We may not have the course you’re looking for. If you enquire or give us a call on 01344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In Financial Management, the right software can be a game-changer, offering robust tools to streamline and enhance the handling of finances. The top 12 Financial Management Software programs stand out for their efficiency, versatility, and user-friendly interfaces, whether for personal use, small businesses, or large businesses. These software solutions range from simple budgeting and expense-tracking applications to comprehensive systems that handle complex accounting tasks, payroll processing, and financial reporting.

These programs are designed to cater to a broad spectrum of financial needs, with advanced features such as real-time analytics, cloud-based accessibility, and customization options integrated. They simplify financial tasks and provide valuable insights, helping users make informed decisions.

Table of Contents

1) What are some of the best Financial Management Software?

a) Kissflow Finance Software

b) Zoho Finance Plus

c) QuickBooks

d) Xero

e) Oracle Financials Cloud

f) Sage Intacct

g) Cube

h) Vena

i) Workday Adaptive Planning

j) Anaplan

k) Prophix

l) FreshBooks

2) Conclusion

What are some of the best Financial Management Software?

Let’s discuss some of the best Financial Management Software that businesses can use:

1) Kissflow Finance Software

Kissflow Finance Software is a comprehensive tool designed to streamline and automate various aspects of Financial Management. It is mainly known for its user-friendly interface and customisable workflows, making it a suitable choice for businesses seeking flexibility in their financial processes. This software covers various functionalities, including budgeting, expense management, and procurement processes.

Its integration capabilities with other systems and real-time reporting features give businesses a holistic view of their financial status, enhancing decision-making and operational efficiency. Kissflow is ideal for organisations prioritising ease of use and customisation in their Financial Management tools.

2) Zoho Finance Plus

Zoho Finance Plus is a suite of financial applications designed to meet the unique needs of small to medium-sized businesses. It offers a range of tools, including invoicing, accounting, expense management, subscription management, and more.

One of the main advantages of this suite is that it provides a single platform for all financial operations, ensuring that data flows seamlessly and consistently across different financial functions.

Additionally, Zoho Finance Plus offers strong automation features, reducing manual work and increasing accuracy. Its user-friendly interface and comprehensive reporting capabilities make it a popular choice for businesses looking to manage their finances efficiently.

3) QuickBooks

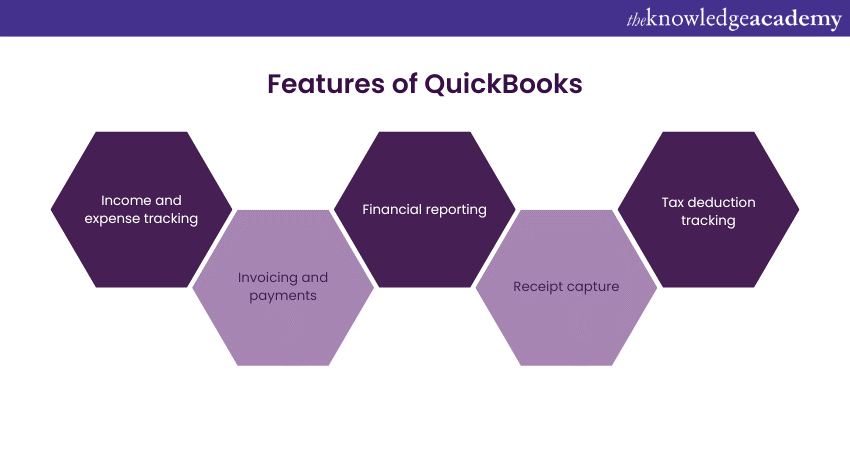

QuickBooks is one of the most popular accounting software solutions, particularly favoured by small and medium-sized businesses. It offers a range of features, including invoicing, payroll processing, expense tracking, and financial reporting.

QuickBooks stands out for its ease of use and strong community support, making it accessible even for those without a strong accounting background. It also offers robust integration with other business applications and banks, streamlining financial workflows.

With its Cloud-based version, users can access their financial data anytime, anywhere, which enhances its appeal for businesses looking for a flexible and efficient Financial Management solution. The platform provides valuable insights through customisable reports and dashboards, helping business owners make informed decisions.

