We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In the insurance sector Robotic Process Automation (RPA) uses AI and bots to assist organisations to automate. RPA reduces repetitive tasks and enhances and expands human abilities. Robotic Process Automation software bots can do far more than automate manual data entry. RPA for Insurance industry can be trained to handle numerous intellectual tasks and take decisions. At present, the RPA is being used in underwriting, processing the insurance claims and analytics in the Insurance sector. Automation is slowly being integrated with almost all the functions in the Insurance industry. According to AI Multiple, by 2025 more than 25% of the industry will be automated using Artificial Intelligence (AI) and Machine Learning (ML) techniques.

In this blog, you will learn about the importance of RPA in Insurance, its benefits and its use cases. Learn more!

Table of Contents

1) How RPA is useful for the Insurance sector?

2) How does Robotic Process Automation work in insurance?

3) Top RPA insurance use cases

4) Advantages of RPA in Insurance

5) Conclusion

How RPA is useful for the Insurance sector?

The Robotic Process Automation software bots can assist insurance companies by performing manual repetitive tasks, extracting data comprising details of the clients from multiple sources and analysing backgrounds. Implementing Robotic Process Automation in Insurance organisations brings about the following benefits:

1) Simplifies integration with legacy systems: Robotic Process Automation works as a bridge between software like ERP solutions. Although, existing programs and devices are necessary for business operations. Sometimes implementing RPA software might swap the existing systems. For example, A North American insurer saved around 40,000 labour hours in a year by implementing RPA automation in legacy processes.

2) It reduces manual operations: Implementing Robotic Process Automation in the insurance sector has reduced the workloads of the employees, and can concentrate more on important tasks. For example, the insurance company Encova have saved employees 25 hours a week by implementing automation in the customer recalling the process. Meanwhile, the Australian Unity company saved around 22,493 hours of employees' manual labour within eight months.

3) A huge decrease in job resignations: Job satisfaction increases once; employees won't get overwhelmed by regular clerical duties. Hong Kong-based insurance companies once used to assign clerical duties to junior staff and resulting in a lot of errors which eventually leads to a rise in attrition rates. Later, the company implemented an automation process which lowered attrition rates.

4) Economical: Even though implementing Robotic Process Automation have initial costs, when compares to the long run, automating these operations would save a huge amount of money. For example, a global insurance company implemented 13 RPA bots and saved around 140,000 hours within six months.

How does Robotic Process Automation work in insurance?

Implementing Robotic Process Automation in insurance companies fills the void between traditional insurance systems by enhancing the efficiency of the operations and customer experience. While integrating the systems via Application Programming Interfaces (APIs), the RPA can also function under the office desk when needed. Thus, the companies can utilise the API connectors while developing their workflows with Robotic Process Automation.

1) Excellent for clerical duties, Robotic Process Automation solutions can do the following:

2) It assists between different applications to copy and paste data.

3) It assists in reading emails and fetching data from the system and transferring them into a main system.

4) It assists in creating month-end reports.

5) Adopt Artificial Intelligence (AI) to improve automation capabilities.

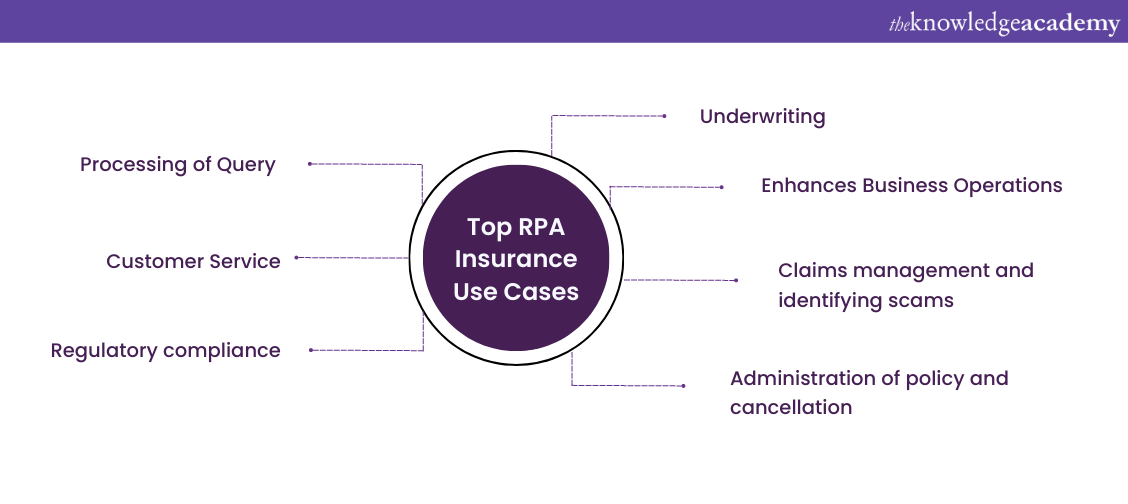

Top RPA insurance use cases

1) Underwriting

The main duty of underwriters is to find the best deals and policy options by analysing data from multiple sources to reduce the risks. For example, adopting traditional methods takes around four weeks for this process. Around 40% of the time is spent on researching and data entry.

