We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In the modern digital world, Accounting has become a simple task thanks to the available effective Accounting software. One of the most used Accounting software is QuickBooks, a software designed to simplify financial tasks for small and medium-sized businesses. Its growing popularity has resulted in many employers seeking professionals who have extensive knowledge of QuickBooks. In this blog, we will provide you with the most asked QuickBooks Interview Questions as well as the answers you will be expected to provide.

Table of Contents

1) A quick introduction to QuickBooks

2) Why are QuickBooks interviews important?

3) Preparing for a QuickBooks interview

4) Top QuickBooks Interview Questions and answers

5) Conclusion

A quick introduction to QuickBooks

Before we explore the most asked QuickBooks Interview Questions, we will first expand on a quick introduction to QuickBooks. QuickBooks, developed by Intuit, is a powerful accounting software widely used by small and medium-sized businesses, often in collaboration with a QuickBooks Accountant for efficient financial management. With a user-friendly interface and comprehensive QuickBooks Features, it simplifies financial tasks, tracks income, manages payroll, and generates essential financial reports. QuickBooks offers versatility, making it an essential tool for efficient financial management across various industries.

Why are QuickBooks interviews important?

QuickBooks interviews hold significant importance for both job seekers and employers. These interviews serve as a critical evaluation of candidates' technical proficiency in using the software for financial management. Employers can assess practical skills through discussions and real-life scenarios, gaining insights into candidates' problem-solving and critical-thinking abilities.

Additionally, interviews help determine adaptability to company processes and reporting requirements and communication skills in articulating complex financial concepts. They also play a role in identifying cultural fit, data security awareness, and training needs. Furthermore, the understanding of how transactions are Paid and Closed in QuickBooks is crucial for assessing a candidate’s competence. Ultimately, QuickBooks interviews aid employers in selecting the most suitable candidate for the role while building trust and confidence in the hiring process.

Unlock your Accounting potential with our QuickBooks Masterclass Course – sign up now!

Preparing for a QuickBooks interview

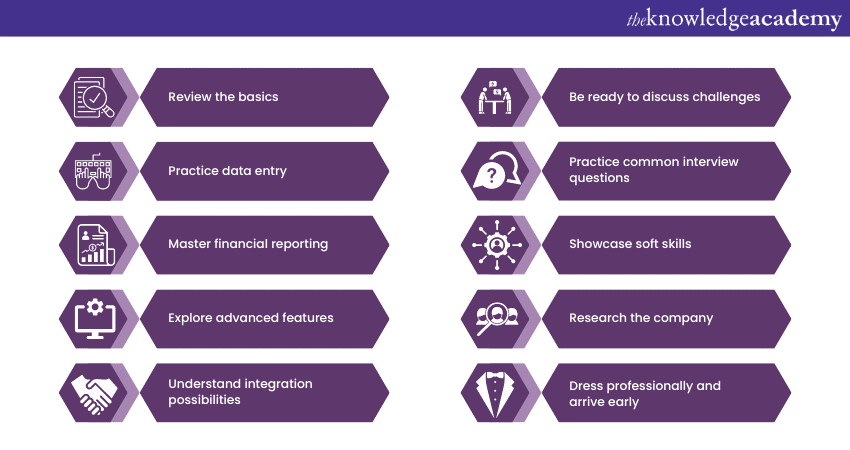

To ensure you are well-prepared and confident in your QuickBooks interview, follow these essential steps:

1) Review the basics

Start your preparation by revisiting the fundamental concepts. Familiarise yourself with the software's interface, main features, and navigation. Demonstrating a solid understanding of the basics will showcase your ability to handle essential tasks efficiently.

2) Practice data entry

Data entry is a crucial aspect of using QuickBooks effectively. Practice accuracy and speed to show interviewers that you can handle high volumes of financial data with precision.

3) Master financial reporting

Proficiently generating financial reports is vital. Understand how to customise reports to meet specific business requirements. Being well-versed in financial reporting demonstrates your ability to analyse and interpret financial data effectively.

4) Explore advanced features

While having a solid understanding of the basics is crucial, it's also beneficial to explore some of QuickBooks' more advanced features. Highlighting your knowledge of advanced features can make you a valuable asset to potential employers.

5) Understand integration possibilities

Research and understand how QuickBooks can integrate with other software and applications. Familiarise yourself with popular integrations such as payment gateways, e-commerce platforms, and CRM systems. Being aware of integration capabilities shows your ability to streamline business processes and increase efficiency.

6) Be ready to discuss challenges

Prepare to discuss any challenges you've encountered while using QuickBooks in your previous roles. Interviewers appreciate candidates who can demonstrate problem-solving skills and a willingness to learn from their experiences.

7) Practice common interview questions

In addition to technical questions, be prepared to answer general interview questions. Preparing thoughtful and articulate responses will make you a more polished candidate.

8) Showcase soft skills

In addition to technical expertise, employers also value soft skills. Highlight your ability to work collaboratively, communicate effectively, and adapt to new challenges. Employers seek individuals who can work well with a team and contribute positively to the organisation's culture.

9) Research the company

Take the time to research the company you are interviewing with and understand its industry and financial needs. Craft your answers to align with the company's goals and values, showcasing how your skills can benefit their specific business operations.

10) Dress professionally and arrive early

On the day of the interview, dress professionally to make a positive first impression. Plan your journey to the interview location, aiming to arrive a few minutes early to avoid any last-minute stress.

Unlock your true financial potential with our Accounting Masterclass Course – sign up now to be the finance expert you always wanted to be!