Additionally, it has a strong community and support network, offering resources, tutorials, and customer support, which is particularly beneficial for smaller businesses without dedicated accounting teams. This comprehensive support and versatility make it a preferred Financial Management tool for many companies.

4) Xero

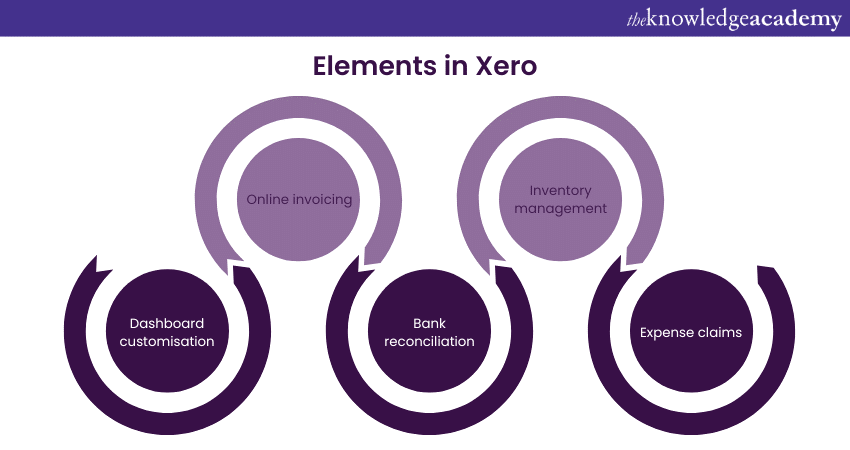

Xero is a Cloud-based accounting software which is known for its simplicity and powerful features. It caters primarily to small and medium-sized businesses. Xero offers real-time financial reporting, invoicing, payroll processing, and expense tracking.

Its robust collaboration features include multi-user access and easy integration with over 800 third-party apps. Therefore, it makes a highly adaptable solution for various business needs. Xero's emphasis on automation, like bank feeds and reconciliation processes, saves time and reduces errors, making it a popular choice for businesses seeking efficient and reliable Financial Management Software.

The software simplifies crucial accounting tasks through features like automatic bank feeds, reconciliation processes, and online invoice payments, enhancing efficiency and accuracy. Its emphasis on collaboration is evident in its multi-user access, which enables seamless sharing and cooperation on financial data among team members.

Its cloud-based nature ensures that businesses can keep up with their finances efficiently, regardless of location, contributing to its growing popularity in the global market.

Are you interested in learning about Finance? Register now for our Finance for Non-Financial Managers Course!

5) Oracle Financials Cloud

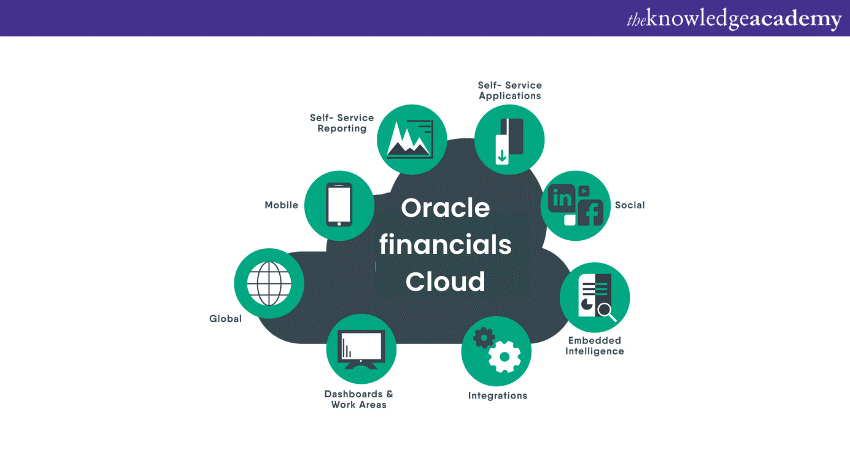

Oracle Financials Cloud is a part of Oracle's comprehensive suite of Cloud applications. It's designed for large enterprises and offers various features, including financial planning, analysis, reporting, and compliance management.

