We may not have the course you’re looking for. If you enquire or give us a call on +49 8000101090 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Do you want to improve the way you handle your finances? Interested in learning how to take control of your money? Take charge of your finances with our list of the top 10 Money Management Tips.

This blog explores the top Money Management Tips, such as how to budget, save, and invest properly for financial success. Let's explore further to find out more!

Table of Contents

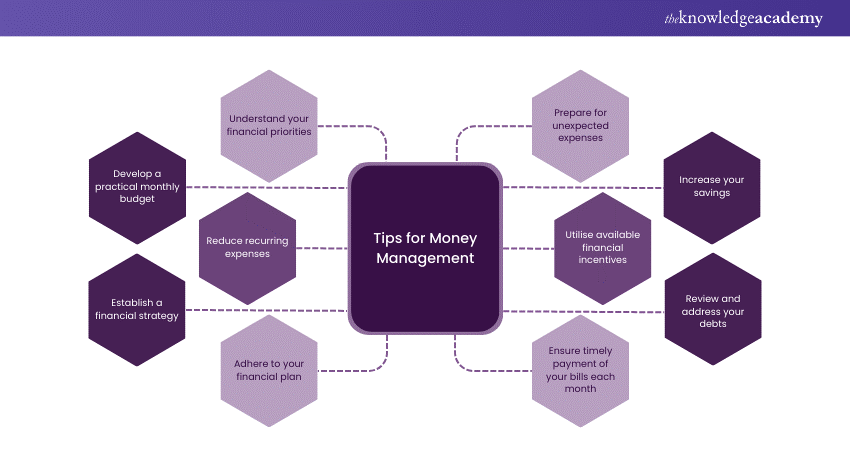

1) Top 10 Money Management Tips

a) Tip 1: Understand your financial priorities

b) Tip 2: Develop a practical monthly budget

c) Tip 3: Reduce recurring expenses

d) Tip 4: Establish a financial strategy

e) Tip 5: Adhere to your financial plan

f) Tip 6: Prepare for unexpected expenses

g) Tip 7: Increase your savings

h) Tip 8: Utilise available financial incentives

i) Tip 9: Review and address your debts

j) Tip 10: Ensure timely payment of your bills each month

2) Conclusion

Top 10 Money Management Tips

Plan to save, invest, and reach your financial goals with these top ten Money Management Tips.

Tip 1: Understand your financial priorities

Identifying priorities is an important phase in creating a budget. You must have a particular goal in order to make sure that your expenditures and aims are aligned. Pay attention to your short- and long-term objectives, which should include retirement savings, emergency fund setup, and property purchase.

Tip 2: Develop a practical monthly budget

A monthly budget can let you reconcile your income and expenditure problems. Besides the essentials like shelter, food, utilities, and transportation, other than those, assign some portion for savings and personal expenses as well.

Tip 3: Reduce recurring expenses

Consider all your everyday expenditure, such as memberships, electricity bills, and subscriptions. To get extra money for savings or debt repayment, look for opportunities to save or negotiate better conditions.

Tip 4: Establish a financial strategy

Create a clear financial plan that supports your goals. To reduce risk and increase returns, think about investing alternatives like stocks, real estate, or retirement accounts. Then, put these into a diverse portfolio.

Tip 5: Adhere to your financial plan

Once you've made a financial plan, follow it regularly. Stay clear of impulsive buys and wasteful spending, and evaluate your progress frequently to make sure you're on track to reach your goals.

Secure your future with our Retirement & Pensions Course- join now!

Tip 6: Prepare for unexpected expenses

To deal with unexpected costs such as vehicle maintenance, medical bills, and loss of the job among other things, set up an emergency fund. The purpose here is to start by putting aside enough money in separate account to cover the living expenses of 3 to 6 months.

Tip 7: Increase your savings

Set aside some money from your monthly income and make saving a priority. To ensure balance in your funds, think about automating your contributions. To maximise your growth, it would be wise to conduct research on savings plans or investment opportunities that could be beneficial for you.

Tip 8: Utilise available financial incentives

Take the opportunity to benefit from accessible financial benefits, such as tax-advantaged accounts, matching contributions, and employer-sponsored retirement plans. To take advantage of possible company matches and tax advantages, make the most of your contributions to these accounts.

Tip 9: Review and address your debts

Check all of your remaining debts, including credit card debt and loans. Make a plan to pay off high-interest bills first, followed by the remaining loans that only require some limited adjustments. Consider possibilities for modifying or combining payments to reduce interest rates and improve debt repayment.

Tip 10: Ensure timely payment of your bills each month

To avoid late penalties and negative notes on your credit history, pay your payments on time every month. Make sure that you never forget a payment date to maintain a clean credit history and create payment schedules or alerts.

Master Financial Management skills with our Financial Management Course today!

Conclusion

An essential component of financial success is prudent Money Management. You can achieve financial goals, reduce stress, and take control of your finances with the help of these ten effective Money Management Tips. Keep in mind that financial planning is an ongoing process, so regularly evaluate and modify your plans as your requirements and goals change.

Transform your career with Financial Analyst Training today!

Frequently Asked Questions

Money Management aims at achieving financial goals and maintaining financial stability. This process includes budgeting, saving, investing, and spending. Here, the idea is to make the most of the resources and prevent any kind of financial risks by making calculated decisions about income, expenditure and investments.

To make smart choices and achieve your financial goals, you need to first understand your financial position. You can improve your understanding of your financial situation and Money Management skills by going through your income, expenditure, resources, and responsibilities. Additionally, create a budget to control your expenditures.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Training, including, Financial Management Course, Finance For Non Financial Managers Training, Cash Cycle Management Training. These courses cater to different skill levels, providing comprehensive insights into Financial Performance Management.

Our Business Skills Blogs cover a range of topics related to Money Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 24th May 2024

Fri 27th Sep 2024

Fri 13th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please