The RPA bots can fetch and process data from both internal and external links and display it on the dashboard for the further decision-making process. According to recent studies conducted by McKinsey, implementing Robotic Process Automation in insurance companies can save time by 34% in the data processing.

RPA bots can operate the following tasks:

1) Research clients to produce data and recommend pricing

2) Able to check whether the individual already has a policy

3) Able to fetch clients' details from third-party resources. For example, Credit Rating from Experian.

Once RPA automates routine clerical tasks it would be easy for the human underwriters to concentrate on more important duties.

2) Enhances Business Operations

It is quite difficult to find operational efficiencies and recognise sectors for development as the insurance companies consist of a lot of paper works. Once RPA bots are implemented, tracking their workflow and monitoring every step become quite feasible. Later, companies analyse and review logs to check whether they require manual intervention or not. The processing speed and error rate can be reduced by automating a process.

An Italian insurance company, Cattolica Assicurazioni implemented UiPath RPA to automate their process after further examination of the documentation and comparing transaction details. They found out that the whole process could be easily automated by the RPA software. They developed RPA bots to perform repetitive duties like comparing with 20.000 lines of numbers. The financial team estimated to finish the task within six months finish this project. By automating 90% of the process with RPA software, it took nearly two months to complete the task without any errors.

Sign up now to learn deploying of Open Span Solutions in OpenSpan RPA Training.

3) Claims management and identifying scams

According to the research conducted by the McKinsey, Robotic Process Automation can reduce manual tasks by 80%. When manually registering the insurance claim, would be a slow process and a lot of errors will be there if it is manually done. Implementing Robotic Process Automation in the insurance sector will enhance better customer experience and ability to process efficiently from First Notice of Loss (FNOL) to payment:

1) Able to incorporate data from numerous sources. For instance, fetching photos of damaged vehicles, configuring vehicles documentation, etc

2) Able to sort out and feed details by scanning physical documents

3) Able to verify insurance claims and detect fraudulent claims

4) Identifies errors or incomplete documentation and information to the administrators

A Canadian Insurance company, SCM Insurance Services implemented RPA automation to fully automate data management for FNOL. Which results in 80% fast processing of insurance claims.

4) Administration of policy and cancellation

Although current policy administrating software reduces the manual task to some extent even if they’re able to navigate through various applications, causes inconsistencies and a lot of errors. The Insurance RPA software is assisted by ML and Natural Language Processing (NLP). Thus, they can receive emails from policyholders, fetch data, and make appropriate changes. The RPA bots can handle operations like policy rating, renewing, issuing, cancellation and many more.

An insurance company, Zurich Insurance Group implemented RPA software built by Capgemini based on Blue Prism Robotic Process Software. RPA bots handle policies as soon as they enter the details into the system, and provide invoices and draft documents that employees can review.

5) Regulatory compliance

To lead processes and documentation, insurance companies depend on various compliance standards like the Health Insurance Portability and Accountability Act (HIPAA) privacy rules and tax law. The employees are expected to keep track on and take action upon any regulatory violations.

Implementing Robotic Process Automation bots take charge of analysing regulations, generating regulatory reports and validating customer data. For instance, one of the most common use cases is Name Screening Alert Review for authorising Politically Exposed Persons (PEP). This system can daily develop thousands of notifications and it would be very difficult to verify by manually going through all notifications to check false data.

6) Customer Service

Implementing Robotic Process Automation in an insurance company enhances customer services by reducing errors, and providing fast-paced services. As there are a lot of insurance companies in the market, clients always choose the better service-providing companies. According to recent studies conducted by Deloitte, around 41% of clients have left the insurer due to a lack of better service.

Implementing Robotic Process Automation in insurance companies facilitates to conduct a detailed analysis to get a better vision of the expectations of the clients and provide personalised offers. For instance, if a client has updated a social media platform about his new trip, the RPA bots collect data and inform the insurance agent. Thus, the agent would be able to create a customised offer, gain an advantage and solve clients' complaints about the lack of personalised offers in insurance policies.

7) Processing of Query

Almost every hour, insurance companies will receive many notifications from client and broker-related queries. It is quite difficult to sort it out manually and quite exhausting for the employees. Implementing RPA bots will guarantee better results within a short period.