This software stands out for its scalability, robust data security, and comprehensive suite of applications that can handle complex financial processes. Oracle Financials Cloud has advanced analytics and Artificial Intelligence capabilities, providing deep insights and predictive analytics.

It’s ideal for organisations looking for an enterprise-grade, integrated Financial Management solution. The software also has advanced analytics and AI capabilities, delivering deep financial insights and predictive analytics to aid strategic decision-making. It emphasises data security and compliance, offering features that support adherence to various global financial regulations.

Its ability to integrate seamlessly with other Oracle Cloud applications creates a unified, efficient business environment, further enhancing operational efficiency and data consistency across the organisation. This integration is crucial for businesses seeking a holistic approach to Enterprise Resource Planning (ERP) and Financial Management.

6) Sage Intacct

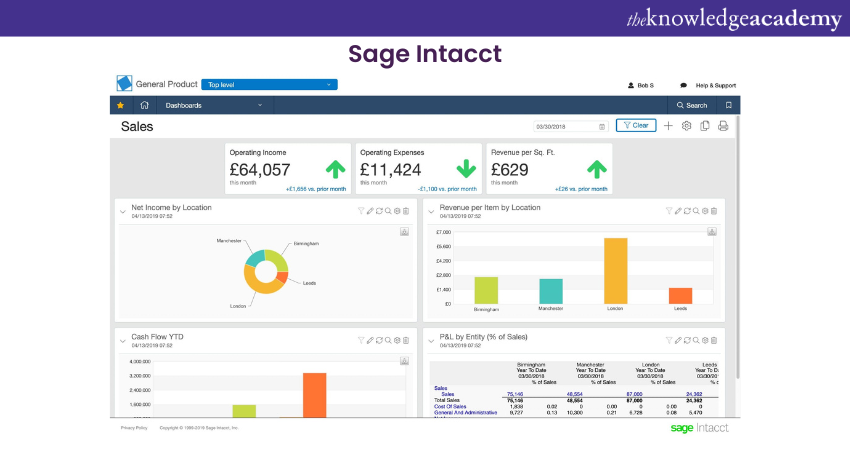

Sage Intacct is a leading Cloud-based Financial Management and accounting software specifically designed to meet the needs of small to medium-sized businesses and non-profit organisations. It is highly regarded for its robust core Financial Management capabilities, including advanced financial reporting, accounts payable and receivable, cash management, and revenue recognition.

A key strength of Sage Intacct is its real-time financial and operational insights, which enable businesses to make informed and strategic decisions. The platform offers deep financial visibility through customisable dashboards and reports, allowing users to easily track and analyse key financial metrics.

Its automation features stand out, especially in streamlining complex financial processes and reducing manual workloads. This efficiency is further enhanced by its robust compliance management tools, which are crucial for businesses needing to adhere to various regulatory standards.

Become an expert in Accounting today – Sign up now for our Accounting & Finance Training!

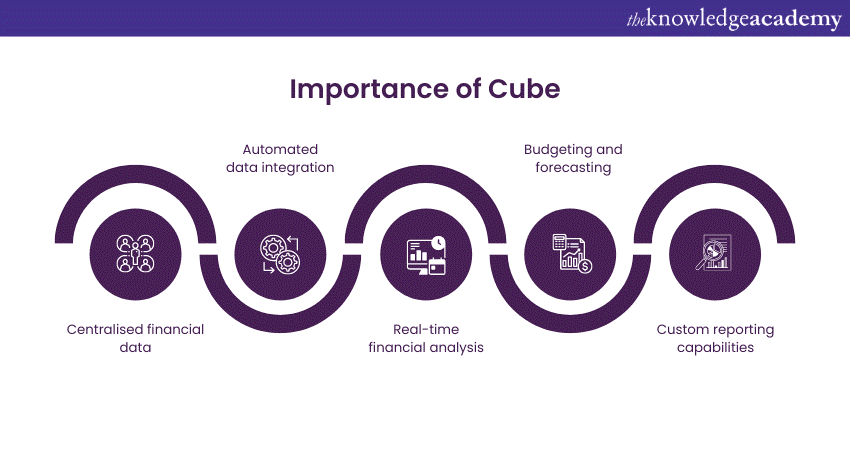

7) Cube

Cube is a modern financial planning and analysis (FP&A) software that streamlines and enhances business budgeting, forecasting, and reporting processes. Its primary strength lies in its spreadsheet-native platform and the ability to integrate seamlessly with existing spreadsheets, databases, and financial systems.