Top QuickBooks Interview Questions and answers

This section of the blog will expand on some of the most asked QuickBooks Interview Questions as well as the answers you will be expected to provide.

Q1) What is QuickBooks?

QuickBooks, developed and marketed by Intuit, is a powerful Accounting software designed to simplify financial management for small and medium-sized businesses. This comprehensive software offers a range of features, including bookkeeping, invoicing, payroll management, expense tracking, and tax preparation. By providing an intuitive interface and user-friendly tools, the software enables businesses to maintain accurate financial records and make informed decisions.

Q2) What are the different versions of QuickBooks available?

QuickBooks caters to diverse business needs through various versions, each tailored to specific requirements. QuickBooks Online, a cloud-based solution, allows users to access their data from anywhere. QuickBooks Desktop, however, is a locally installed software that offers more robust functionality.

QuickBooks Pro is suitable for small businesses, while QuickBooks Premier includes industry-specific features. QuickBooks Enterprise is designed for medium to large-sized businesses with advanced reporting and scalability.

Q3) How can you set up a company?

Setting up a company is a crucial first step towards efficient financial management. To begin, install the software and create a new company file by entering basic information such as the company's name, address, and industry type. Customising the chart of accounts according to your business needs allows you to categorise transactions accurately. Additionally, setting up products, services, vendors, customers, and employees ensures smooth data entry and management.

Q4) Explain the importance of the Chart of Accounts

The Chart of Accounts plays a vital role as it organises all financial transactions into specific categories. These categories include assets, liabilities, equity, income, and expenses. By maintaining a well-structured Chart of Accounts, businesses can generate detailed financial reports and gain insights into their financial health. It also simplifies tax preparation and ensures compliance with Accounting standards. Regularly reviewing and updating the Chart of Accounts is essential to maintain accuracy and relevance as the business evolves.

Q5) How can you reconcile accounts?

Reconciling accounts is crucial for ensuring that the recorded transactions match the bank's records accurately. To reconcile accounts, access the "Reconcile" window and select the account you want to reconcile. Enter the ending balance and statement date from your bank statement.

Then, systematically match the transactions on your bank statement with those in QuickBooks. If discrepancies are found, make the necessary adjustments until the difference is zero. Regular reconciliations help identify potential errors or fraudulent activities, providing businesses with financial transparency and security.

Q6) What is the significance of the 'Void' and 'Delete' functions?

In QuickBooks, the 'Void' function allows users to cancel a check or a transaction, while the 'Delete' function permanently removes a transaction from the system. Understanding when to use each function is crucial to maintaining accurate financial records.

When voiding a transaction, the system retains a record of the original entry, providing an audit trail for future reference. On the other hand, the 'Delete' function erases the transaction entirely, making it challenging to trace the transaction's history. To avoid irreversible mistakes, exercise caution when using these functions, and consider consulting a financial expert if unsure about the appropriate action.

Q7) How can you create and send invoices?

Creating and sending invoices is a straightforward process that streamlines the billing cycle. Begin by navigating to the "Create Invoice" option and selecting the customer you want to bill. Add the products or services provided, along with their respective quantities and prices.

Customise the invoice template with your company logo and payment terms to maintain a professional appearance. Before sending the invoice, review it to ensure accuracy and completeness. QuickBooks allows you to send the invoice directly to the customer's email, saving time and improving efficiency. Prompt and accurate invoicing not only fosters positive customer relationships but also enhances cash flow management for the business.

Q8) Explain the concept of 'Classes' in QuickBooks.

The 'Classes' feature in QuickBooks enables businesses to categorise transactions based on different segments or departments within the organisation. This functionality is particularly useful for companies operating in multiple locations or offering various product lines.

By classifying transactions into distinct categories, businesses gain deeper insights into the performance of individual segments. 'Classes' also facilitate the generation of customised reports, allowing business owners to make data-driven decisions. Properly utilising the 'Classes' feature enhances financial analysis and simplifies budgeting and forecasting processes.

Q9) How can you create a backup of QuickBooks data?

Creating regular backups of data is critical to safeguarding valuable financial information. To create a backup, access the "File" menu and select "Backup Company." Choose the location where you want to save the backup file, ensuring it is stored securely.

Regularly scheduled backups protect against data loss due to system failures, hardware issues, or human errors. In the event of a data loss, restoring from a recent backup ensures minimal disruption to business operations. Additionally, consider maintaining multiple copies of backups in different locations to further mitigate the risk of data loss.

Q10) Can you integrate QuickBooks with other applications?

Yes, QuickBooks offers integration with various third-party applications, allowing businesses to streamline workflows and enhance efficiency. Integration with payment gateways enables businesses to receive payments seamlessly, reducing the need for manual data entry.

Integrating QuickBooks with e-commerce platforms ensures that sales transactions and inventory updates are automatically synchronised, reducing data entry errors and saving time. Furthermore, integrating the software with Customer Relationship Management (CRM) systems improves customer data management and enhances the overall customer experience. Businesses can choose from a variety of compatible applications based on their unique needs and industry requirements.

Conclusion

Mastering QuickBooks is essential for individuals seeking opportunities in the Accounting and finance domain. This blog has covered essential QuickBooks Interview Questions and answers that will undoubtedly assist you in preparing for your interview. Remember to practice these concepts and demonstrate your proficiency during the interview to impress potential employers and secure your dream job.

Enhance your financial expertise with our expert-led Accounting and Finance Training Courses – join now!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 7th Mar 2025

Fri 9th May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please