An insurance company Hollard Group implemented RPA bots to manage broker communication by automating 98% of email operations. That resulted in a great reduction in time consumption for implementation by 600% and saved employees 2000 hours per month.

Register for our course Blue Prism Training to learn how to check errors using the validation tool.

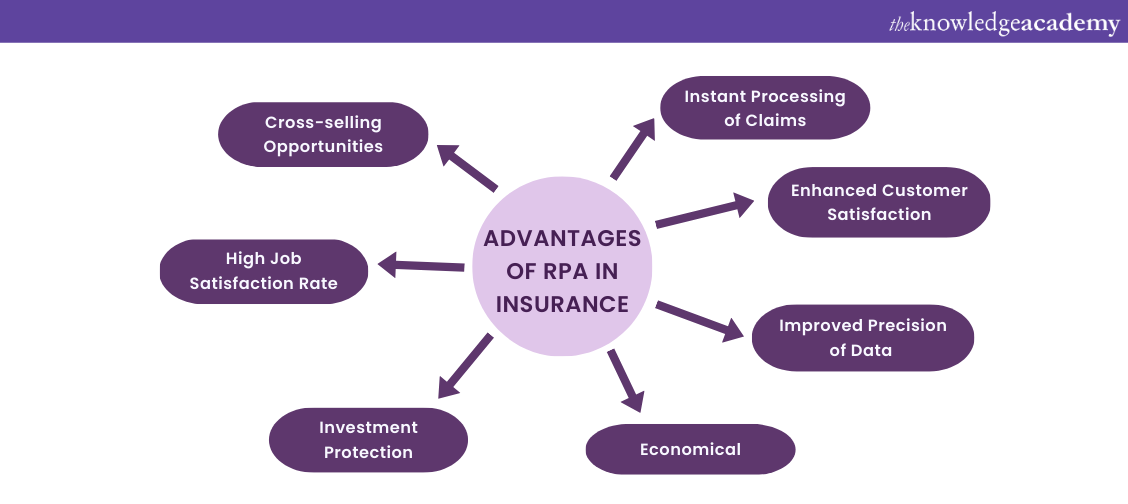

Advantages of RPA in Insurance

Implementing RPA in Insurance sectors will evolve the workflow and enhance back-office operations and improve customer services. Moreover, the employees don’t have to do boring tasks like data entry.

Following are some of the advantages of using RPA in insurance sectors:

1) Instant Processing of Claims

In traditional methodologies, the processing of claims will take a lot of procedures like fetching data from multiple documents and shifting to other systems. This can be solved by implementing RPA software. With a single click the RPA bots can transfer huge amount of the data. Thus, customers get an instant response when they register an insurance claim.

2) Enhanced Customer Satisfaction

Implementing RPA software automation enhances insurers to process multiple data instantly. Robotic Proces Automation can switch to different systems automatically to transfer data. Thus, it will improve customer satisfaction by reducing time consumption and manual operations.

3) Improved Data Precision

Implementing RPA software helps insurers to reduce human errors by switching manual tasks to automation. RPA improves the authenticity of data, which is a vital factor for regulatory compliance.

4) Economical

Implementing RPA software is a great deal to enhance productivity and overall cost-savings in business. This will assist companies to assign higher tasks to employees, which will increase the growth of the business.

5) Investment Protection

Implementing robots is a lifetime investment and can be updated to function on other systems. The RPA bots can process faster than traditional IT project methodologies.

6) High Job Satisfaction Rate

Implementing Robotic Process Automation enhances job satisfaction rates among employees by automating repetitive and boring tasks. This leads employees to concentrate more on important tasks that help them in job promotion.

7) Cross-selling Opportunities

Robotic Process Automation tools like chatbots can carry out personalised product or service recommendations to improve the customer experience. Moreover, RPA bots can be utilised to develop innovations in business like personalised life insurance packages, required property coverage etc.

Register today to learn about fundamental concepts of UI Automation in Robotic Process Automation Using UiPath.

Conclusion

Above we have discussed, how RPA bots enhance overall performance in the insurance sector. The Fact is that we don’t like to wait for anything, and it would be fantastic if it happens instantly! This is the prime reason for implementing RPA bot in insurance sectors because back-office operations are tedious tasks in insurance sectors that require high efficiency while processing. Thus, automating these operations will improve overall productivity.

If you would like to pursue a career in Robotic Process Automation, Sign up now for Robot Framework Training.

Frequently Asked Questions

Upcoming Business Analysis Resources Batches & Dates

Date

Robotic Process Automation using UiPath

Robotic Process Automation using UiPath

Thu 9th May 2024

Thu 27th Jun 2024

Thu 18th Jul 2024

Thu 12th Sep 2024

Thu 7th Nov 2024

Thu 12th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please