This means it operates within the familiar environment of spreadsheets, reducing the learning curve and increasing adoption rates among finance teams. It automates data consolidation from various sources, enabling real-time financial insights and reducing the manual effort typically associated with financial reporting and analysis.

It also offers advanced modelling capabilities, allowing finance professionals to create detailed, adaptable financial models and forecasts. These capabilities are crucial for accurate financial planning and strategic decision-making. The platform facilitates collaboration, enabling multiple team members to work on financial plans simultaneously, ensuring consistency and efficiency.

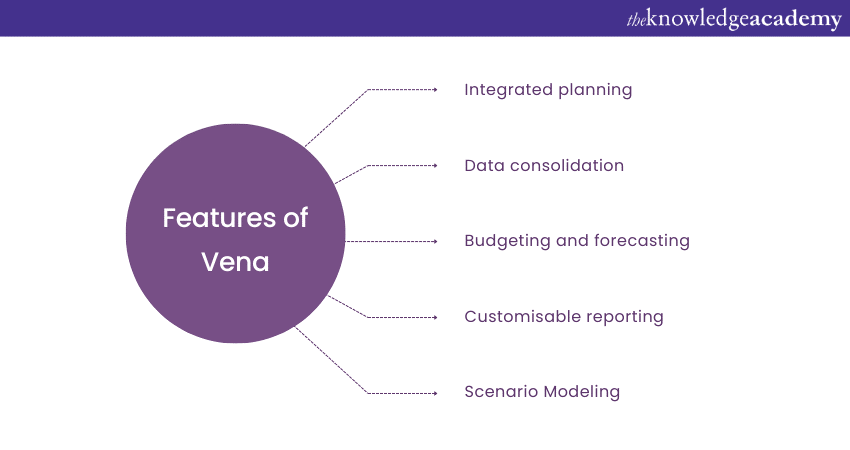

8) Vena

Vena is a comprehensive Corporate Performance Management (CPM) software that blends advanced financial planning and analysis capabilities with the familiar interface of Microsoft Excel. This unique combination makes it a powerful tool for businesses seeking sophisticated financial functionality while maintaining the comfort and familiarity of Excel.

It excels in budgeting, forecasting, and financial reporting and provides a platform for businesses to manage their financial processes efficiently. Its strength lies in enabling detailed, flexible financial modelling for accurate forecasting and strategic planning.

The software's real-time data consolidation ensures that all financial information is up-to-date and accurate, facilitating informed decision-making. Another key feature of Vena is its collaborative workflow, which allows multiple users to contribute to the same financial plan or report simultaneously.

This feature enhances teamwork and ensures consistency across departments. Vena also offers strong scenario analysis capabilities, enabling businesses to evaluate various economic outcomes and make strategic decisions accordingly.

