Course

Fri 28th Jun 2024

Fri 19th Jul 2024

Fri 30th Aug 2024

Fri 27th Sep 2024

Fri 25th Oct 2024

Fri 22nd Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please