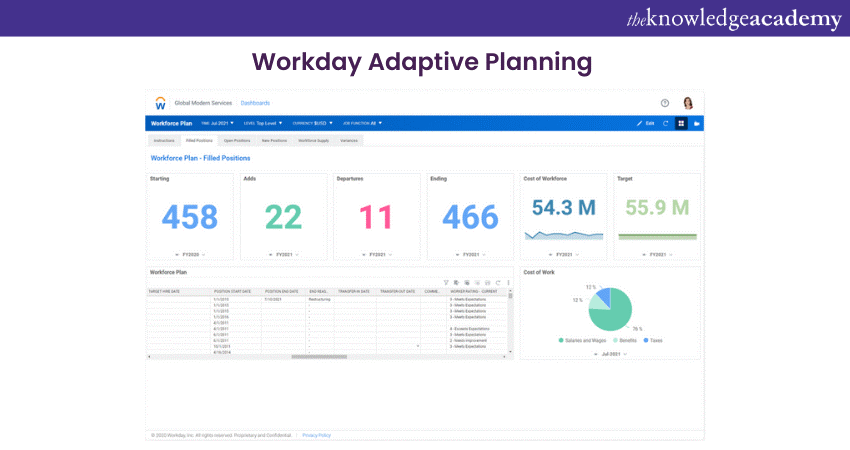

9) Workday Adaptive Planning

Workday Adaptive Planning is a leading Cloud-based software for business planning, recognised for its comprehensive budgeting, forecasting, and financial reporting capabilities. It caters to businesses of all sizes, providing tools for seamless financial and operational planning.

A significant feature of Workday Adaptive Planning is its powerful modelling capabilities, which enable users to create detailed, flexible financial models. These models are instrumental in forecasting and analysing various business scenarios, aiding strategic decision-making.

The platform’s real-time analytics provide instant insights into business performance, allowing for agile responses to market changes. Collaboration is another crucial aspect of Workday Adaptive Planning.

The software facilitates collaborative planning across different departments, ensuring organisational objectives and strategies are aligned. Its user-friendly interface and easy-to-use dashboards enhance this, making complex data accessible and understandable for all stakeholders.

Do you want to become a professional in Accounting? Join our Accounting Masterclass now!

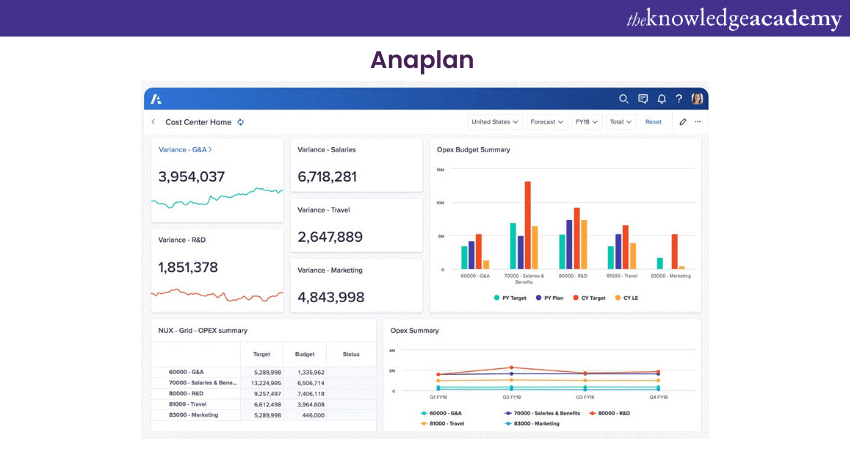

10) Anaplan

Anaplan is a sophisticated cloud-based planning and performance management platform renowned for handling complex and large-scale business planning needs across various organisational functions. It caters primarily to large enterprises, offering a highly flexible and scalable solution for integrated business planning.

Its core strength lies in its advanced modelling capabilities, allowing organisations to construct detailed, multi-dimensional financial and operational planning models. This includes budgeting, forecasting, demand planning, supply chain management, and sales performance management.

The platform's real-time data processing and collaborative features enable quick, informed decision-making and alignment across different departments. One of the key differentiators of Anaplan is its user-friendly interface, which provides a seamless experience even when dealing with intricate and voluminous data sets.

It also supports scenario analysis, enabling businesses to simulate various conditions and outcomes, aiding in strategic planning and risk management.

11) Prophix

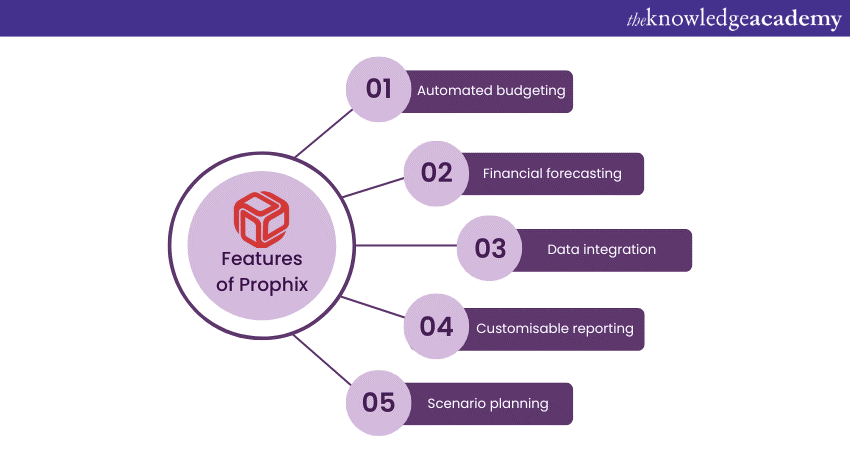

Prophix is a comprehensive Corporate Performance Management (CPM) software designed to cater to the needs of mid-sized businesses and large enterprises. It stands out for its ability to automate complex financial processes, enhancing efficiency and accuracy in financial planning and analysis.

Prophix provides a robust suite of budgeting, forecasting, reporting, and financial consolidation tools, which are crucial for effective Financial Management and strategic decision-making. A key feature of Prophix is its strong capability in financial and operational data analysis.

It allows organisations to delve deep into their financial data, offering detailed insights that support informed business decisions. The software's flexibility in handling multi-dimensional data analysis is precious for companies with diverse revenue streams and complex financial structures.

12) FreshBooks

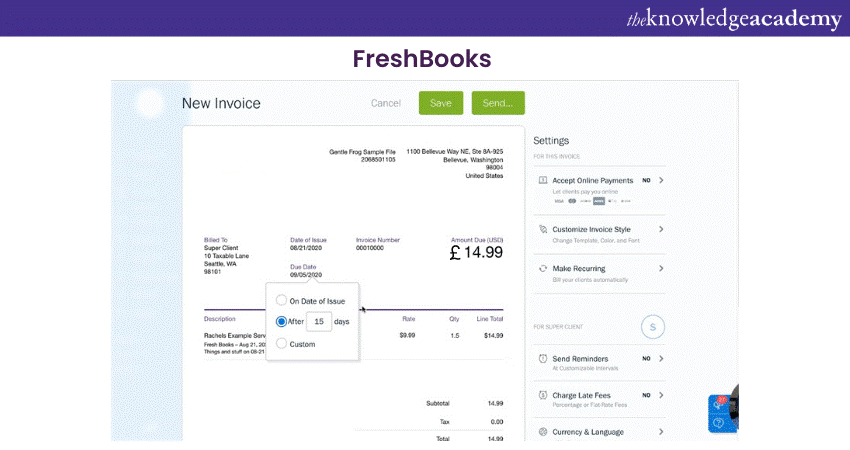

FreshBooks is a user-friendly cloud-based accounting software tailored for small businesses and freelancers. Renowned for its simplicity and intuitive design, it primarily focuses on streamlining invoicing, expense tracking, and time tracking. One of its key strengths is the ability to create professional-looking invoices quickly and easily, coupled with features for automated billing and customisable templates. Here is an example of how its invoice looks:

FreshBooks also offers robust expense management tools, allowing users to link bank accounts automatically and categorise expenses. Its time-tracking capabilities are particularly beneficial for freelancers and agencies.

The software's mobile app enhances accessibility, enabling users to manage their finances efficiently from anywhere. Additionally, FreshBooks provides excellent customer support, further simplifying the accounting process for its users.

Learn about Financial Modelling and help your business grow – Register now for our Financial Modelling Course!

Conclusion

Financial Management Software has revolutionised how businesses handle their finances, offering diverse tools for various needs. From simplifying accounting processes to providing real-time financial insights, these software solutions enhance efficiency, accuracy, and decision-making capabilities, catering to businesses of all sizes and industries.

Learn how to forecast and stay ahead of your competitors with our Financial Modelling and Forecasting Training – Join now!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Regression Analysis Training

Regression Analysis Training

Fri 5th Jul 2024

Fri 1st Nov 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please